Chapter 1 – ECONOMY and MINING TITLES

Economy

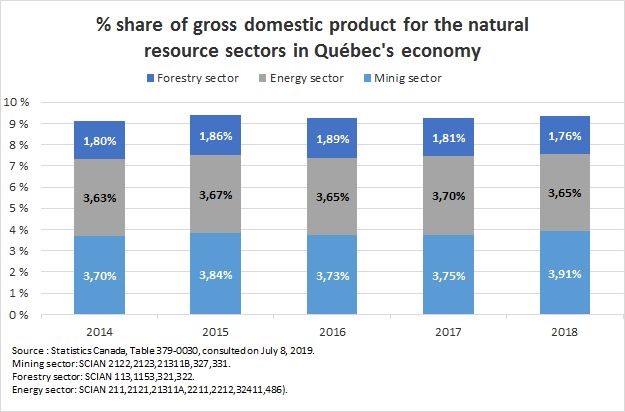

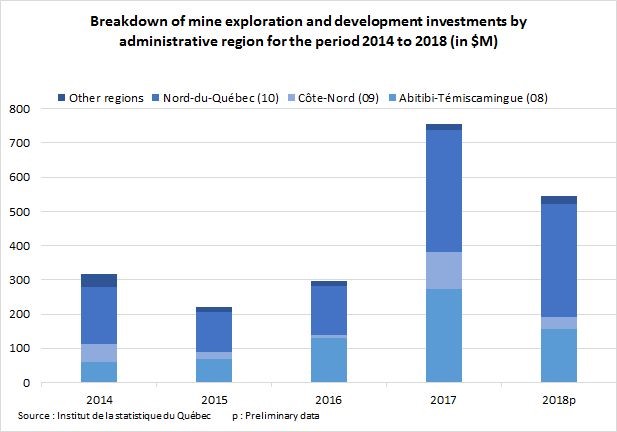

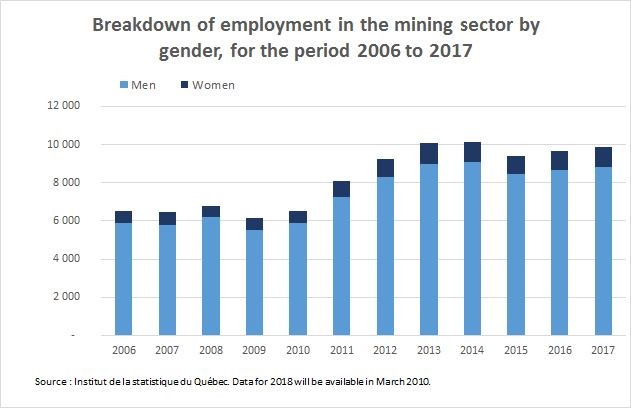

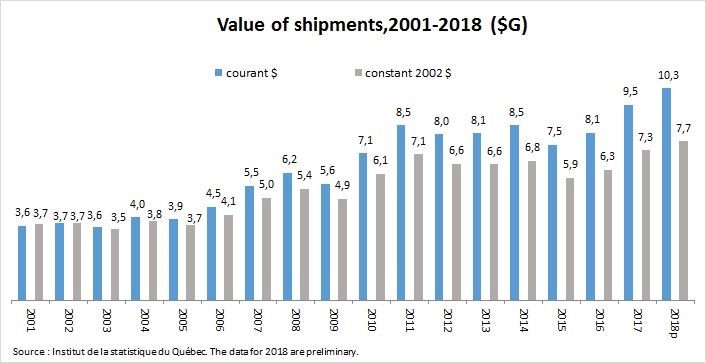

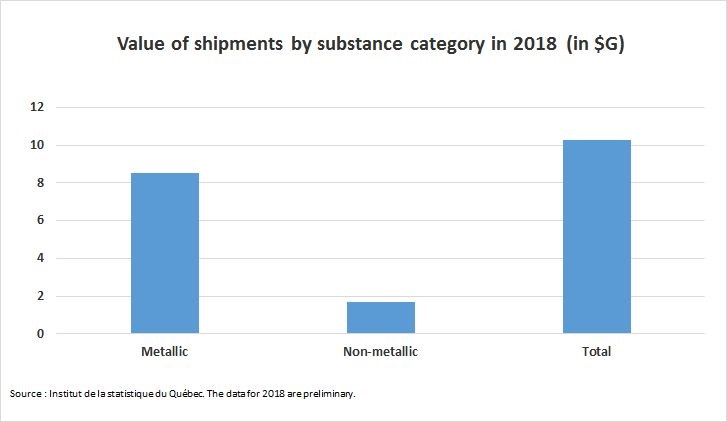

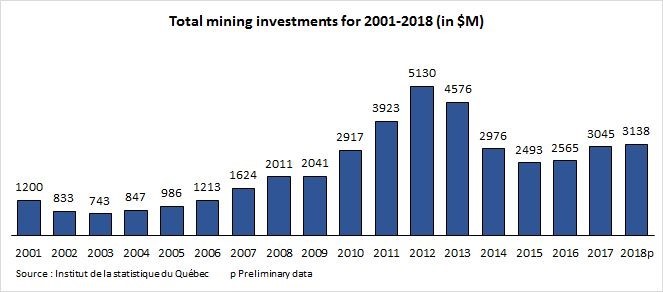

Although mineral substance markets fluctuated in 2018, mainly due to trade issues between China and the United States, the year was generally one of growth, with most raw material prices either increasing or remaining stable. In Québec’s mining sector, both overall investments and shipment values rose. Expenditures in 2018 also remained high, despite lower investments in exploration and development compared to 2017. Expenditures are the principal motor for development in the mining sector, and their current level suggests that growth, after some economically difficult years, now appears to be firmly in place.

