Note to readers:

Some significant changes have been made to the method used to present the Mining Activity Report, beginning in 2016. From now onwards, the document will be published in digital format in the form of web pages on the Internet. The text, figures and tables now include hyperlinks to the Interactive Map in Québec’s geomining information system, generally known by its French acronym SIGÉOM. The main aim of this new format is to circulate information more effectively and ensure that it is easier to understand.

CHAPTER 1 – ECONOMY AND MINING TITLES

CHAPTER 1.1 ECONOMY

After peaking in 2011 and 2012, the mining sector underwent a decline that has affected every economic aspect of its activity. Falling metal prices led to a decrease in exploration and development investments. However, in 2016 the sector’s economic context improved to some extent.

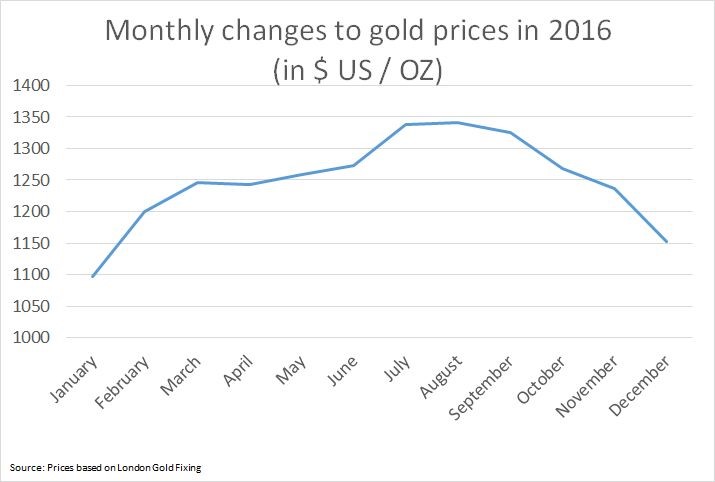

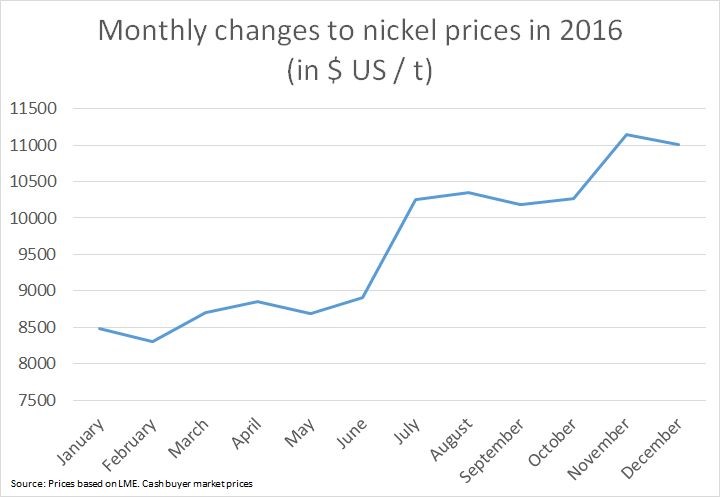

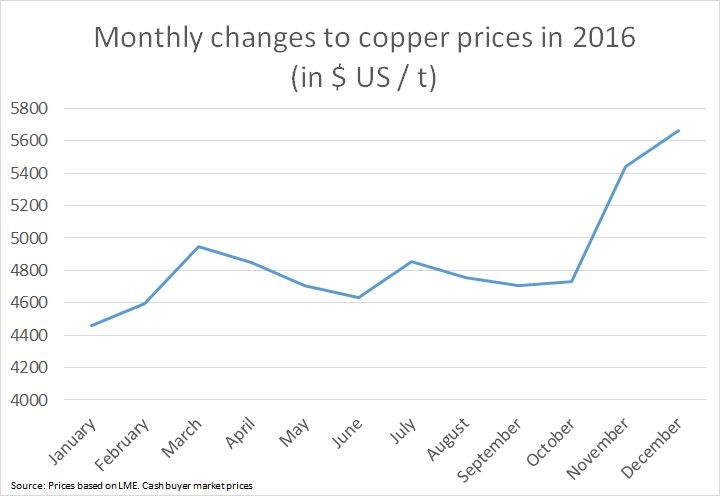

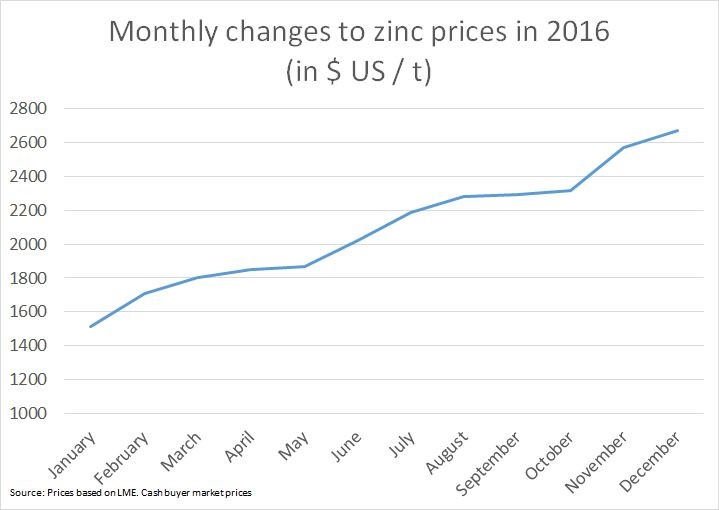

The mineral substance market experienced two difficult years from the standpoint of economic growth. The prices of mineral substances, including gold, zinc, iron, nickel and copper, generally declined between mid-2015 and mid-2016, but began to recover slowly later in 2016. The increase was triggered mainly by a small rise in infrastructure construction in China, the world’s principal consumer of mineral substances

As shown in the graphs below, gold prices were the only ones to decline at the end of 2016. This is explained by gold’s role as an inflation hedge in the economy. The interest rate hike announced by the United States Federal Reserve, supported by an improvement in that country’s general economic context, led to a sudden decline in the demand for gold as an inflation hedge, causing prices to fall at the end of 2016.

For other substances, including iron, the resumption of growth is due to traditional economic dynamics. Growth was also stimulated by the election of Donald Trump as President of the United States and his promise to invest massively in infrastructures, which was particularly favourable to growth in iron prices.

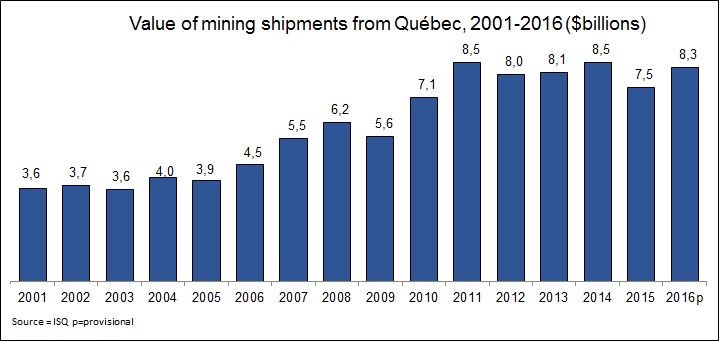

Value of shipments

Production data clearly show that the rise in prices at the end of 2016 had a significant impact on the overall value of shipments by Québec’s mining sector. Shipment value increased from $7.5 billion in 2015 to $8.3 billion in 2016. The increase was due solely to the metallic substance market, the value of which rose by 12.3% between 2015 and 2016.

The increase in shipments of metallic substances was confined mainly to the ilmenite and iron ore markets. In the case of iron, the increase was due solely to better trade terms, because shipments actually declined by 2% in terms of tonnage, compared to 2015.

Gold also had a good year in 2016. Like iron, higher prices were a significant factor in the increased value of shipments, which rose by 13% between 2015 and 2016; of this, 12% was due directly to higher gold prices.

Iron and gold therefore ranked first in terms of shipment value, accounting for more than 55% of total value.

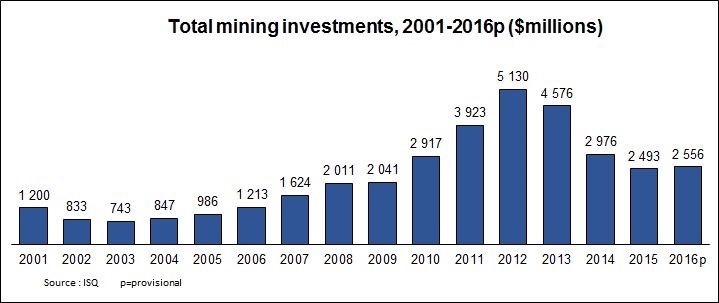

Mining investments

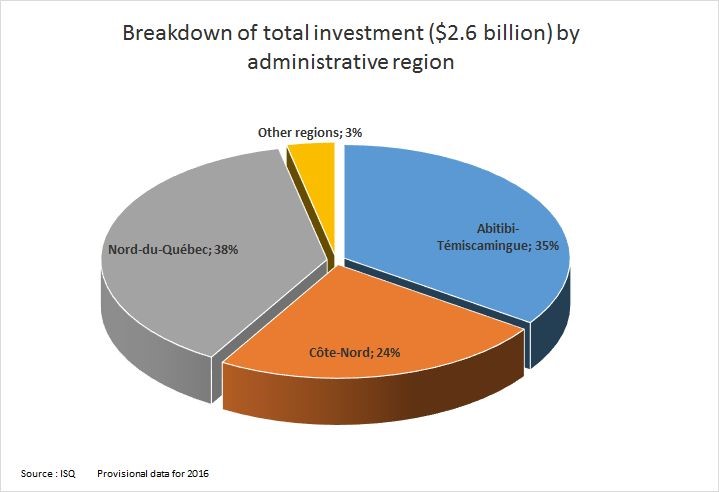

From an economic standpoint, the highlight of 2016 was undoubtedly the end of the decline in investments. Although it was still difficult for mining companies in general, and for junior exploration companies in particular, to find funding, the slight upturn in the metal market generated a small increase of 2.5% in total investments, compared to the previous year. Investments rose from $2.49 billion in 2015 to $2.56 billion in 2016. This was the first increase observed since the historical summit of 2012, when investments were $5.1 billion. Although less than in 2012, the 2016 investments were comparable to the average for the last ten years ($3 billion), which is reassuring, given the uncertainty that still surrounds the metal market.

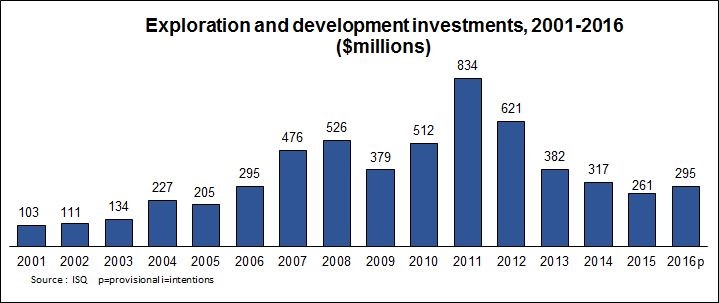

Exploration and development

Exploration and development expenses have declined steadily since 2011. The results for 2015 confirmed this situation, showing a decline of 69% since 2011. However, the trend was reversed to some extent in 2016 ($295 million), with an increase of 13% compared to 2015 ($261 million).

Exploration expenses can lead to higher investments, which in turn can lead to mining operations. The increase in investments, or more specifically the end of the decline in exploration and development investments, is a positive factor suggesting the possibility of long-term growth for the mining sector.

The region that benefited the most from investments in 2016 was Nord-du-Québec, thanks in particular to the end of development work at Stornoway’s Renard mine.

CHAPTER 1.2 MINING TITLES

Number of and area covered by exploration and mining titles in Québec

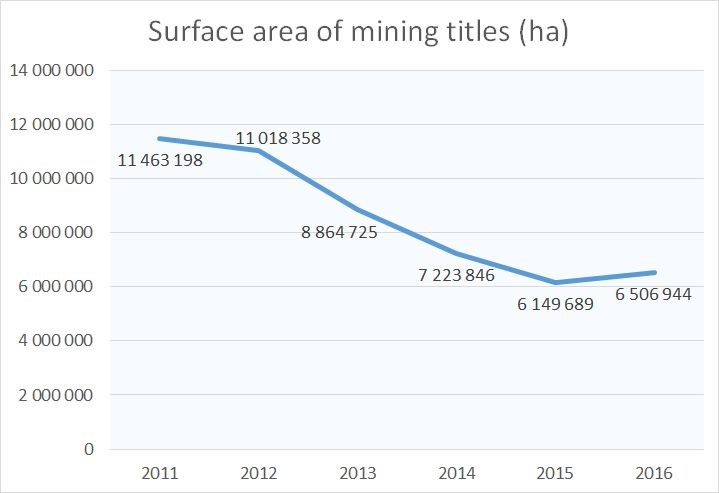

The number of mining titles has declined considerably in the last three years. In 2011, Québec had 249,116 mining titles covering a total area of 11,463,198 hectares. In 2015, it had only 130,407 titles, covering a total area of 6,149,689 hectares – a drop of 47.7% in the number of mining titles and of 46.4% in the total area covered, compared to 2011.