Employment

Value of Shipments

Mining Investments

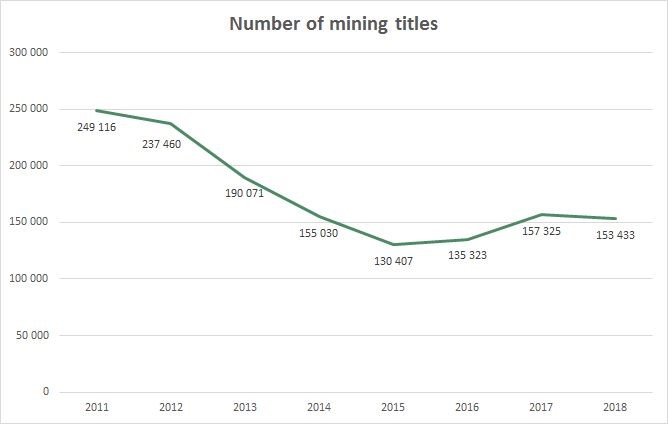

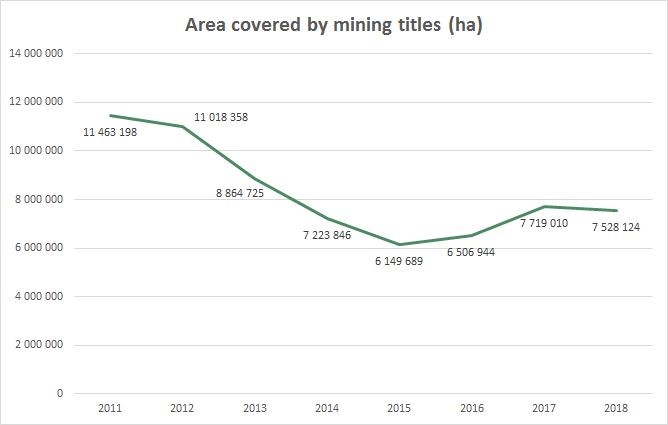

Mining Titles

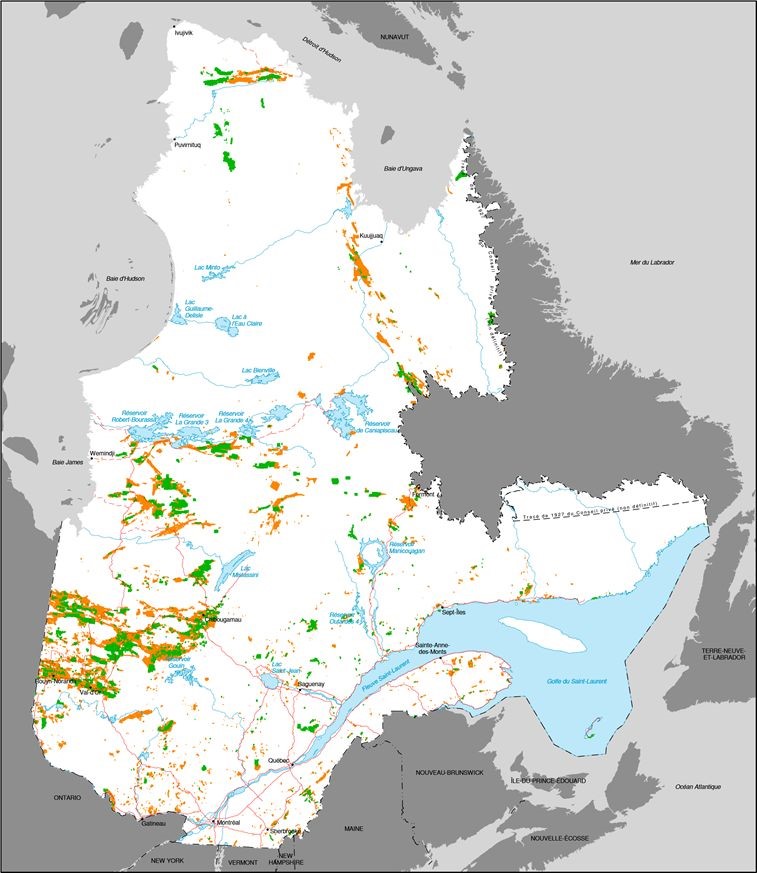

Number of exploration and mining titles in Québec and area covered

The number of mining titles has increased steadily since 2015, but declined slightly in 2018 from 2017 levels.

As of December 31, 2018, there were 153,433 mining titles in Québec, covering a total area of 7,528,124 ha. Both these figures were down by 2.47% from their 2017 levels.

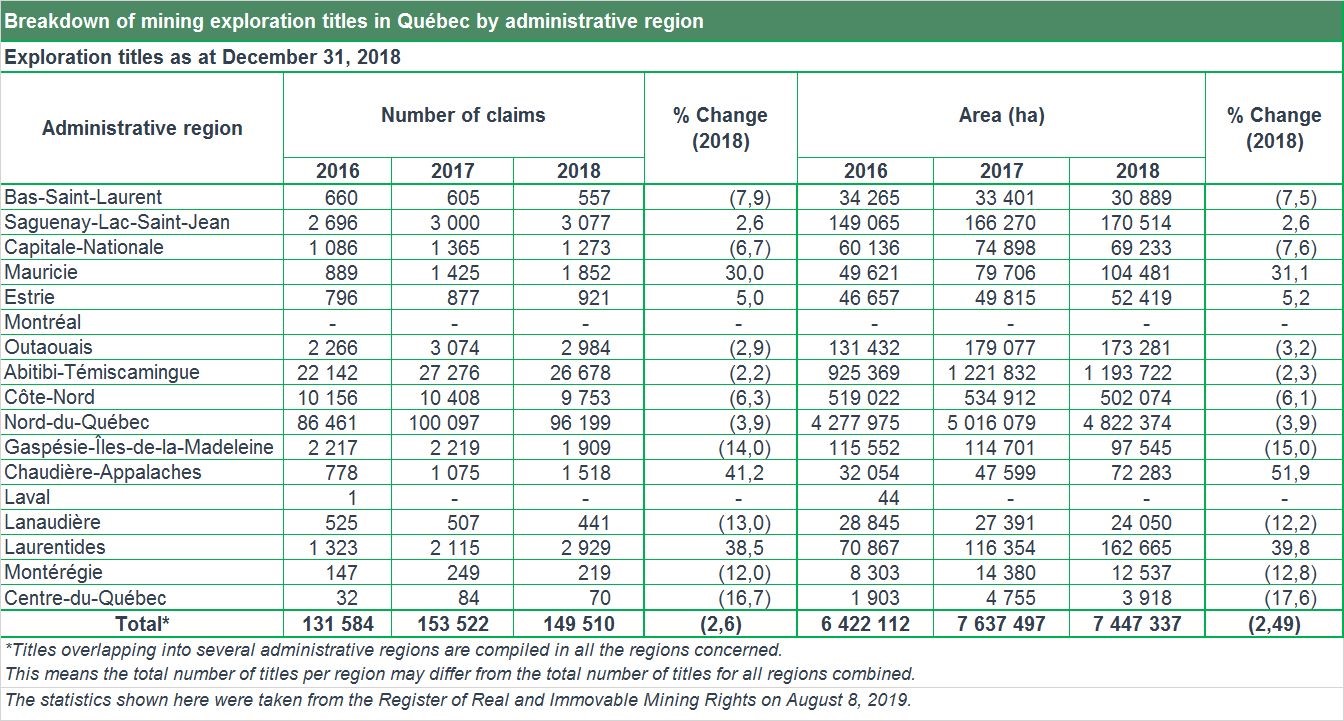

Breakdown of mining exploration titles in Québec by administrative region

The number of current mining exploration titles increased in 2018, compared to 2017, in some administrative regions of Québec, including Chaudière-Appalaches (41.2%), Laurentides (38.5%) and Mauricie (30.0%). In contrast, numbers declined in most administrative regions, and especially in Centre‑du‑Québec (16.7%), Gaspésie–Îles-de-la-Madeleine (14.0%), Lanaudière (13.0%) and Montérégie (12.0%).

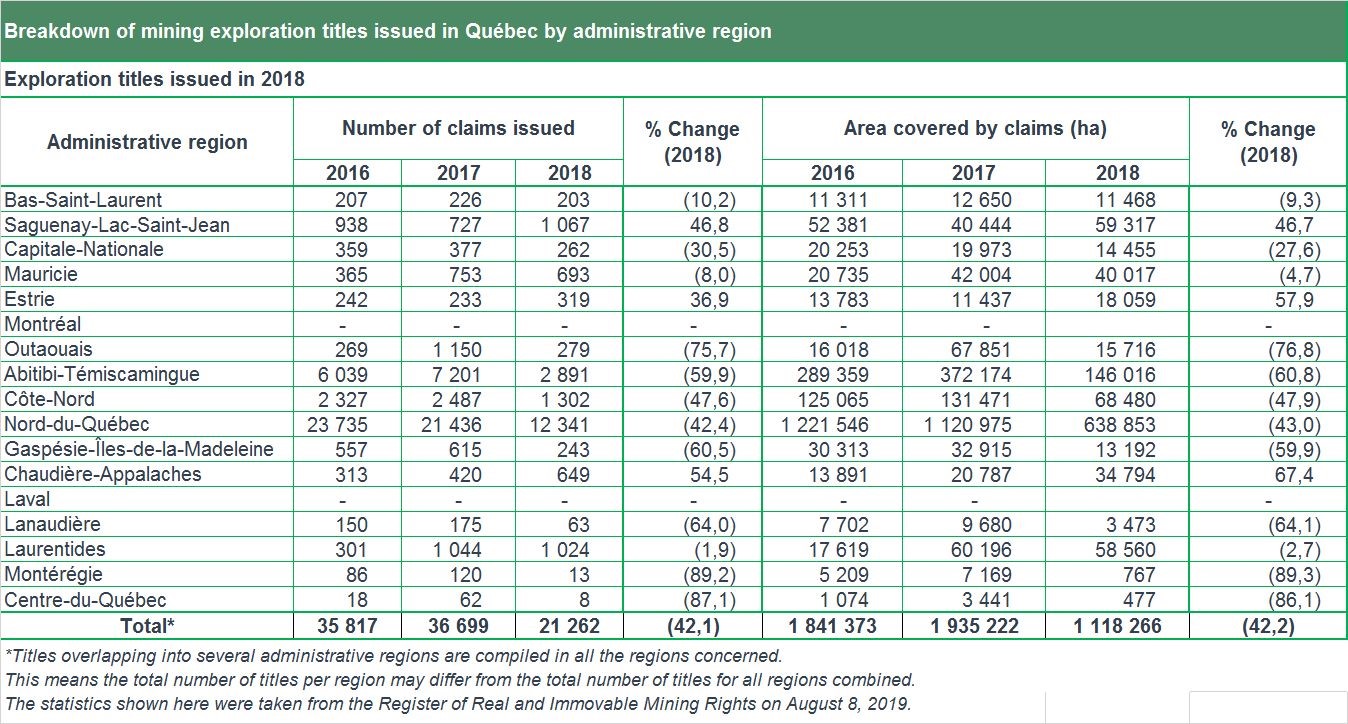

Breakdown of mining exploration titles issued in Québec by administrative region

A total of 21,262 exploration titles were issued in 2018 and entered in public Register of Real and Immovable Mining Rights (referred to as the Register). They covered a total area of 1,118,266 ha. Numbers were down by 42.1% from their 2017 levels, and the total area covered by the titles also declined by 42.2%.

Fewer claims were also issued in most administrative regions of Québec, and particularly in Montérégie (89.2%), Centre‑du‑Québec (87.1%) and Outaouais (75.7%). However, increases were observed in Chaudière-Appalaches (54.5%), Saguenay–Lac‑Saint‑Jean (46.8%) and Estrie (36.9%).

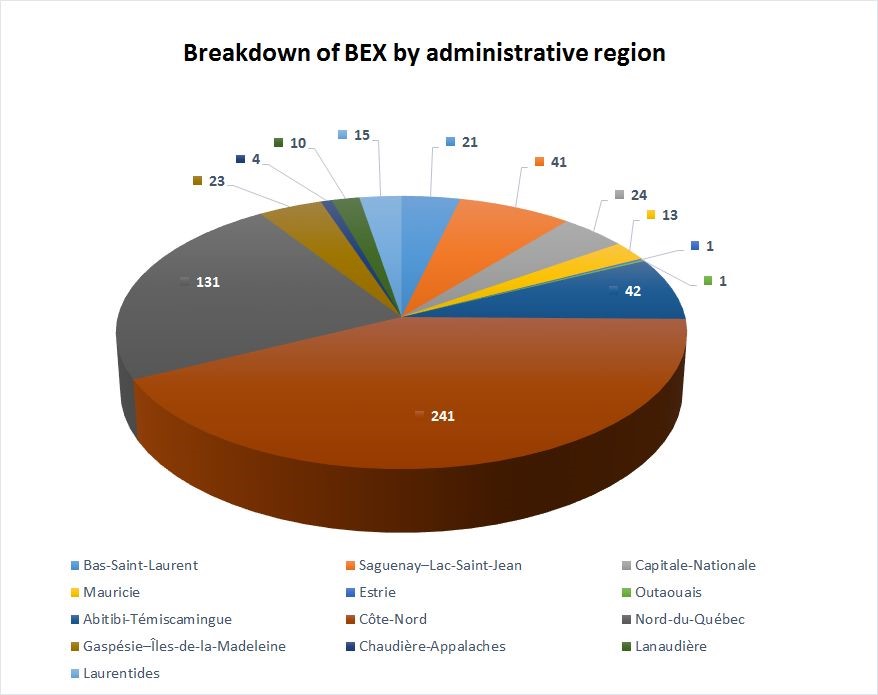

Breakdown of mining exploration titles by administrative region

As of December 31, 2018, the Register showed that 88.7% of all mining exploration titles were situated in the Nord‑du‑Québec (64.3%), Abitibi‑Témiscamingue (17.8%) and Côte‑Nord (6.5%) regions.