Number of and area covered by exploration and mining titles in Québec

As of December 31, 2016, Québec had 135,323 mining titles covering a total area of 6,506,944 hectares, which represents an increase of 3% in the number of titles and 5.8% in the total area covered, compared to 2015.

Breakdown of exploration titles in Québec by administrative region

*Titles overlapping several administrative regions are counted for each of those regions.

The sum of the total number of titles per region may therefore be different from the total number of titles for all regions.

The number of exploration titles increased from their 2015 levels in some of Québec’s administrative regions, including Montérégie (23.5 %), Capitale-Nationale (11.6 %) and Mauricie (8.5 %). Conversely, the number of titles declined significantly in the administrative regions of Centre-du-Québec (60.5 %), Chaudière-Appalaches (33.6 %) and Laurentides (16.9 %).

Breakdown of exploration titles in Québec by administrative region

*Titles overlapping several administrative regions are counted for each of those regions.

The sum of the total number of titles per region may therefore be different from the total number of titles for all regions.

In 2016, 35,817 exploration titles were entered in Québec’s Public Register of Real and Immovable Mining Rights, covering a total area of 706,621 hectares. This represents an increase of 150.3% compared to the number of exploration titles entered in the Register in 2015, and an increase of 159.7% in the total area covered.

The increase was seen across most of Québec’s administrative regions, but particularly in Montérégie (437.5 %), Nord-du-Québec (231.4 %), Capitale-Nationale (182.7 %) and Mauricie (129.6 %).

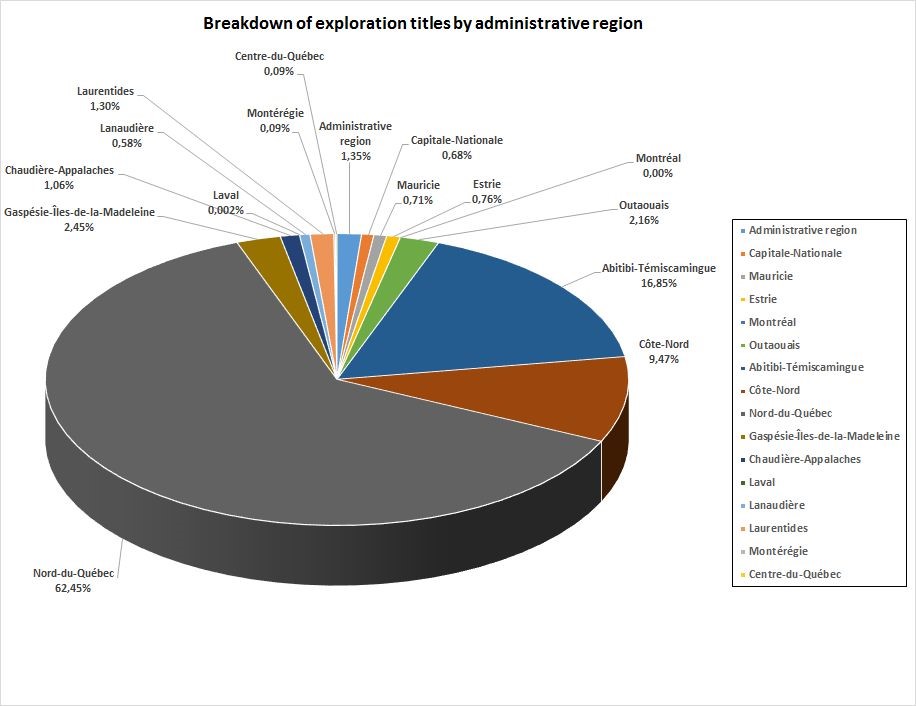

Breakdown of exploration titles by administrative region

Register data as at December 31, 2016 show that 88.7% of exploration titles are situated in the following three administrative regions: Nord-du-Québec (62.45 %), Abitibi-Témiscamingue (16.85 %) and Côte-Nord (9.47 %).

No exploration titles were issued for the Montreal administrative region, and fewer than 3% of all exploration titles were situated in the administrative regions of Laval (0.002 %), Montérégie (0.09 %), Centre-du-Québec (0.09 %), Lanaudière (0.58 %), Capitale-Nationale (0.68 %), Mauricie (0.71 %) and Estrie (0.76 %).

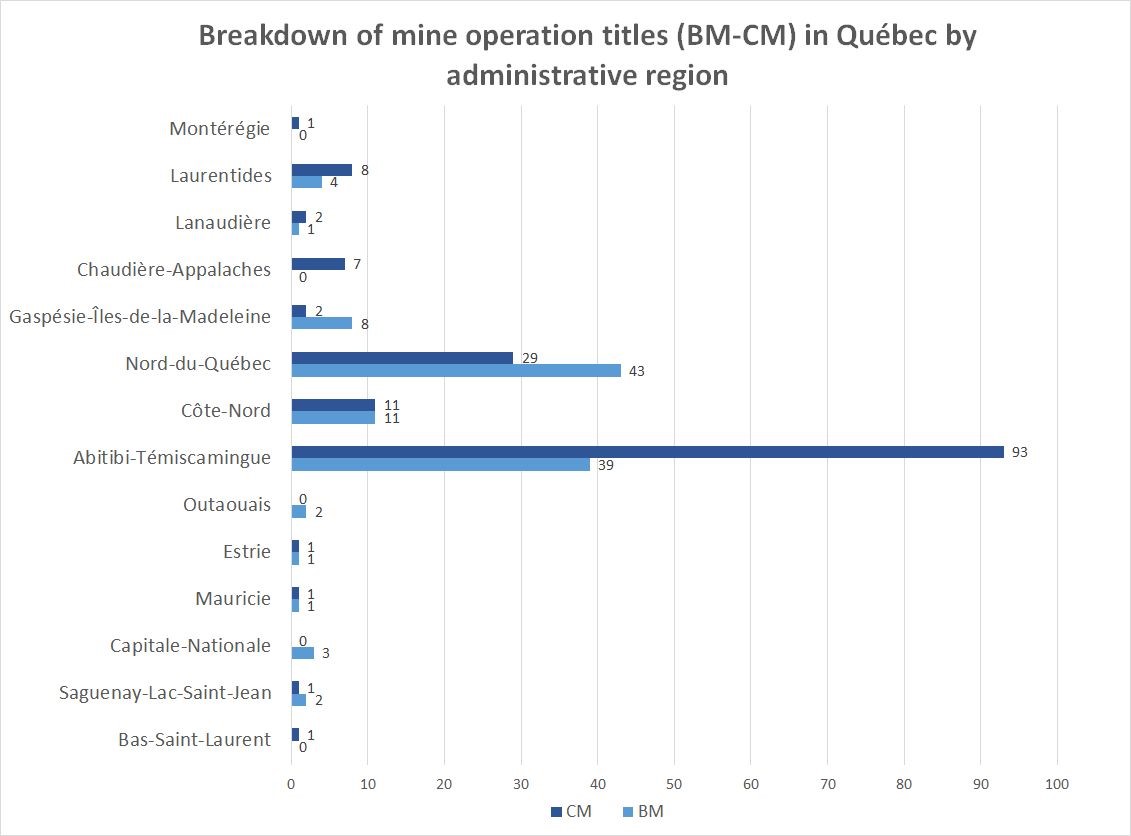

Breakdown of mining titles (BM and CM) by administrative region

In all, 83 % of all mining titles (mining leases – BM – and mining concessions – CM) are located in the administrative regions of Abitibi- Témiscamingue (48.7 %), Nord-du-Québec (26.5 %) and Côte-Nord (8.1 %).

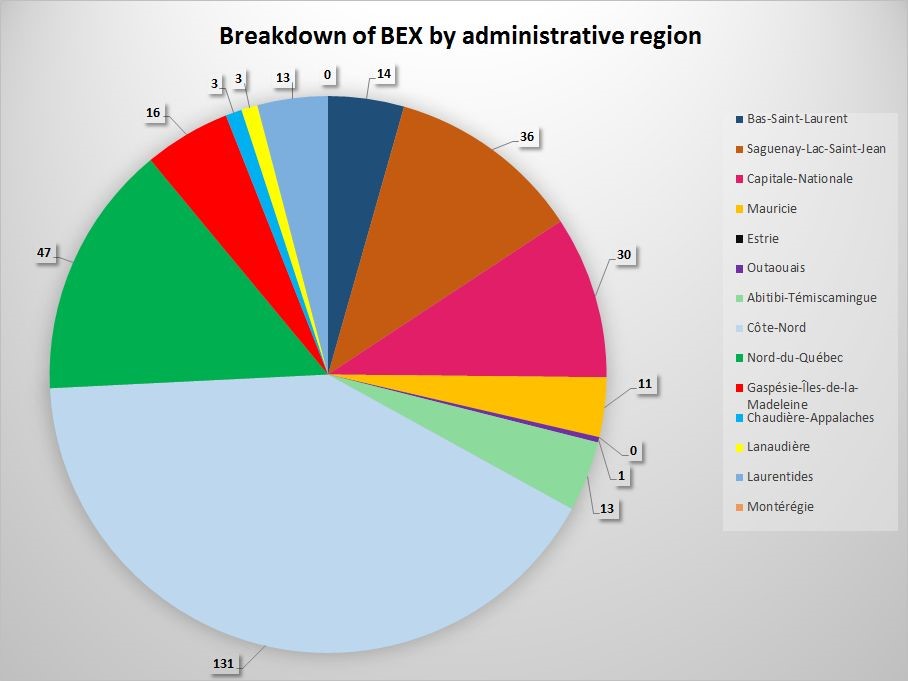

Breakdown of exclusive mining leases by administrative region

Surface mineral substances (BEX)

As of December 31, 2016, the total number of exclusive leases to mine surface mineral substances (BEX) was 318. This number encompasses the various substances mined under an BEX, namely dimensional stone, crushed stone, peat, silica ore, sand and gravel.

Nearly 76 % of the BEXs are situated in the administrative regions of Côte-Nord (131), Nord-du-Québec (47), Saguenay-Lac -Saint-Jean (36) and Capitale-Nationale (30).

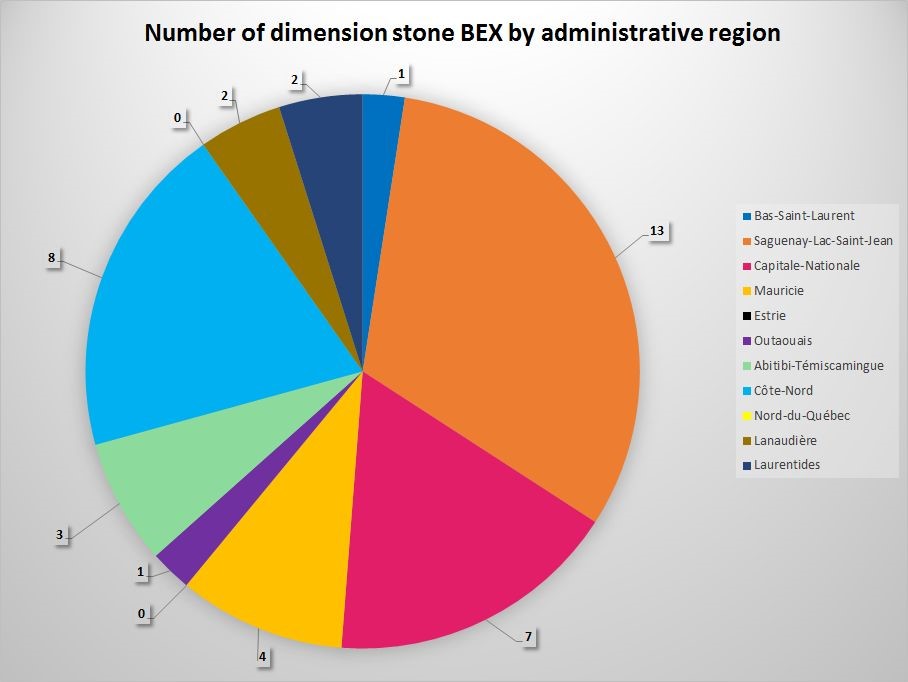

Dimensional stone

The total number of BEXs for dimensional stone is 41, for all administrative regions of Québec. Most of them (68 %) are situated in the administrative regions of Saguenay–Lac-Saint-Jean (13), Côte- Nord (8) and Capitale-Nationale (7).

Crushed stone

As of December 31, 2016, 220 crushed stone BEXs had been issued across all the administrative regions of Québec.

In all, 91 were situated in the Côte-Nord administrative region (41.36%), 47 in Nord-du- Québec (21.36 %) and 14 Gaspésie–Îles- de-la-Madeleine (6.36%).