There were no exploration titles in the Montreal and Laval administrative regions, and the following regions had less than 1% of the total number: Capitale‑Nationale (0.85%), Estrie (0.62%), Bas‑Saint‑Laurent (0.37%), Lanaudière (0.29%), Montérégie (0.15%) and Centre‑du‑Québec (0.05%).

Distribution of Mining Titles (Mining Lease [BM] and Mineral Concession [CM]) by Administrative Region

Note: Titles overlapping into several administrative regions are compiled in all the regions concerned.

As of December 31, 2018, there were 119 mining leases and 149 mining concessions in Québec, for a total of 268 titles. Overall, 84.7% of all mining titles, whether leases or concessions, were situated in the Abitibi‑Témiscamingue (49.6%), Nord‑du‑Québec (27.2%) and Côte‑Nord (7.8%) administrative regions.

Breakdown of exclusive leases to mine surface mineral substances, by administrative region

As of December 31, 2018, there were 567 exclusive leases to mine surface mineral substances in Québec. This number includes all the different substances mined under exclusive leases, namely dimension stone, crushed stone, peat, silica mineral, sand and gravel.

In all, 80.2% of all exclusive leases to mine surface mineral substances were situated in the Côte‑Nord (42.5%), Nord‑du‑Québec (23.1%), Abitibi‑Témiscamingue (7.4%) and Saguenay–Lac‑Saint‑Jean (7.2%) administrative regions.

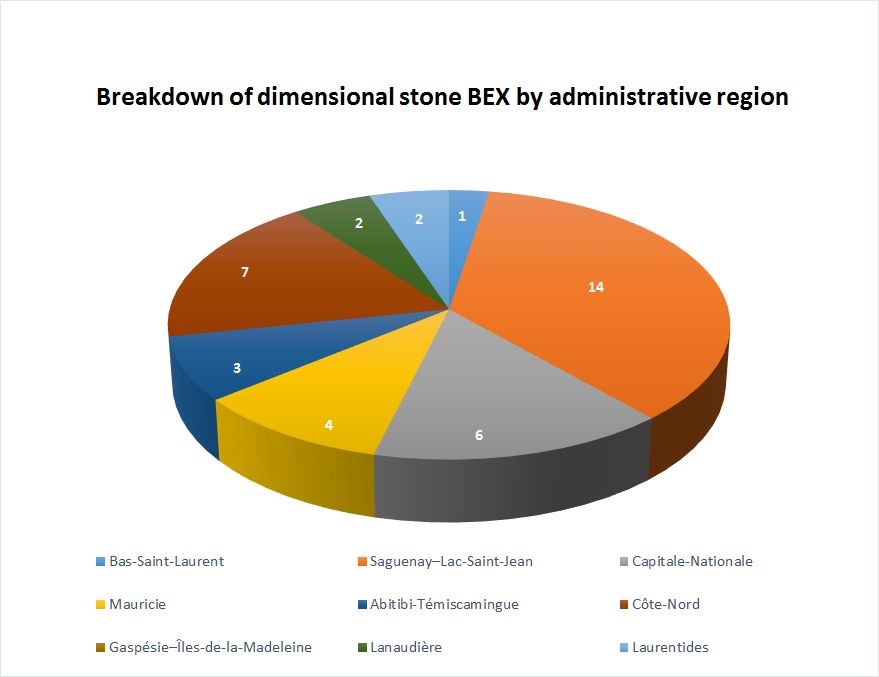

Breakdown of exclusive leases to mine dimensional stone, by administrative region

As of December 31, 2018, 39 dimensional stone leases had been issued in Québec. Most (69.2%) were situated in the Saguenay–Lac‑Saint‑Jean (35.9%), Côte‑Nord (17.9%) and Capitale‑Nationale (15.4%) administrative regions.

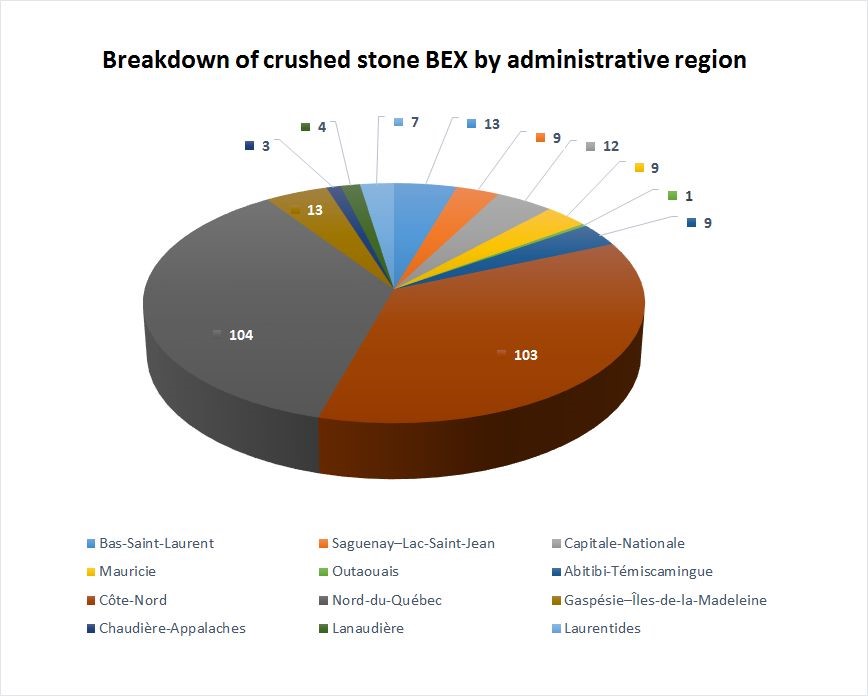

Breakdown of exclusive leases to mine crushed stone, by administrative region

As of December 31, 2018, 287 exclusive leases to mine crushed stone had been issued in 12 administrative regions of Québec. Of this total, 104 (36.2%) were situated in the Nord‑du‑Québec administrative region and 103 (35.9%) in the Côte‑Nord administrative region.

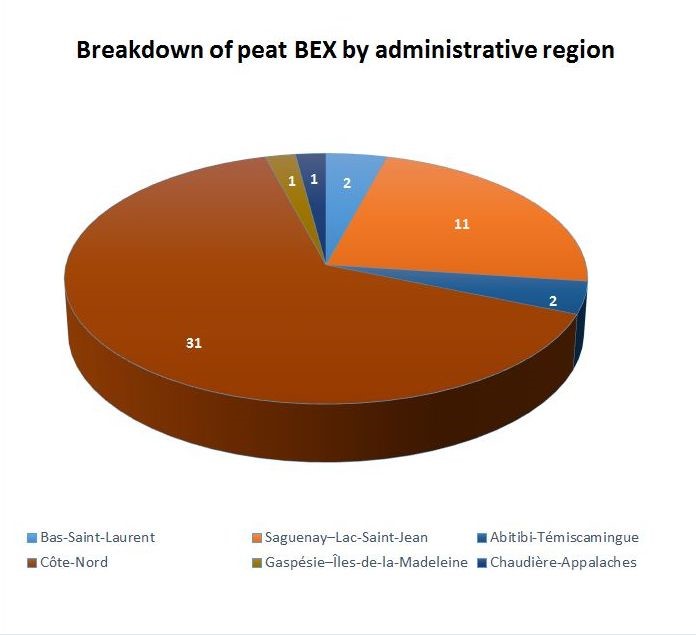

Breakdown of exclusive leases to extract peat by administrative region

As of December 31, 2018, there were 48 exclusive peat leases in six administrative regions of Québec. Most were in two regions in particular: 31 (64.6%) in the Côte-Nord region and 11 (22.9%) in the Saguenay–Lac‑Saint‑Jean region.

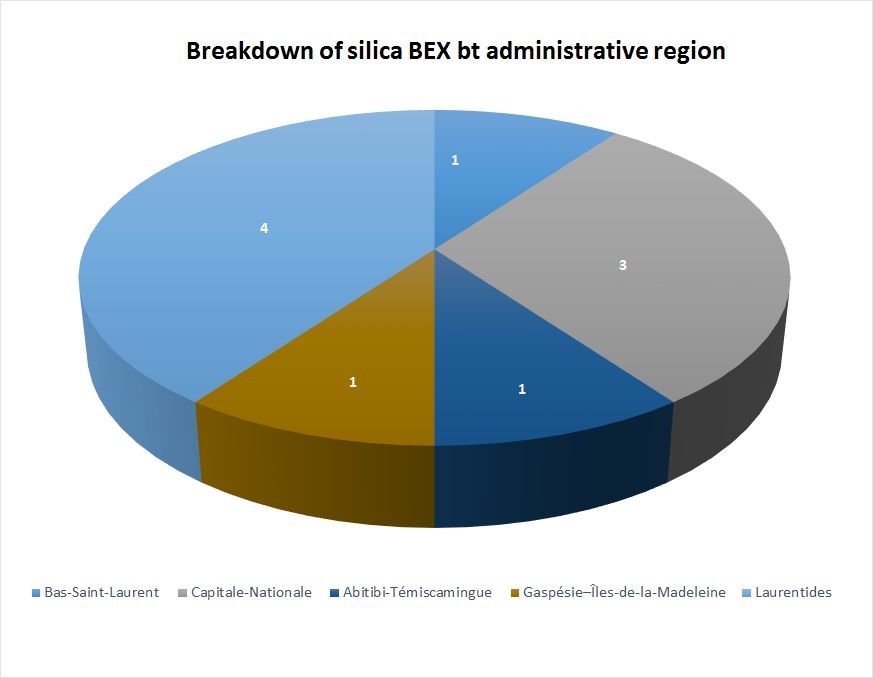

Breakdown of exclusive leases to mine silica mineral, by administrative region

As of December 31, 2018, there were 10 exclusive leases to mine silica mineral in Québec. They were situated in five administrative regions, but most were in the Laurentides (40.0%) and Capitale‑Nationale (30.0%) regions.

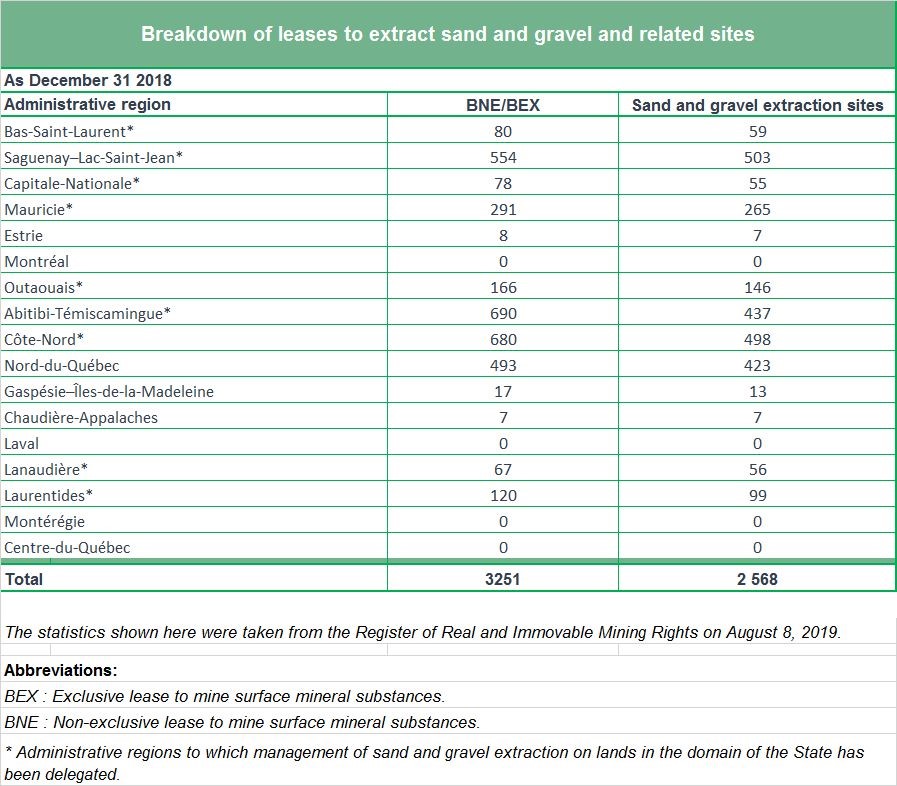

Breakdown of leases to extract sand and gravel and related sites

As of December 31, 2018, there were 3,251 leases to extract sand and gravel in Québec, covering 2,568 surface mineral extraction sites. In all, 2,726 (83.9%) of these titles were managed by the regional county municipalities (RCMs) and the other 525 were managed by the Ministère de l’Énergie et des Ressources naturelles (MERN).

As of December 31, 2018, there were no active sand or gravel extraction sites on public land covered by leases to extract surface mineral substances in the Laval, Montreal, Montérégie and Centre‑du‑Québec administrative regions. All the sand pits in those regions are located on land that was transferred or alienated by the State before January 1, 1966, for purposes other than mining, and some substances, including sand and gravel, were abandoned to the landowners at that time. As a result they are no longer in the domain of the State.