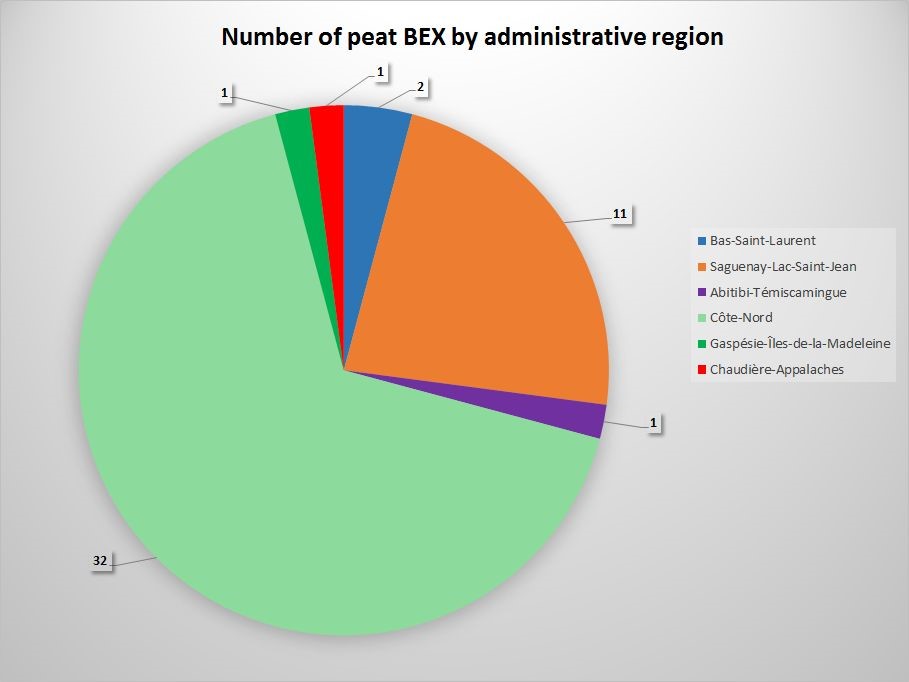

Peat

In 2016, there were 48 BEXs for peat in Québec. They were mainly situated in two administrative regions, namely Côte-Nord (32) and Saguenay–Lac-Saint-Jean (11).

Silica ore

There are 9 silica ore BEXs in all, divided among four administrative regions, including Laurentides (4) and Capitale-Nationale (3).

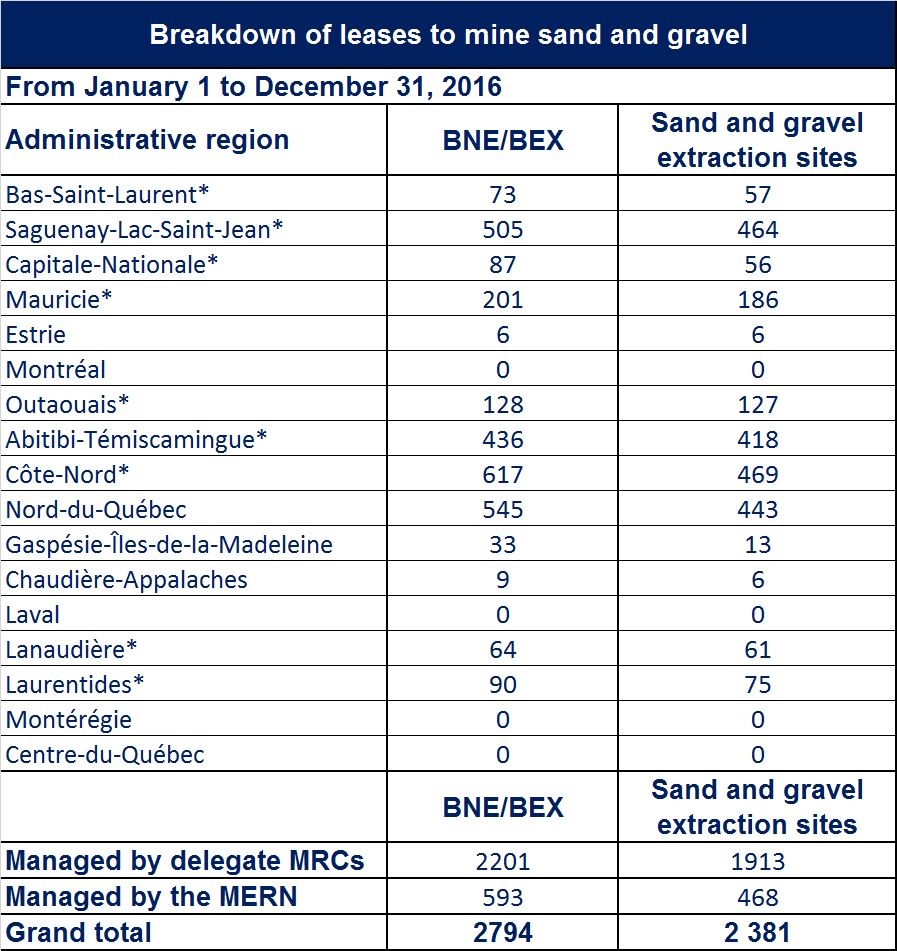

Breakdown of exclusive leases to mine sand and gravel

Acronyms

BEX : Exclusive lease to mine surface mineral substances

BNE : Non-exclusive lease to mine surface mineral substances

* Delegatee administrative regions

In all, there were 2,794 licences to mine sand and gravel throughout Québec, divided among 2,381 surface mineral substance mining sites. Of this number, 2,201 titles (78.7%) were managed by regional county municipalities (MRC). The 593 others were managed by the Ministère de l’Énergie et des Ressources naturelles (MERN).

There were no mining sites for sand and gravel in the domain of the State in the administrative regions of Laval, Montréal, Montérégie and Centre-du-Québec. Existing sand pits in these regions are located on land that was conceded or alienated by the State for purposes other than mining before January 1, 1966. On this land, some substances, including sand and gravel, were abandoned to the owners of the soil and are therefore not in the domain of the State.

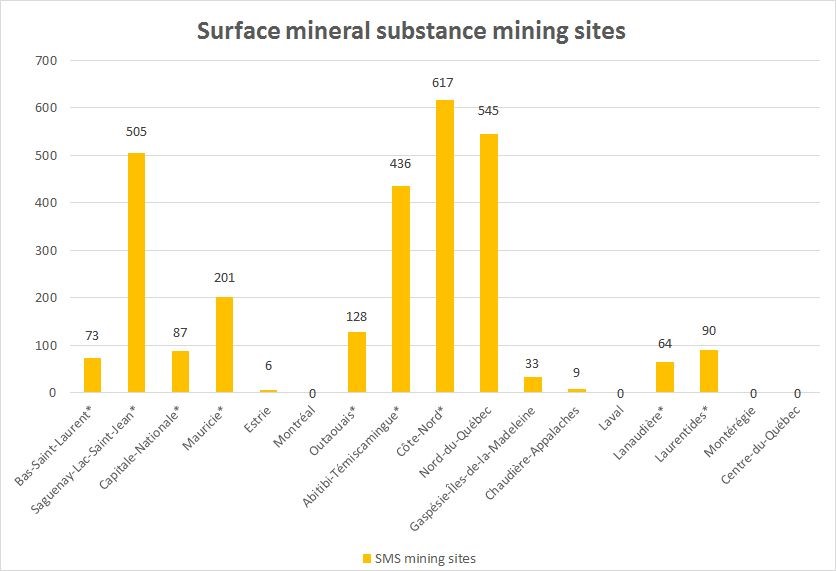

Breakdown of surface mineral substance mining sites by administrative region

The administrative regions with the most surface mineral substance mining sites were Côte-Nord (617), Nord-du-Québec (545), Saguenay–Lac-Saint-Jean (505) and Abitibi-Témiscamingue (436).

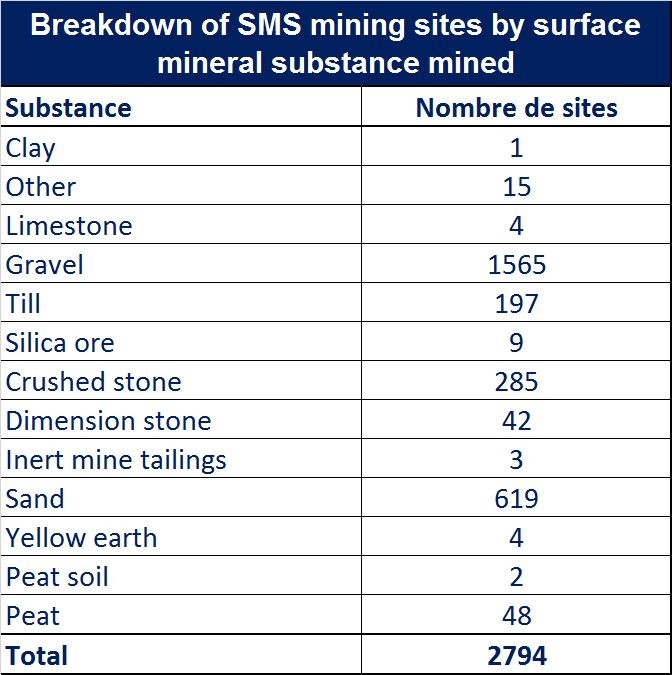

Breakdown of surface mineral substance mining sites by surface mineral substance mined

Québec has 2,794 surface mineral substance mining sites, including 1,565 sites for gravel, 619 sites for sand, 285 sites for crushed stone, 197 sites for moraine, 48 sites for peat and 42 sites for dimension stone.

Declared exploration activities

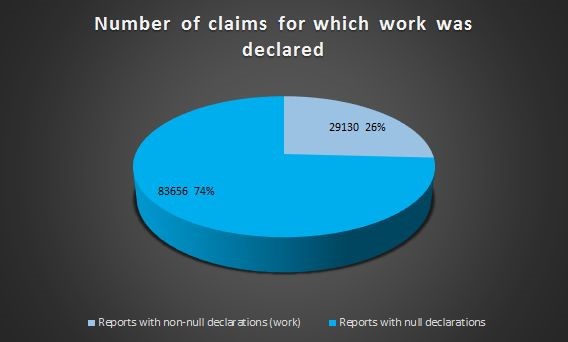

As of December 31, 2016, there were 131,584 claims. Declarations of work were made for 112,786 (85.71 %) of these claims, by means of a report on the work carried out in 2016, sent to the Minister by the claim holder.

The reports of only 29,130 claims, or 26 % of all the claims for which declarations where made, were non-null declarations. These are claims for which exploration or financing activities, partner searches or public or Aboriginal consultations were carried out.

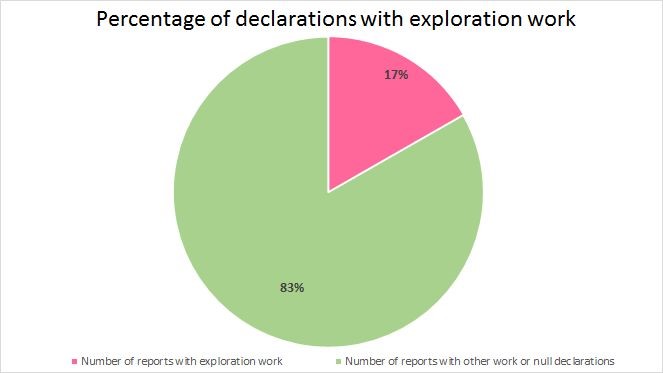

Declarations with exploration work

In 2016, exploration work was carried out for 18,872 claims, or 17 % of the 112,786 claims for which an annual report of work was submitted. The declared work was work other than financing, partner searches and public or Aboriginal consultations.

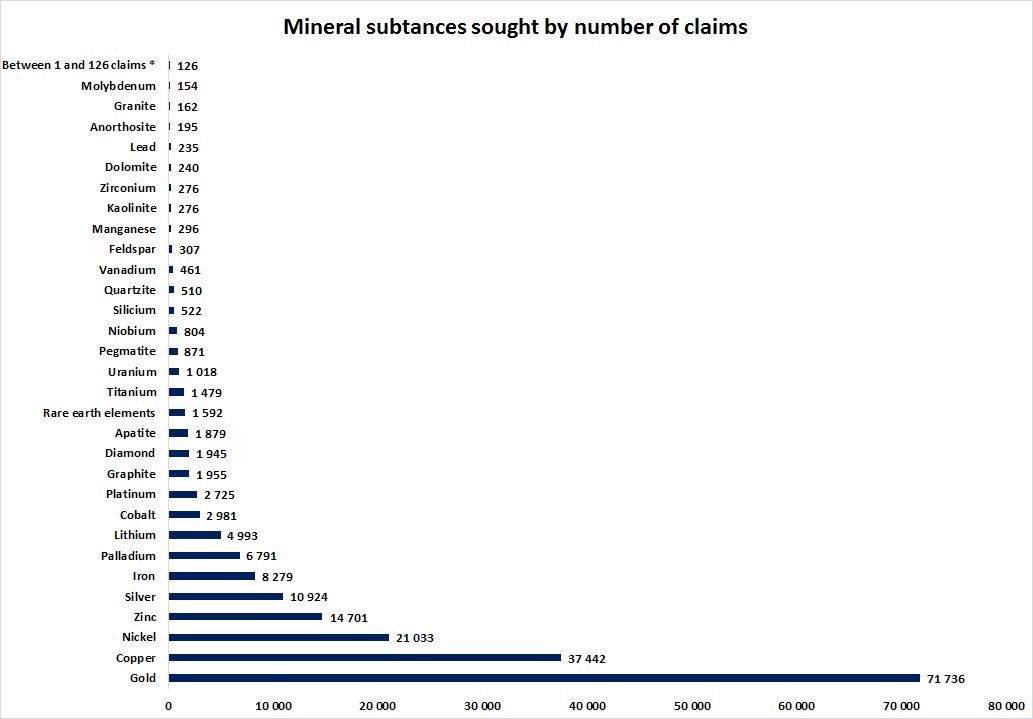

Breakdown of mineral substances sought, by number of claims

*Garnet, marble, serpentine, tin, fluoride, paragneiss, salt, gneiss, magnesium, talc, barytine, thorium, shale, tungsten, limestone, chrome, mica, building stone, peat, ilmenite.