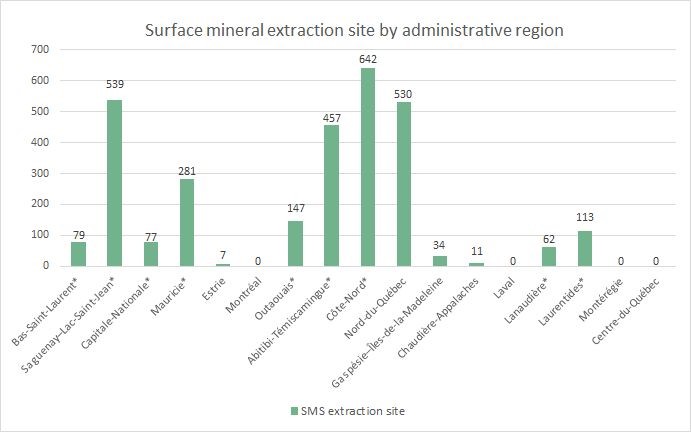

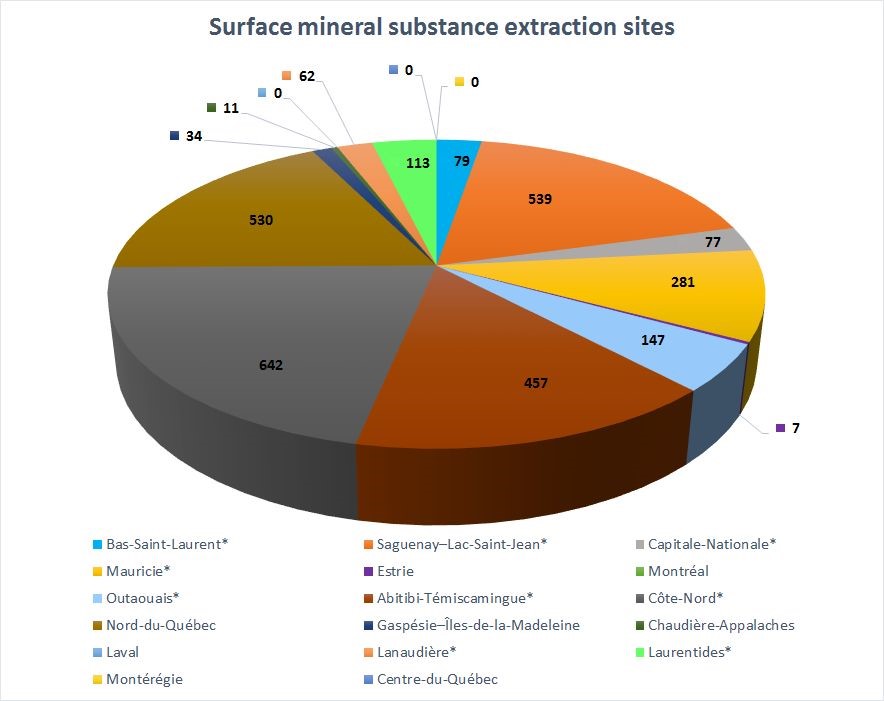

Breakdown of surface mineral extraction sites by administrative region

** Administrative regions to which the management of sand and gravel extraction on lands in the domain of the State has been delegated.

The administrative regions with the most surface mineral substance (SMS) extraction sites covered by leases to mine surface mineral substances that were active as of December 31, 2018, were Côte‑Nord (21.6%), Saguenay–Lac‑Saint‑Jean (18.1%), Nord‑du‑Québec (17.8) and Abitibi‑Témiscamingue (15.3%).

Declared exploration activities

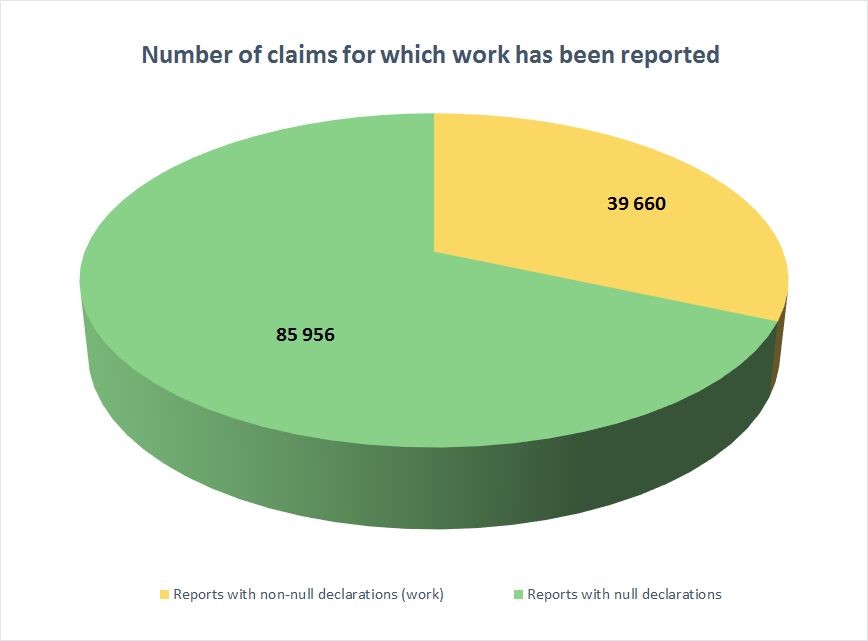

As of December 31, 2018, there were 149,510 claims in total. Work was declared in connection with 125,616 claims (84.0%), by means of a report on the work carried out in 2018, sent to the Minister by the claim holder.

The reports in connection with 39,660 of the 125,616 claims (31.6% of claims for which work was declared) were non-null declarations. These are claims for which exploration, financing activities, partner searches or consultations with Aboriginal communities or the general public had been carried out.

The reports in connection with 85,956 claims (68.4% of claims for which work was declared) were null declarations. In these cases, no exploration work had taken place in the areas covered by the claims.

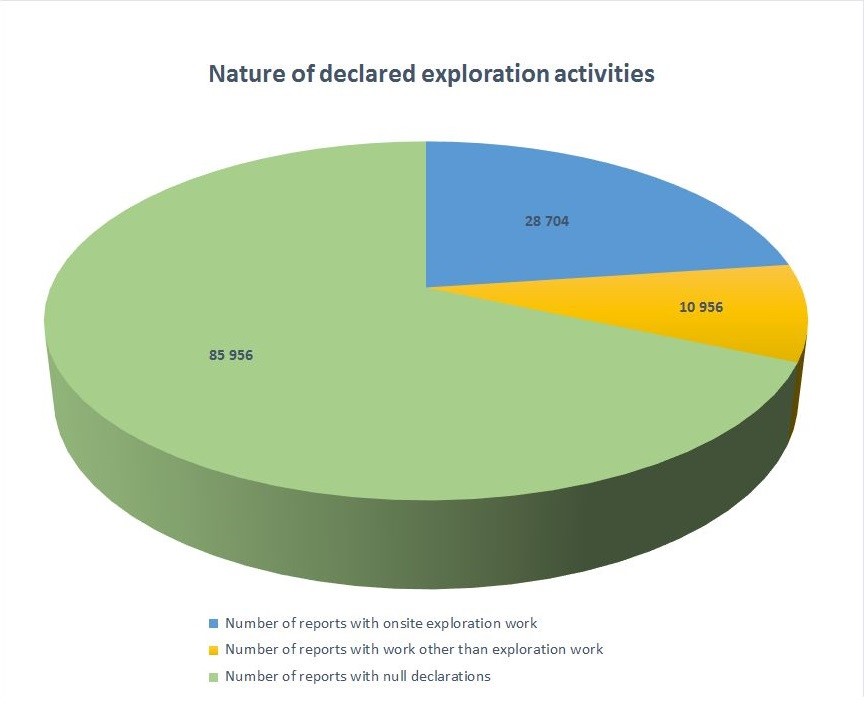

Nature of declared exploration activities

In 2018, onsite exploration work was carried out in connection with 28,704 claims, or 22.9% of the 125,616 claims for which annual reports were filed. In the case of 10,956 claims, the reports contained declarations of work other than exploration work (e.g. financing, partner searches and consultations of Aboriginal communities or the general public). This latter group accounted for 8.7% of the claims for which annual reports were filed.

Declared exploration activities

Breakdown of mineral substances sought, by administrative region

Breakdown of mineral substances sought, by order of importance

In the annual reports for 2018, gold was declared as the primary substance sought in 76,200 claims, or 60.66% of all claims for which declarations of work were filed.

Copper was declared as the primary substance sought in 11,729 claims, or 9.34% of all claims for which declarations of work were filed.

Note: ; In an annual report, the claim holder may declare three different substances sought under the claim, by order of importance: namely one primary substance, considered to be the main substance sought, one secondary substance and one tertiary substance.

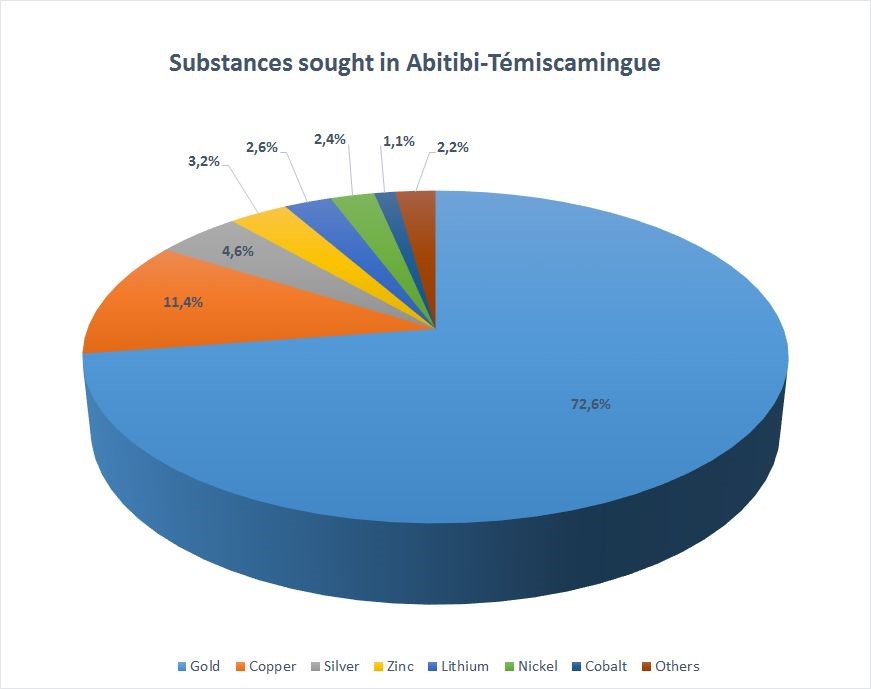

Breakdown of primary mineral substances sought in the main administrative region

Abitibi-Témiscamingue

According to the annual reports for 2018, the main primary mineral substances sought in claims located in the Abitibi‑Témiscamingue administrative region were gold (72.6% of claims), copper (11.4% of claims) and silver (4.6% of claims).

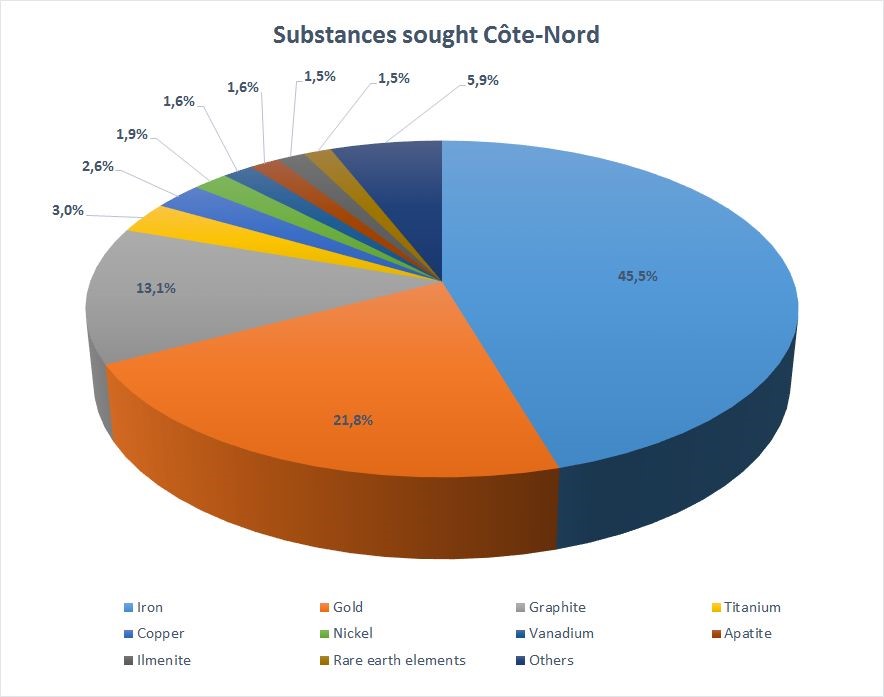

Côte-Nord

According to the annual reports for 2018, the main primary mineral substances sought in claims located in the Côte‑Nord administrative region were iron (45.5% of claims), gold (21.8% of claims) and graphite (13.1% of claims).