The data below relate to the 112,786 claims (86%) for which an annual report was filed.

The mineral substances that were most sought-after in Québec in 2016 were gold (71,736 claims), copper (37,442 claims), nickel (21,033 claims), zinc (14,701 claims) and silver (10,924 claims).

It should be noted that more than one mineral substance can be sought under a single claim.

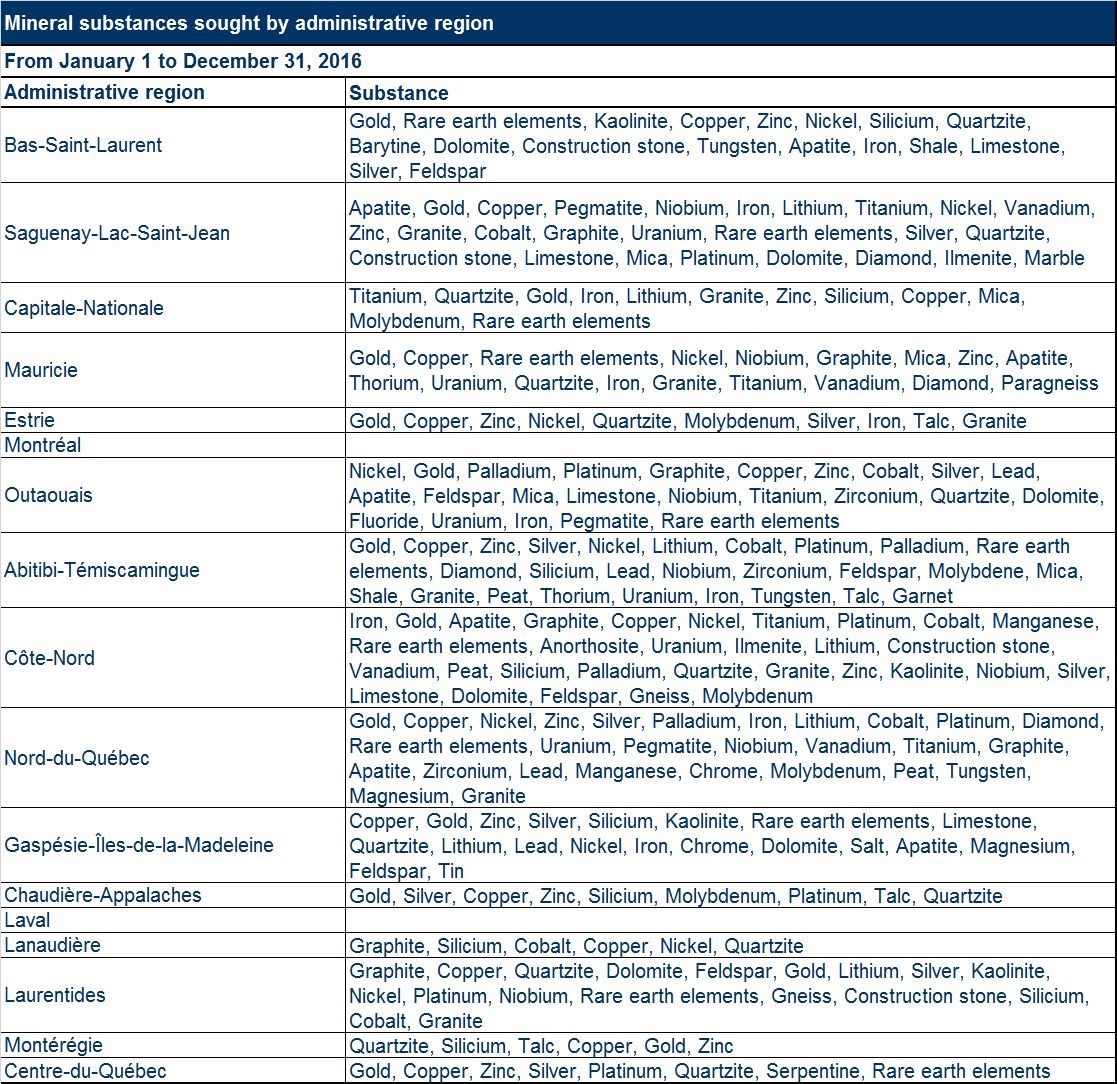

Breakdown of mineral substances sought by administrative region

Note: Mineral substances are presented in order of importance.

Breakdown of “primary” mineral substances sought in Québec’s main administrative regions

Abitibi-Témiscamingue

Primary mineral substances declared as being sought in claims located in Abitibi- Témiscamingue, broken down as follows: gold: 71% of claims, copper: 12% of claims and zinc: 5% of claims.

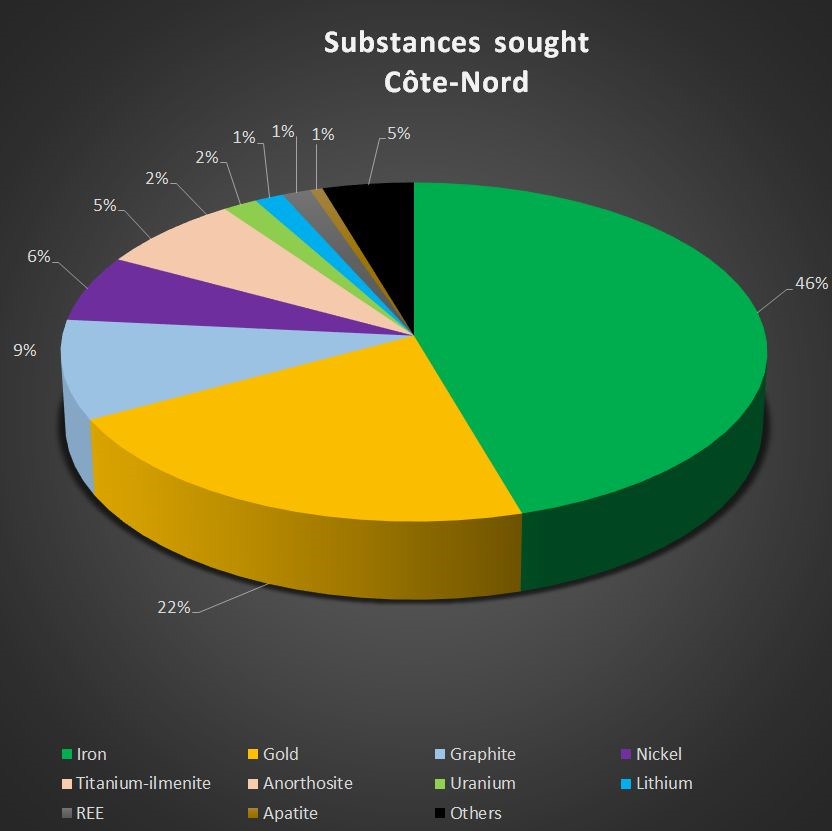

Côte-Nord

Primary mineral substances declared as being sought in claims located in Côte-Nord, broken down as follows: iron: 46% of claims, gold: 22% of claims and graphite: 9% of claims.

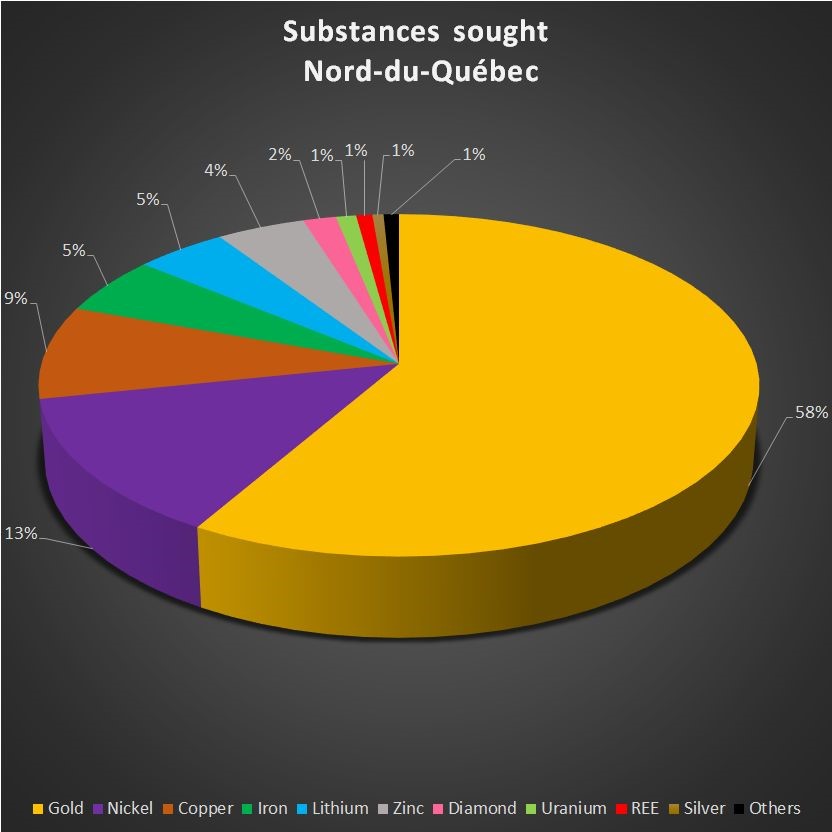

Nord-du-Québec

Primary mineral substances declared as being sought in claims located in Nord-du-Québec, broken down as follows: gold: 58% of claims, nickel: 13% of claims and copper: 9% of claims.

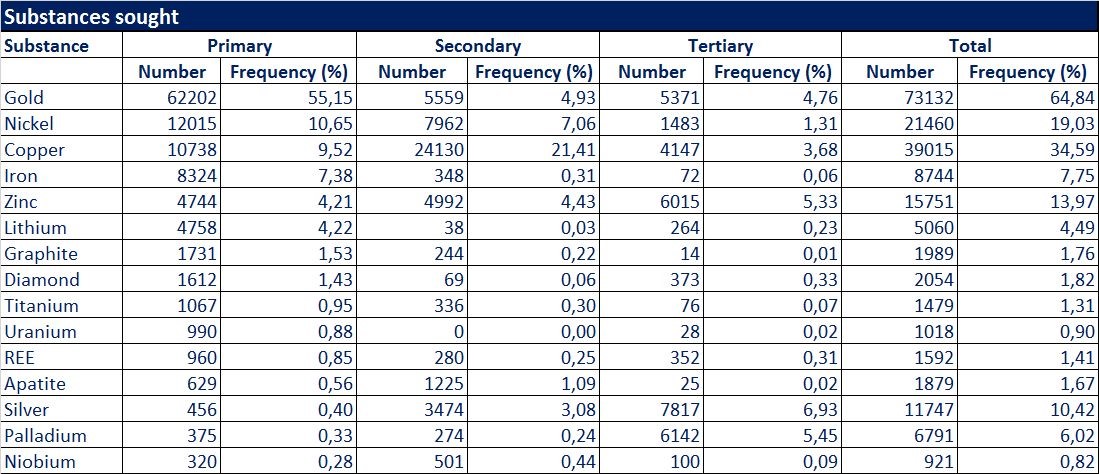

Breakdown of mineral substances sought, in order of importance

Note: In an annual report, the claim holder can declare three different substances sought under the claim, in order of importance: the principal substance sought is considered to be the primary substance, and the others are the secondary and tertiary substances.

Gold was reported to be the primary substance in 62,202 claims, or 55.15% of the claims for which declarations were filed.

Nickel was reported to be the primary substance in 12,015 claims, or 10.65% of the claims for which declarations were filed.

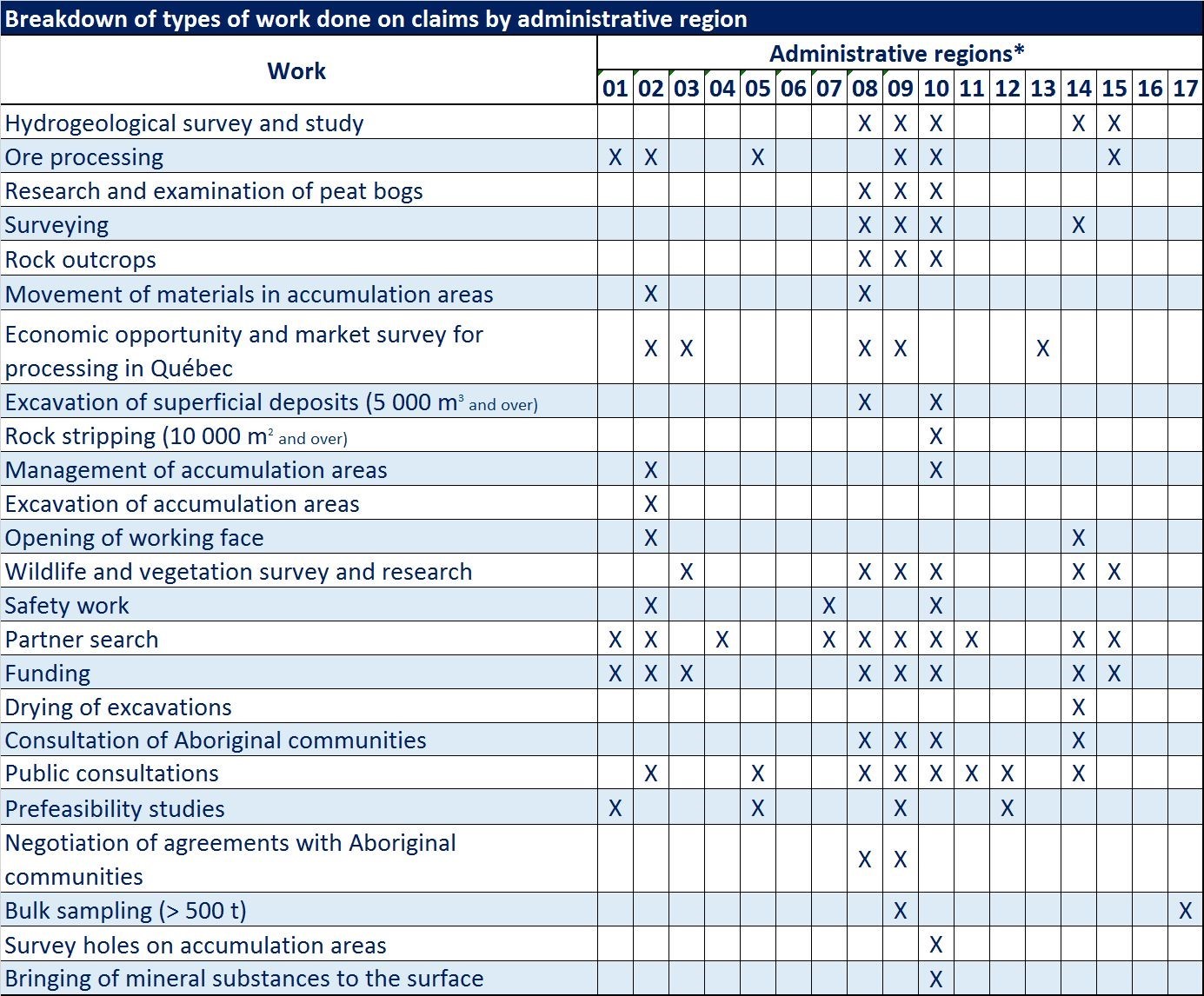

Breakdown of types of work done on claims, by administrative region

* Administrative regions: Bas-Saint-Laurent (01), Saguenay–Lac-Saint-Jean (02), Capitale-Nationale (03), Mauricie (04), Estrie (05), Montréal (06), Outaouais (07), Abitibi- Témiscamingue (08), Côte-Nord (09), Nord-du-Québec (10), Gaspésie–Îles-de-la-Madeleine (11), Chaudière-Appalaches (12), Laval (13), Lanaudière (14), Laurentides (15), Montérégie (16) and Centre-du-Québec (17).

Mining-incompatible territories

Highlights

On December 14, 2016, the Québec Government adopted a land development policy direction for mining activity entitled « Pour assurer une cohabitation harmonieuse de l’activité minière avec les autres utilisations du territoire » which is available in French only.

Since that date, the MRCs, as well as the cities and agglomerations with some MRC responsibilities, can establish mining-incompatible territories within the meaning of the Mining Act. These territories must satisfy the criteria set out in the policy direction document. Mining-incompatible territories are exempt from mining once they are published on the map of mining titles maintained by the Ministère de l’Énergie et des Ressources naturelles.

The MRCs may exercise their power to establish mining-incompatible territories in order to protect activities whose viability would be compromised by the impacts of mining. The MRCs must also promote the development of mineral resources by harmonizing uses. The Government’s policy direction for mining-related development will help achieve better social acceptability for mining projects.

Government’s policy direction for mining-related development: : Pour assurer une cohabitation harmonieuse de l’activité minière avec les autres utilisations du territoire

The provisions of the Mining Act concerning mining-incompatible territories came into force on December 14, 2016. Since that date, the MRCs can establish mining-incompatible territories in their land use and development plans. A mining-incompatible territory within the meaning of section 304.1.1 of the Mining Act is a territory in which the viability of activities would be compromised by the impacts of mining. Exploration and mining activities are prohibited in these areas as soon as they are entered on the MERN’s map of mining titles.

The Government adopted a policy direction document setting out its objectives and expectations, in order to structure the MRCs’ new power and specify which types of activities and territories may be exempted from mining.

The new policy direction adopted by the Government is intended to ensure harmonious cohabitation of mining with other land uses. The policy direction comes with two objectives. The first is to protect activities whose viability would be compromised by the impacts of mining, based on land uses and community concerns. To fulfill this objective, which is not mandatory, the MRC can establish mining-incompatible territories based on the following criteria, which are also set out in the Government’s policy direction document:

- All or part of an urbanization perimeter identified and delimited in the MRC’s land use and development plan currently in force, within the meaning of the Act respecting land use planning and development;

- For territories located outside an urbanization perimeter, the territory must be characterized by all the following elements:

- There must be, in the territory, at least one of the activities mentioned in the document, i.e. urban and residential, historical, cultural or heritage, agricultural, agri-tourism, intensive recreational, tourism or conservation activities, or an activity to remove groundwater or surface water for human consumption.

- It must be difficult to move the activity.

- Maintenance of the activity must be in the common interest.

- The viability of the activity would be compromised by the impacts of mining.

The MRC must show that mining-incompatible territories comply with the criteria set out in the policy direction document. In doing so, the MRC must rely on proper information and on consultations with the general public, Aboriginal communities and the holders of mining rights.

To facilitate public consultations on proposed mining-incompatible territories, the MRC may ask the MERN to temporarily suspend staking and map designation rights. The suspension comes into force at the time it is published on the map of mining titles.

The second objective for MRCs is to promote the development of mineral resources by harmonizing uses. In other words, MRCs must establish land occupation measures to avoid the implementation, in the vicinity of mining sites, of uses sensitive to the impacts of mining.

Banning of mining activities on mining-incompatible territories means that no new mine exploration rights may be granted. Mining rights already in force are maintained, but a new condition for renewal of claims in these territories now applies: claim holders must carry out work on the land for which they wish to renew titles, during every period of validity after the mining-incompatible territory is established.

Before applying for a claim, mine promoters can therefore find out about the territories identified by the MRC as being designated as mining-incompatible, thereby avoiding investments of time and money in areas where it will be difficult, if not impossible, to carry out a mining project. In addition, they can take part in the public consultations organized by the MRCs on amendments to their land use and development plans, in order to demonstrate the area’s mineral potential and the economic development possibilities offered by mining.

These new measures clearly show the importance the Government ascribes to achieving a balance between different potential land uses in the MRC and the development of its mineral potential. They also show the importance ascribed to social acceptability by emphasizing dialogue and consultations between MRCs, their citizens and mine promoters.

CHAPTER 2 – GEOSCIENTIFIC WORK

In 2016, the MERN carried out 21 geoscientific knowledge acquisition projects ,including 12 geological surveys, five geophysical surveys and four Quaternary surveys. The fieldwork for 20 projects had been completed by the end of the year, and one geophysical survey began in the winter of 2017 (the Rivière Moisie project, Block B). A detailed overview of the projects can be found (in French only) in the document summarizing the conferences and photo-presentations at Québec Mines 2016 (DV 2016-03).

GEOLOGICAL REPORTS

The list of documents published by the DGGQ in 2016 include 60 documents in the QERPUB collection:

- 17 geoscientific compilation maps (CG);

- 14 documents in the Public Document series (DP);

- 4 documents in the Miscellaneous series (DV);

- 18 documents in the Manuscript series (MB);

- 2 documents in the Promotional Document series (PRO);

- 2 documents in the Geological Report series (RG);

- 3 documents in the Preliminary Report series (RP).

In addition, an initial geological report prototype in Web format on the geology of Lac Jeannin was published in the fall of 2016. This new knowledge dissemination tool is designed to speed up publication and simplify the presentation of geological information gathered by the DGGQ’s geologists.

CHAPTER 3 – MINING SECTOR HIGHLIGHTS

METALLIC SUBSTANCES

Saguenay–Lac-Saint-Jean (02)

Arianne Phosphate continued to develop the phosphate and titanium deposit at Lac à Paul, located north of Lac Saint-Jean.

Capitale-Nationale (03)

Rogue Resources changed the name of its Lac de la Grosse Femelle project, located north of Baie-Saint-Paul; since March, the project has been known as the La Crête de Silicium (Silicon Ridge) project. In 2016, the company announced the most recent results obtained from drilling carried out in 2015, published a new resource calculation in June and published the results of a preliminary economic assessment in September.

Outaouais (07)

On March 4, 2016, Canada Carbon published the results of a preliminary economic assessment of its Miller project, in Outaouais. A few days later, the company began a pre-feasibility study. A new resource calculation was also produced and published for the project in December 2016.

Abitibi-Témiscamingue (08)

A number of properties, characterized by the presence of lithium indicators and located in the former Québec Lithium mine sector, were purchased during 2016 by new industry players. Altair Resources acquired the Kino Lithium, East Authier, Virium Lithium and Tilia properties, while Fairmont Resources acquired the Rome Lithium property. In May 2016, Globex Mining acquired the Chubb, Bouvier and McNeely projects located near Amos. In addition, AIS Resources announced in July that it had acquired the Fiedmont property. Prospecting work carried out by Alix Resources during the summer at its La Corne 2 and La Corne 4 properties revealed a spodumene ore dyke. Analysis results were still pending at the end of 2016. The arrival of these companies clearly shows a renewed interest in lithium in the Preissac-La Corne sector.

Jien Lithium is working to re-launch operations at the North American Lithium mine (the former Québec Lithium mine, closed since October 2014) in the La Corne sector.

Sayona Mining finalized its acquisition of the Authier in July 2016. A pre-feasibility study was underway at the end of the year.

Agnico Eagle Mines carried out an internal technical study to assess the feasibility of mining the Bousquet 5 zone, located west of the LaRonde mine. The company also updated its reserves and resources in zone 3 of the La Ronde mine, located under zone 2, which is currently being mined at a depth of more than 3.1 km. The Goldex mine began operations in the Deep 1 zone.

Integra Gold continued its drilling operations on its Lamaque project in Val-d’Or. A resource calculation for different zones was published on November 16 and an update to the preliminary economic assessment is expected in the first quarter of 2017.

Métanor Resources published a resource estimate for its Barry project north-east of Val-d’Or. In September, the company announced positive results for the project’s preliminary economic assessment.

In the Malartic sector, Osisko Mining (formerly Oban Mining) published a new resource estimate for its Marban project in June.

Falco Resources obtained the permits it needed for the partial dewatering of well no. 2 at the former Quémont mine, and for an underground drilling campaign at its Horne 5 project. In May, the company announced positive results from the preliminary economic assessment and began a feasibility study. It also published a new resource estimate in October.

In May 2016, Gold Bullion Development Corporation (Granada Gold Mine since January 2017) obtained a certificate of authorization from the MDDELCC to mine gold ore at its Granada project south of Rouyn-Noranda.

Monarques Gold Corporation updated the mineralization index at Gold Bug on its Croinor property located east of Val-d’Or. It also carried out drilling on the main Croinor Gold deposit. In November, it announced the acquisition of the former Beacon mine property (surface and underground facilities).

Côte-Nord (09)

Focus Graphite continued metallurgical testing on ore from its Lac Knife project, located roughly 30 km south of Fermont. In August, the company announced that it had obtained 99.99% purity using an exclusive, effective and economic graphite purification process.

With respect to the Kwyjibo project, partners Focus Graphite and SOQUEM unveiled the results of metallurgical testing in November. They also stated that a preliminary economic assessment and resource estimate would be carried out in 2017-2018.

In February 2016, Mason Graphite presented an updated version of the feasibility study for its Lac Guéret project, published in 2015.

Nord-du-Québec (10)

Gold exploration work continued in several sectors of interest: the Urban-Barry sector east of Lebel-sur-Quévillon, along the known regional structures west of Matagami, the Opinaca reservoir region, the deformation corridors south of Chapais, the greenstone belts in Eeyou Istchee Baie-James and the Labrador Trough.

With respect to base metals, several companies announced new resource estimates, including the Estrades project (Cu-Zn) (Galway Metals), the B26-Brouillan project (Cu-Zn) (SOQUEM), the Grasset project (Cu-Ni) (Balmoral Resources), the Scott project (Cu-Zn) (Les Ressources Yorbeau) and the Troilus Mine project (Cu-Au) (Sulliden Mining Capital).

Following the significant progress of Nemaska Lithium’s Whabouchi lithium project, a number of mining companies acquired properties to prospect for lithium in the project sector and in the vicinity of the Cyr-Lithium, Rose and Moblan deposits.

At Hecla Mining-Québec’s Casa Beradi mine, surface and underground drilling programs identified replacements for its 2015 gold production, as well as new resources at the East and West mines. The East Mine’s surface mining operations began on July 22, 2016.

Wallbridge Mining Company updated its estimate of mineral resources in the Discovery zone for the Fénelon Mine project and also undertook a pre-feasibility study.

Ressources Métanor updated its estimate of mineral resources in the Discovery zone for the Fénelon Mine project and also undertook a pre-feasibility study.

At Osisko Mining’s Lac Windfall project, fill-in drilling programs above the Red Dog intrusive along with expansion drilling above and below Red Dog confirmed the presence of mineralized gold zones in three broad WSW-ENE mineralized corridors: the Caribou corridor, the zone 27 corridor and the Underdog corridor. A preliminary economic study has been carried out.

Goldcorp published a new reserve and resource estimate for the Éléonore mine (June 30, 2016).

Several gold drill intersections have been reported for a number of projects, including: Martinière (Balmoral Resources), Detour Quebec (Probe Metals and SOQUEM), Moroy (Ressources Métanor), Gladiator (BonTerra Resources), Urban (Ressources Beaufield), Lac Surprise Gold (Northern Superior Resources and Bold Ventures), Nelligan (Corporation IAMGOLD and Ressources minières Vanstar), Lac au Monstre (Corporation IAMGOLD et Corporation Tomagold), Hazeur (Visible Gold Mine and Corporation Tomagold), Eastmain and Clearwater mine (Eastmain Resources), Cheechoo (Ressources Sirios), Au 33W-Heberto (Exploration Dios), Éléonore Sud (Eastmain Resources, Goldcorp and Exploration Azimut), Sakami (Explorations Matamec and Métaux stratégiques du Canada), Kan-Fosse (Osisko Mining and Corporation aurifère Barrick) and Willbob (Exploration Midland).

Gaspésie–Îles-de-la-Madeleine (11)

Canadian Metals, owner of the Langis project, published the results of the preliminary economic assessment for quartz quarry operations. The company had to amend the study, and a revised version was presented in October.

Chaudière-Appalaches (12)

In early November 2016, Golden Hope Mines announced that contracts had been awarded for the work needed to obtain a certificate of authorization from the MDDELCC, along with a mining lease, for its Bellechasse-Timmins project located 83 km east-south-east of Québec City.

Lanaudière (14)

Nouveau Monde Mining published the results of a resource calculation for the western area of the Tony block at its Matawinie project in February. The results of a preliminary economic assessment for the project were published in June.

NON-METALLIC SUBSTANCES

In the area of architectural stone, Polycor, a Québec company, purchased Rock of Ages, an American producer of natural stone, thereby becoming one of the largest producers of natural stone in the world. The company also acquired Blackburn Quartz, a quartz producer in the Fermont area.

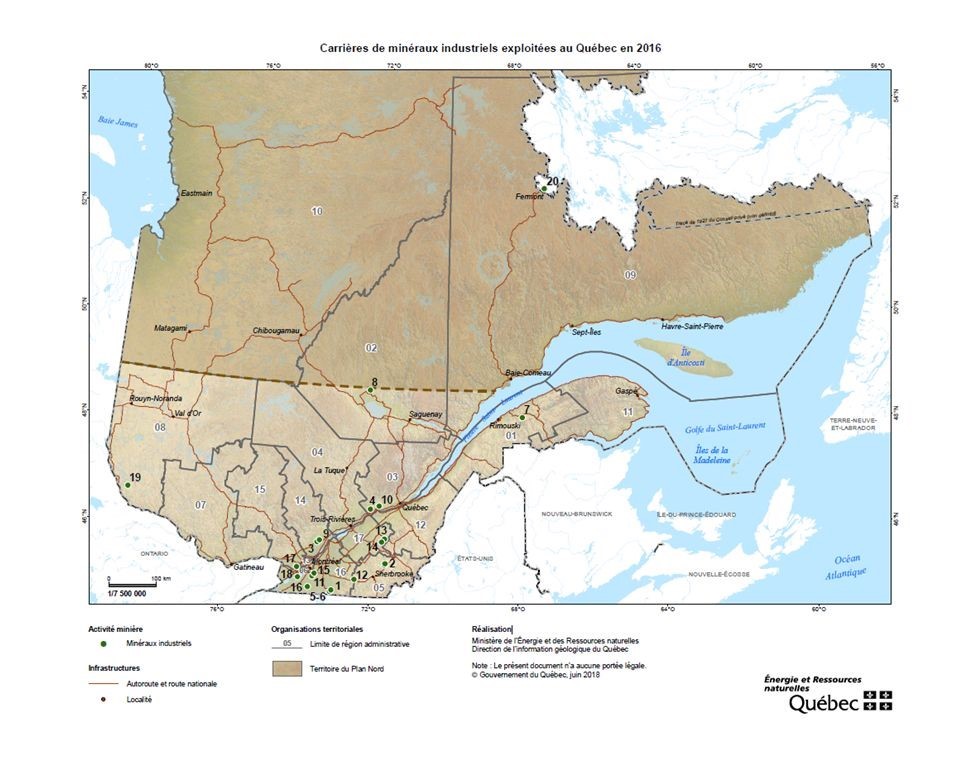

Industrial minerals

The non-metallic substances (industrial minerals) mined in Québec include graphite, mica, sodium chloride, potassium feldspar and silica.

Flake graphite is mined at the Lac-des-Îles south of Mont-Laurier by Timcal Canada.

Phlogopite has been mined since 1970 at the Lac Letondal mine in Haute Mauricie by Imerys Mica Suzorite. The company extracts ore on a sporadic basis to supply its processing plant in Boucherville.

Salt is mined at the Seleine mine by the Canadian Salt Company in the Îles-de-la- Madeleine.

Silica comes from the Saint Canut (Mirabel region) and Petit lac Malbaie (Charlevoix region) deposits. Silicium Québec extracts and processes the ore at Petit lac Malbaie. Part of the production is used to supply its silicon metal plant at Bécancour.

Potassium feldspar mined by Dentsply Canada at the Othmer mine is used to make dental ceramics. Mining occurs sporadically through the year, to build up reserves for the plant.

Industrial stone

The industrial stones extracted in Québec are limestone, dolomite, marble, quartzite, clay and shale.

Limestone, dolomite and marble are mined for industrial purposes to produce quicklime, granulated products (liming materials, fillers, granules) and cement products.

The main sources of silica are quartzites, clays and natural sand deposits. Shale is mined at only one site in the Montreal region and is used to produce face brick.

Industrial stone quarries in operation in Québec in 2016

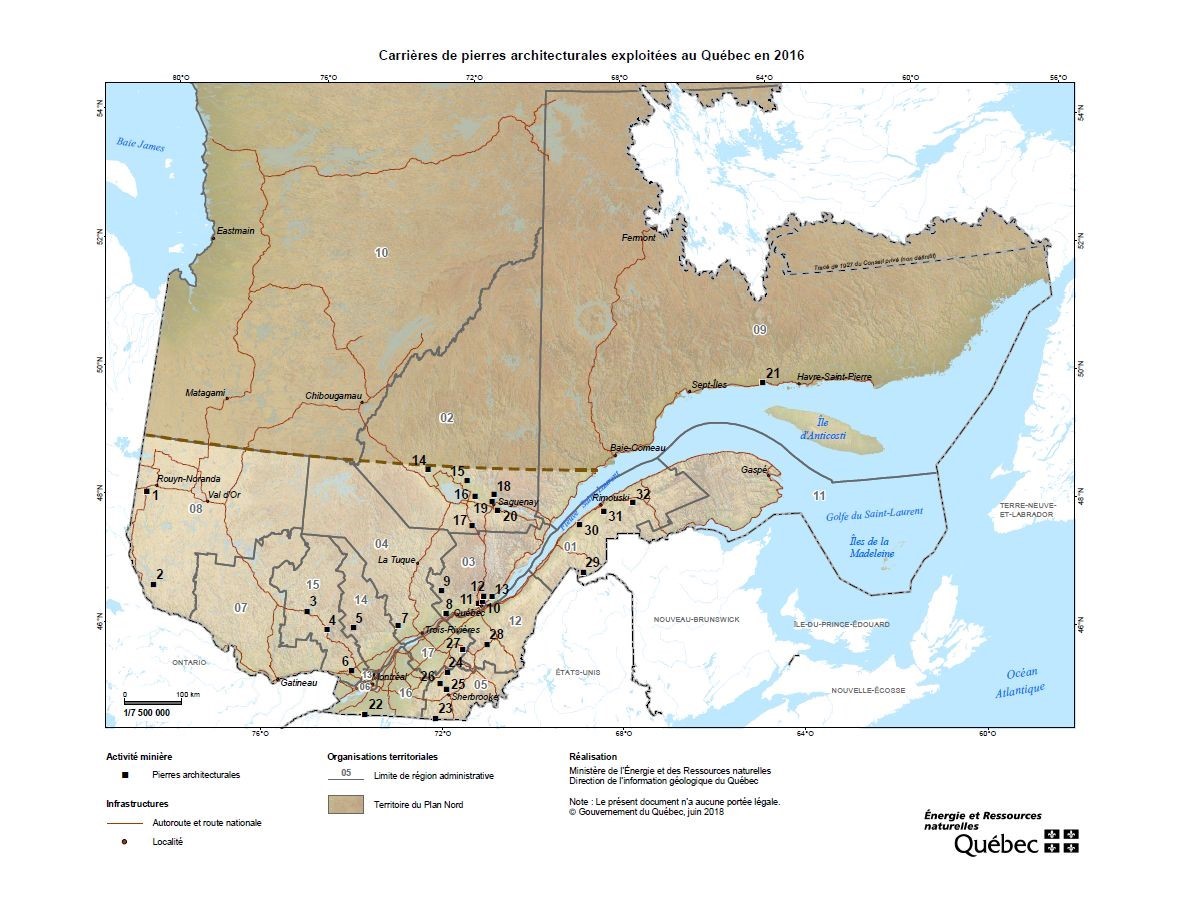

Architectural stone

There are many architectural stone quarries in Québec. The Rivière-à-Pierre sector is the province’s main extraction area. Other mining sites include the Saint-Nazaire and Chute-des-Passes sectors (in Lac-Saint-Jean) and the Saint-Alexis-des-Monts and Saint-Didace sectors (Lanaudière region).

Architectural stone quarries operated in Québec in 2016

CHAPTER 4 – MINING ACTIVITY

Here are the mines and projects for 2016. They are presented in the form of a downloadable PDF table and located on two maps (Producing mines and Mining projects).

CHAPTER 5 – RESTORATION OF MINING SITES

INTRODUCTION

The Mining Act provides that a rehabilitation and restoration plan must be approved before a mining lease can be awarded to undertake mining operations. The plan sets out the restoration work to be done and the amount to be paid as a guarantee.

In addition to proposed mines and active mines, Québec also has a number of abandoned mines. The owners of these sites are either unknown or insolvent. The Ministère de l’Énergie et des Ressources naturelles (MERN) has elected to take action and restore these sites. It also monitors sites that were given back to it or for which a certificate of release from restoration obligations has been granted, as provided for in the Mining Act.

The Québec Government, in its 2016-2017 Budget Speech, announced that the restoration of abandoned mining sites would be intensified, with a view to reducing their environmental liability by 80% between now and 2022; the previous target was 50%.

The Government’s commitment led to an announcement, in November 2016, of a work plan for restoration of abandoned mining sites.

ACTIVE MINES

Every person who carries out mining activities must file a rehabilitation and restoration plan, along with a financial guarantee, before beginning work.

In 2016, mine operators had paid a total of $165 million in financial guarantees, bringing the total amount of guarantees held by the MERN to $843 million.

STATE MINING SITES (TRANSFERRED, RELEASED OR ABANDONED)

Environmental liability

In 2006, to reduce the scope of the environmental liability, the Government asked all government departments and public agencies to prepare an inventory of contaminated abandoned sites.

The monies needed to restore abandoned mining sites are set against the amount of environmental liability from contaminated sites in the Government’s consolidated financial statements.

As of March 31, 2016, 499 mining sites were listed as environmental liabilities for the Québec Government, for a total amount of $803.4 million. Of these sites:

- 263 were mine exploration sites:

- 50 exploration sites in Nunavik;

- 213 exploration sites in the Eeyou Istchee James Bay territory.

- 230 were active mining sites:

- 127 had been restored or secured and the MERN was responsible for monitoring and maintaining them;

- 18 sites were undergoing restoration;

- 39 sites had yet to be restored;

- 46 sites had yet to be secured;

- 6 were quarries and sand pits.

Between April 1, 2016 and March 31, 2017, the Mining Sector spent a total of $18.8 million on restoration work at abandoned mining sites. In the period since 2007, the MERN had spent an additional $15 million on restoration work.

A full list of sites entered as environmental liabilities, along with a map showing their locations, can be found on the MERN’s website at: https://mern.gouv.qc.ca/en/mines/mining-reclamation/list-of-abandoned-mining-sites/

Characterization work

To identify the environmental impacts of abandoned mining sites in more detail, the MERN has set up an environmental characterization program for sites awaiting restoration. The first qualification program ended in September 2015 and a new one began in 2016, to continue the initiative. Companies that qualify under the program remain qualified for three years. Among other things, characterization is used to assess the real impacts of an abandoned site for the surrounding environment. Restoration plans are prepared, specifying the amount of restoration costs to be entered against environmental liability, and sites are then ranked in priority order for restoration.

In the coming year, characterization work will be carried out at the Normetmar, St. Lawrence Columbium, Joutel-Copper and West Malartic mines.

The following characterizations were completed in 2016.

Cournor

The former Cournor mine is located roughly 15 km east of Val-d’Or. Gold was mined at the site from 1932 to 1935, and from 1937 to 1942. The ore was processed on site using a mercury amalgamation process during the first mining period, and a cyanide process during the second.

Environmental characterization of the site began in October 2016 and will end in July 2017. The work will include the design, planning and application of a survey including an assessment of the impacts on land damaged by the presence of tailings, waste rock or any other contamination source resulting from past mining activity, with a view to restoring the site.

In the fall of 2016, the MERN carried out 34 test trenches, 15 bores, including 11 that were equipped as underground water observation sites, and 40 manual surveys.

The following observations were made:

- The mine tailings site at the Cournor mine extends over 9.8 hectares and the waste rock stack over roughly 2 hectares. There is also a shallow layer of mine tailings in the surrounding woodland over an area of approximately 11.6 hectares.

- The mine tailings are slightly leachable in copper and may potentially generate acids.

- All the soil samples analyzed fell within the thresholds established by the Ministère du Développement durable, de l’Environnement et de la Lutte contre les changements climatiques (MDDELCC) for residential land.

- However, copper values slightly in excess of MDDELCC thresholds were measured in surface and underground water samples.

Restoration work

Outaouais (07)

Lac Renzy

The former Lac Renzy mine is located roughly 40 kilometres west of Route 117, at kilometre 294, on the territory of the Poirier outfitting operation.

Nickel and copper were mined at the site from 1969 to 1972. Nearly 0.8 Mt of ore were extracted from an open-pit mine. The ore was processed on site. The pit itself has been flooded by Lac de Renzy. Mining operations generated a waste rock stack covering an area of 1.2 hectares and a mine tailings site covering roughly 6.7 hectares in the middle of Lac de Renzy, splitting it into two separate hydrological entities.

Characterization work at the site revealed that the tailings and waste rock may be acidic and leachable. In addition, soil, sediment and surface/underground water quality levels were slightly in excess of the thresholds set by the MDDELCC for certain metals.

Plans and specifications were drawn up and preliminary engineering work on the concepts chosen for the rehabilitation plan was carried out in 2016, at the same time as environmental authorizations were requested. A plan to submerge the tailings and waste rock in the downstream portion of Lac de Renzy, which was used as a polishing basin during mining, was chosen. A biopile method was selected for restoration of contaminated soils on the site of the former mine facilities. Detailed engineering work will begin in 2017.

New Calumet

The New Calumet mining site is located 6 kilometres west of the municipality of Bryson. This former lead and zinc mine was active between 1943 and 1968. Operations generated three tailings sites (A, B and C) covering a total area of roughly 20 hectares, with a volume of roughly 1.3 Mm3.

The New Calumet mining site is located 6 kilometres west of the municipality of Bryson. This former lead and zinc mine was active between 1943 and 1968. Operations generated three tailings sites (A, B and C) covering a total area of roughly 20 hectares, with a volume of roughly 1.3 Mm3.

The mine tailings have the potential to be acidic and leachable (high risk). Surface and underground water on the site is contaminated by metals (zinc, cadmium, copper, lead) in excess of MDDELCC thresholds. In addition, wind erosion of the tailings has contaminated the sector’s surface water.

The restoration plan was produced and detailed engineering work on the restoration concept was carried out in 2014. A concept involving multi-layer covering with a bentonitic membrane was chosen for sites B and C, to prevent surface water and precipitation from entering the mine tailings. This type of membrane is composed of a natural clay material placed between two woven geotextile membranes.

As for site A, a capillary barrier-type cover and conservation and improvement of the existing wetland area was chosen. This dual concept will form an oxygen barrier around the entire mine tailings site and will prevent oxidation of the sulphur present in the mine tailings.

Work began in 2015. The first phase involved the transportation of roughly 180,000 m³ of mine tailings from site B to site C. This work was needed because site B’s profile, with its steep slopes and a tailings depth of roughly 30 metres, made it impossible to apply the chosen restoration concept. This preparatory phase took place from September to December 2015, and reduced site B’s slopes by 33%. Demolition of the buildings and management of the waste rock stacks and contaminated soils also took place at the same time.

Work began in 2015. The first phase involved the transportation of roughly 180,000 m³ of mine tailings from site B to site C. This work was needed because site B’s profile, with its steep slopes and a tailings depth of roughly 30 metres, made it impossible to apply the chosen restoration concept. This preparatory phase took place from September to December 2015, and reduced site B’s slopes by 33%. Demolition of the buildings and management of the waste rock stacks and contaminated soils also took place at the same time.

In 2016, work began to install the covers, decontaminate neighbouring ground and restore vegetation in the three mine tailings sites. Work was interrupted by a snowstorm in mid-November, when roughly 90% had been completed. The remainder of the work will be completed in the summer of 2017.

Abitibi-Témiscamingue (08)

Barvue

The Barvue mine site is located in the municipality of Barraute, roughly 50 kilometres north-west of Val-d’Or. Zinc and silver were mined at the site between 1952 and 1957, leaving behind a mine tailings site covering an area of roughly 35 hectares.

The Barvue mine site is located in the municipality of Barraute, roughly 50 kilometres north-west of Val-d’Or. Zinc and silver were mined at the site between 1952 and 1957, leaving behind a mine tailings site covering an area of roughly 35 hectares.

The dike north of the mine tailings site was breached during mine operations, creating a spill area of approximately 28 hectares along the banks of Ruisseau Marcotte, which flows into Rivière Laflamme.

A characterization study carried out at the site in 2009 revealed that the mine tailings had potential for acid generation and for leaching heavy metals into the receiving environment. It also revealed the need to secure the tailings site containment dike in the short term. A restoration plan was prepared in the fall of 2011 for the entire site. The restoration concept required the installation of a multi-layer covering including a textured HDPE geomembrane to limit oxidation of the tailings and acid drainage.

A characterization study carried out at the site in 2009 revealed that the mine tailings had potential for acid generation and for leaching heavy metals into the receiving environment. It also revealed the need to secure the tailings site containment dike in the short term. A restoration plan was prepared in the fall of 2011 for the entire site. The restoration concept required the installation of a multi-layer covering including a textured HDPE geomembrane to limit oxidation of the tailings and acid drainage.

Restoration work began in the winter of 2012 with construction of an access road to the site and deforestation of the areas to be restored. In the summer and fall of 2012, stabilization and reshaping work took place on the former tailings site dikes. To strengthen the northern dike, which had been breached in the 1950s, a berm was built and Ruisseau Marcotte was partially diverted.

In 2013, nearly 400,000 m3 of mine tailings were removed from the banks of Ruisseau Marcotte, which were then redeveloped, and vegetation was restored. Settling basins were also built.

Work on the final phase of the project began in the spring of 2014. It involved the installation of a multi-layer geomembrane cover on the tailings park, along with the instruments required for environmental monitoring, and restoration of vegetation using fertilizing waste instead of natural humus.

East Malartic

This former gold mine, located in the town of Malartic, was one of the largest mines in Abitibi-Témiscamingue when it was active.

Following signature of the East-Osisko Project agreement by the MERN and Osisko Mining, the company took over responsibility for managing site restoration in 2010. Under the partnership, restoration costs, estimated at $23 million, are shared. The MERN’s maximum contribution has been set at $11.5 million.

Restoration work continued as planned at the East Malartic mine’s former mine tailings site, even though Canadian Malartic GP (owned by Agnico Eagle Mines and Yamana Gold) purchased Osisko Mining in 2015.

Manitou

This process was originally planned to last for eight years, but was interrupted when the Goldex mine’s operations ceased temporarily in October 2011. By that time, nearly 8 Mt of tailings had been deposited at the Manitou site. During the stoppage, a new restoration scenario was drawn up, to optimize the initial concept. The volume required for rehabilitation was reduced, due to new operating methods at the Goldex mine and the need to fill the work sites. The new scenario provided for the use of 3.5 Mt of mine tailings from Goldex.

Since work resumed in 2013, 2.552 Mt of tailings have been sent to the Manitou site, including 1.01 Mt in 2015 and 632,644 tons in 2016. The low tonnage for 2016 was due to maintenance work on the pipe, which began in July 2016 and was completed at the end of the year.

Two test cells were also installed on the mine tailings site in 2015. The two 100 m2 plots test the behaviour of two different multi-layer coverings, with a view to choosing the best scenario for covering the top part of the tailings site. The tests continued in 2016 and will continue into 2017.

Preissac Molybdénite B

This is a former molybdenum and bismuth mine located near the municipality of Preissac. The mine was active from 1962 to 1971, and roughly 2.2 Mt of ore were extracted and processed on site. These activities generated a waste rock stack covering approximately two hectares, plus two unconfined mine tailings sites covering approximately 12 hectares (site A) and 22 hectares (site B). Site A, located at the mine, appears to contain roughly 1.2 Mt of tailings. Site B, located on lots 11 and 12 of Rang IV of the Township of Preissac, was restored in 1992. In 1971, tar containing copper chloride was burned clandestinely at the site and along the shores of Lac Fontbonne. The burn waste was placed on the waste rock stack when the mining facilities were subsequently decommissioned. Environmental characterization work carried out since 2011 has confirmed the presence of contamination by chlorine-containing dioxins and furans (D and F) in the waste rock, fill materials, surface soils and underground water sampled on the site and on the shores of Lac Fontbonne. The presence of contamination was also confirmed in the commodities (fish, hares, grouse, moose and small fruits) harvested in the sector. The Public Health department of the Abitibi-Témiscamingue Health and Social Services Agency therefore recommended that the general public in the area should avoid the site and should not consume food commodities harvested in the sector.

Data were collected up to 2016, including samples of commodities from the exposed area (the site and surrounding area) and in a control zone (a sector not exposed to contamination), and are currently being analyzed by the Public Health Department to verify the need to maintain the recommendations currently in force.

In addition to contamination by chlorine-containing furans, 2,000 m3 of waste rock were contaminated by petroleum hydrocarbons. The site’s waste rock is also considered to be acid-producing, since highly acidic pH levels have been measured in the underground water at the site of the stack. As for the site’s mine tailings, they are leachable and subject to water erosion, which affects the quality of the surface water downstream from the site. Site restoration solutions, including rehabilitation of the land contaminated by furans, are currently being identified.

Nord-du-Québec (10)

Main Mine

The former Main (Campbell) copper mine was one of the largest mines in the Chibougamau region, and was active from 1953 to 1979. The processing plant at the site was used by neighbouring mines until 2010, when the company declared bankruptcy. The mining site covers an area of more than 300 hectares and includes three mine tailings sites, one polishing basin and one ore extraction and concentration site. It is the largest abandoned mining site in Québec.

A number of studies have been carried out since 2010 with a view to restoring the site, including an environmental characterization, a geotechnical assessment of surface pillar stability, preparation of a restoration plan (conceptual engineering) and specific engineering and characterization studies of the sites’ geochemical and hydrogeological conditions.

The Main mine site is located on the Cree community of Oujé-Bougoumou’s trapline O-59 and on the territory of the town of Chibougamau. These communities are stakeholders in all site rehabilitation and restoration work, through their involvement in a steering committee and a technical subcommittee.

In 2016, the MERN continued the engineering work required to restore the site. These efforts narrowed down the choice of a final restoration scenario and led to the preparation of specific plans and specifications for the scenarios retained. An observation well was installed to obtain additional information on the site, with a view to finalizing the restoration scenarios. Hydrogeological modelling began in 2015, and led to detailed engineering for the proposed scenarios at the three mine tailings sites. Preparatory work was carried out on site, including waste cleanup at the mine. A major drilling and geotechnical characterization campaign took place at the former underground sites in the summer of 2016, to test the stability of the surface pillars.

In 2017, the MERN plans to analyze the data obtained during the geotechnical investigation, in order to decide on the steps needed to restore the site to a satisfactory condition and ensure public safety. Plans and specifications for the chosen restoration scenarios will also be finalized in 2017.

Mine exploration sites in Nunavik

An inventory carried out in 2001 identified 275 abandoned mine exploration sites in Nunavik, including 19 sites classified as major.

The Québec Government, the Kativik Regional Government, the Makivik Corporation and the Restor-Action Nunavik Fund (a group of mining companies) signed a partnership agreement in 2007 to clean up the 19 major sites.

In 2012, since the work on the major sites had cost less than anticipated, the agreement was extended to cover cleanup of the 27 sites classified as intermediate, and was prolonged until 2017.

Following work done in the summer of 2016, cleanup operations have been completed at 44 mine exploration sites as part of the agreement.

In 2016, the parties agreed to prolong the agreement for a further two years, until 2019.

Other sites undergoing restoration

Restoration work has begun at the Arntfield, Capelton, Darius (O’Brien), Delbridge, East-Sullivan, Icon Sullivan, Lapa (Zulapa), Molybdenite Corp., Pandora, Thompson Cadillac and Siscoe sites, and will continue in future years.

5.4 – INSPECTION AND SECUREMENT

Every year, the MERN carries out an extensive inspection program at mining sites on its environmental liability list, to identify potential risks to the environment or to human safety, and to plan maintenance and securement work. The main purpose of this is to secure former mine openings by filling them or installing fences or concrete slabs.

In 2016, 209 abandoned mining sites were visited by MERN inspectors, among other things to ensure that they were safe. Maintenance or securement work was subsequently carried out at 16 of these sites, namely Acton Copper, Aldermac, Back, Beaudry, Buffadison, Charbonneau, Derry, Evans, Lacoma, Montauban, Normetmar, Opémiska, Phosphate King, Québec Explorers, Resenor and Villeneuve.

5.5 – ENVIRONMENTAL MONITORING OF ABANDONED MINING SITES RESTORED BY THE STATE

The DRSM carries out annual monitoring of surface water and groundwater quality at mining sites restored under State responsibility.

Monitoring is required to comply with the conditions contained in the certificates of authorization issued by the MDDELCC for the restoration work. More specifically, it is used to ensure that the effluent from the sites satisfies the requirements of Directive 019 on the mining industry, published by the MDDELCC, and to assess the performance of restoration measures applied to the sites.

So far, monitoring has taken place at 18 sites that have been or are currently being restored. They are located in the following regions: Abitibi-Témiscamingue (11), Estrie (2), Gaspésie (2), Mauricie (1) and Nord-du-Québec (2).

5.6 – CONCLUSION

The Québec Government considers restoration of abandoned mining sites to be one of its main priorities. The MERN therefore intends to respect the commitment announced in the 2016-2017 Budget Speech, namely to reduce the environmental liability from mining by 80% between now and 2022. The MERN’s work plan for restoration of abandoned mining sites can be found at: https://mern.gouv.qc.ca/en/mines/mining-reclamation/reclamation-of-abandoned-mining-sites/

CHAPTER 6 – RESEARCH AND DEVELOPMENT

INNOVATION AND MINE DEVELOPMENT

In early 2016, Québec Premier Philippe Couillard said that the two main vectors of economic growth for Québec in the coming years will be innovation and decarbonation. This statement was further supported by the publication of the Strategic Vision for Mining Development in Québec, which talks, among other things, of stimulating investments in research and development, providing stable and predictable research funding for research organizations, supporting the commercialization of research results, preparing an action plan for Québec’s metallurgical industry, fostering mine waste valorization, developing renewable energy sources and adopting clean technologies.

At the Conference of Ministers of Energy and Mines in 2016, the Ministers asked the Inter-Governmental Working Group (IGWG) to develop a pan-Canadian innovation strategy with an emphasis on clean technologies. The Ministère de l’Énergie et des Ressources naturelles (MERN) is working with other IGWG partners on this matter.

In innovation, Revolution 4.0, also known as the Fourth Industrial Revolution, is gradually gaining ground in the mining sector, with the arrival of mobile devices, geopositioning, smart detectors, 3D printing, algorithm analysis, enhanced reality and so on. Some mining companies have expressed an interest in data management to optimize their assets. For example, Rio Tinto has established a remote control and surveillance room in Australia, to manage those of its mines that use independent automatic vehicles. The Canadian company Barrick Gold has also taken up the digital challenge by forming a partners hip with technology leader Cisco. Pilot projects are also taking place in smaller companies. In Québec, companies have expressed an interest in the use of drones for exploration in remote regions or for site supervision during mine construction work.

Ideas relating to innovation, decarbonation and clean technologies formed the basis for a number of acions in 2016 in the field of R&D and innovation, including:

- The Fonds de Recherche du Québec Nature et Technologies launched its last call for proposals for research into mining waste valorization, with a budget of $1.5 million for 2015-2016, 2016-2017 and 2017-2018. In all, the MERN will have spent $16.5 million on the research program since 2013, funding 63 research projects.

- Climate change : In 2014, the MERN asked the Université du Québec en Abitibi-Témiscamingue to review the current status of the mining industry’s vulnerability to climate change. The report was delivered to the MERN in 2017 and the final report should be published in 2018.

- The federal budget of March 2016 provided for an amount of $401 over two years for clean technologies.

- The Québec Government’s 2016-2017 budget included an amount of $15 million over three years for the creation of the Valorisation Carbone Québec Consortium, tasked with developing and implementing real solutions to capture and develop CO2.

- Local organizations in Asbestos are working to raise funding for a mining innovation centre to be installed on the site of the Jeffrey Mine. Its mission will be to provide technical support for the development and scaling of hydrometallurgical processes for recovery of metal values from mine tailings.

- Groupe MISA obtained $869,500 from the Québec Government to implement a project on continuous improvement and another on energy source management in the mining industry.

Exploration – R&D projects and innovations in 2016

- The Consortium de recherche en exploration minérale (known by its French acronym CONSOREM), based at the Université du Québec à Chicoutimi, researches exploration geotechnologies in Québec. It acts as a liaison between mineral sector stakeholders from the industrial, government and academic communities, CONSOREM works on the development of modern exploration techniques and concepts designed to optimize the discovery of new deposits in resource regions.

The Consortium de recherche en exploration minérale (known by its French acronym CONSOREM), based at the Université du Québec à Chicoutimi, researches exploration geotechnologies in Québec. It acts as a liaison between mineral sector stakeholders from the industrial, government and academic communities, CONSOREM works on the development of modern exploration techniques and concepts designed to optimize the discovery of new deposits in resource regions.

CONSOREM and the MERN signed a new agreement in 2016, covering fiscal years 2016-2017, 2017-2018 and 2018-2019. Under the agreement, the MERN grants funding of $150,000 per year to enhance applied research into mine exploration geotechnologies in Québec and support mine development activities in Québec. - Groupe Roullier presented a new multifunctional geotechnical drill GT8, which is used to analyze soil and perform mining drilling, as well as a software application that can invoice metres drilled almost in real time, and a new type of bit for diamond drilling.

- Integra Gold decided to take an innovative approach by asking the general public to analyze geological information, with its Gold Rushchallenge offering grants totalling $1 million. Québec’s SGS Geostat team won the challenge with a proposal to produce exploration targets over the entire Lamaque project. A certain number of exploration targets established as a result of the challenge are unlike anything seen by Integra Gold in the past. The company has decided to speed up the exploration program and start surveying some of the targets identified.

sprucecanopies to analyze tiny quantities of precious metals, in order to help mining companies target exploration sites. Analysis of tree elements over large areas, combined with mapping, could provide an overview of the types and quantities of commercial metals under the roots.

Mining – R&D projects and innovations in 2016

- In addition to its regular activities in 2016, COREM obtained financial support of $600,000 from the Québec Government to develop an innovative technology on a semi-industrial scale to estimate the metal content of ore loaded into mining trucks and the metal content of ore from drilling waste. The potential spinoffs from the technology are particularly important in terms of potential improvements to mining efficiency and reduction of the environmental footprint, because it will allow for better management of waste rock and ore. In addition, in May 2016, COREM announced a non-refundable contribution from the MERN for fiscal years 2015-2016, 2016-2017 and 2017-2018, to support the mining industry’s technological research and innovation activities.

- In 2016, SOREDEM and its members worked on the following three projects: 1) development of norms and standards for the use of hydrogen in underground mines; 2) a portable gold analyzer to give immediate, accurate readings of ore content in rocks, using LIBS laser technology; 3) testing of synthetic cables to replace steel cables for hauling of ore in deep mines.

- The latest developments in the European Union’s I2Mine program appear to show how mining operations at depths. Of more than 1,500 metres can be “invisible” from the surface: fully underground mining, with waste deposited underground.

- Rio Tinto launched its Mine of the Future program in 2008, to develop second-generation mining technologies. In 2016, Rio Tinto also announced its AutoHaul® driverless train program to transport iron ore across Australia.

- Agnico Eagle Mines signed a contract with Rail-Veyor® Global Technologiesin Sudbury for the installation of a new rail/conveyor material handling system at its Goldex mine in Val-d’Or.

- Atlas Copco unveiled the ST7, a fully electric, battery operated cload-haul dump(LHD)rig.

- The second phase of the biomass biomass air heating project at Hecla Québec’s Casa Beradi mine, expected to remain in operation until 2025, is now underway. In the next nine years, the equipment will take over from the propane system during the warmer winter days.

- Dundee Sustainable Technologies has developed a cyanide and mercury-free gold mining process. After the success of its demonstrator program with pyrite concentrate, the company signed a number of agreements with several promoters to assess the applicability of the Dundeeprocess.

- The use of air cargo to transport merchandise is becoming more popular in the mining sector. Quest Rare Minerals and Lockheed Martinsigned a 10-year agreement with an estimated value of $850 million. Starting in 2019, seven air cargos will transport materials and 200,000 tons of ore per year between the Strange Lake deposit and Schefferville.

- In Ontario, GoldcorpGoldcorp is hoping to create the first diesel-free mine in Canada at its Borden mine, located in Chapleau, in the north-eastern portion of the province. The company hopes to make significant savings by reducing ventilation as a result of eliminating diesel from its underground operations.

- Nippon Dragon ResourcesResources has announced that testing on its mini-burner, which fits easily into commonly sized pilot holes in mines, has been conclusive. The technology uses a thermal head inserted into a bore hole to fragment mineralized rock.

- The following companies received financial assistance for their pilot projects:

- AArcelorMittal ($4.5 million) to test the use of liquefied natural gas in its iron pellet manufacturing process.

- New World Mining ($25,000) to fund the development of a chemical process for graphite ore.

- Quest Rare Minerals ($5 million) to support the operational phase of a large-scale pilot plant to produce mixed rare earth oxides. Quest also received $183,729 in financial support from the Québec Government (ÉcoPerformance Program) to prepare an integrated renewable energy solution for the development of the Strange Lake rare earths deposit with Tugliq Energy.

- Alliance Magnesium ($3 million) for the preparation and operation of its metal magnesium demonstrator unit in Asbestos.

- Nemaska Lithium ($14 million) to support the implementation of a hydroxide and lithium carbonate pilot plant in Shawinigan.

- GéoMégA ($500,000) to continue the development of its exclusive rare earth separation process.

- Mag-One Operations ($495,000) to carry out a project that will develop, test and pilot an innovative, patented process to produce highly pure magnesium and silica oxide and hydroxide in Asbestos. The investment is estimated at $1,122,750. Les Sources MRC’s Economic Diversification Fund has also paid $495,000 in financial assistance.

| Andrea Amortegui, Geo, Manager, Direction de la promotion et du soutien aux opérations |

| Katrie Bergeron, Eng., Direction générale du développement de l’industrie minière |

| Louis Bienvenu, Eng., Direction générale du développement de l’industrie minière |

| Steve Boulet, Direction générale des mandats stratégiques |

| Olivia Dawson, Eng., Direction de la restauration des sites miniers |

| Claude Dion, Eng., Direction de la promotion et du soutien aux opérations |

| Dorra Djemal, Direction du développement et du contrôle de l’activité minière |

| Pierre Doucet, Geo, Direction régionale de l’Abitibi-Témiscamingue |

| Roch Gaudreau, directeur, Direction du développement et du contrôle de l’activité minière |

| Patrick Houle, Geo, Direction régionale du Nord-du-Québec |

| Robert Lacroix, Eng., Direction de la restauration des sites miniers |

| Philippe-André Lafrance, Eng., Direction de la restauration des sites miniers |

| Josée Morency, directrice, Direction de la restauration des sites miniers |

| Martine Paradis, Eng., Direction de la restauration des sites miniers |

| Sophie Proulx, Eng., Direction de la restauration des sites miniers |

| Charles Roy, Direction générale de Géologie Québec |

| N’Golo Togola, Geo, Direction de la promotion et du soutien aux opérations |

| Sophie Turcotte, Geo., Direction de la restauration des sites miniers |

| Malek Zetchi, Chemist, Direction de la restauration des sites miniers |