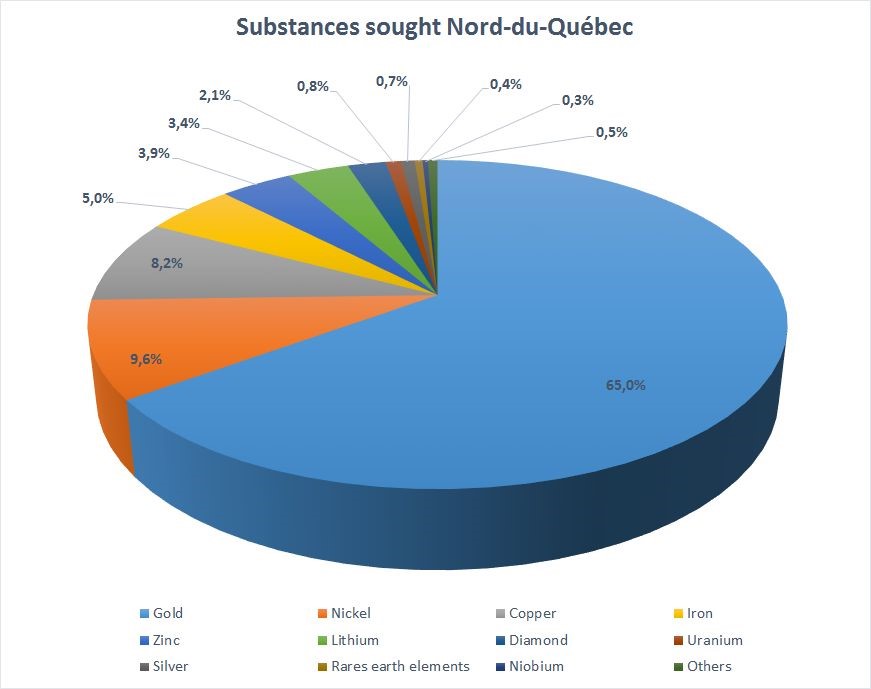

Nord-du-Québec

According to the annual reports for 2018, the main primary mineral substances sought in claims located in the Nord‑du‑Québec administrative region were gold (65.0% of claims), nickel (9.6% of claims) and copper (8.2% of claims).

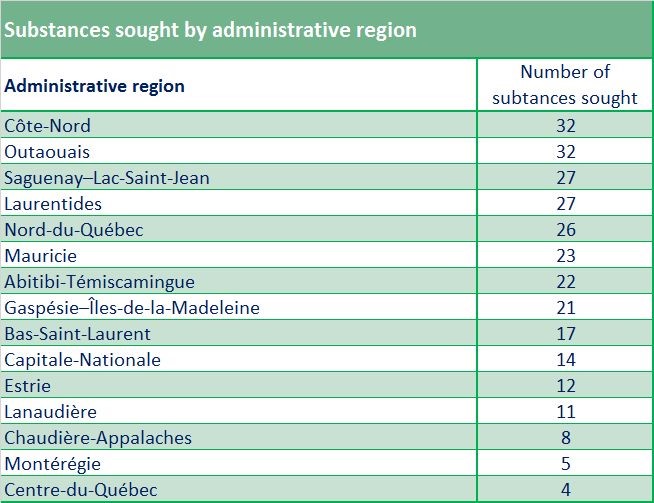

Number of mineral substances sought by administrative region

According to the annual reports filed, the administrative regions in which the most substances were sought were: Côte‑Nord (32 substances), Outaouais (32 substances), Saguenay–Lac‑Saint‑Jean (27 substances), Laurentides (27 substances) and Nord‑du‑Québec (26 substances).

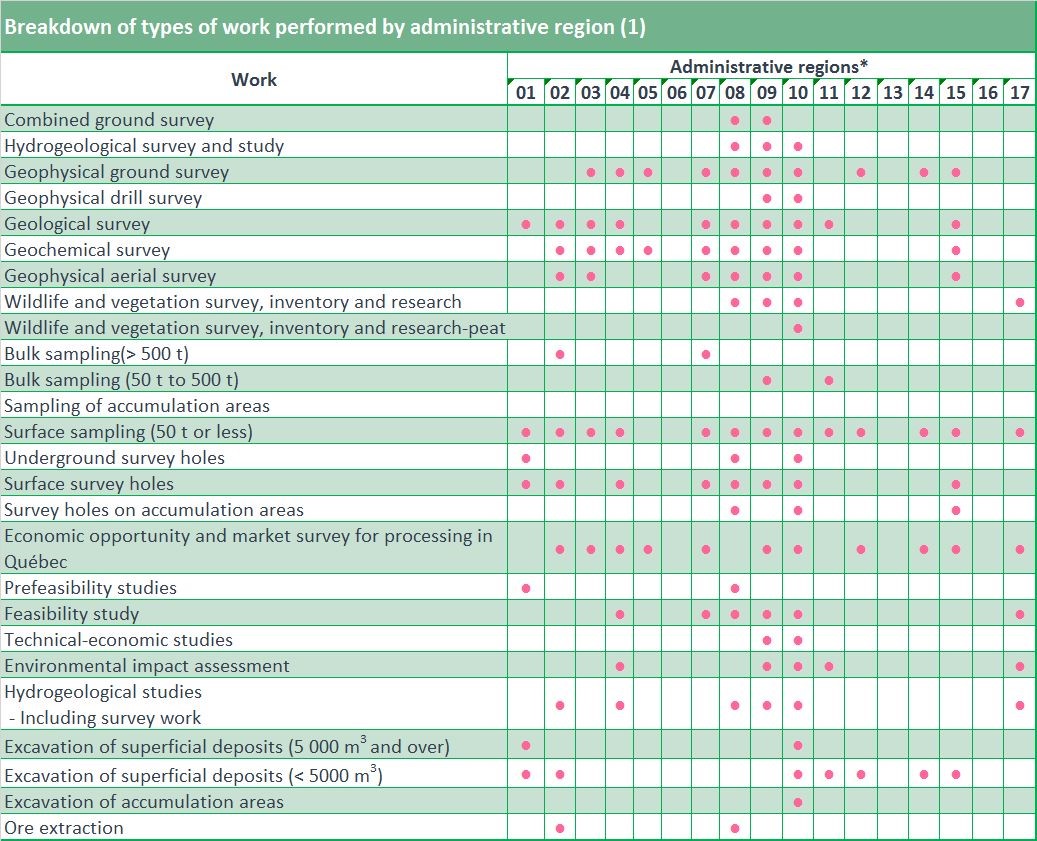

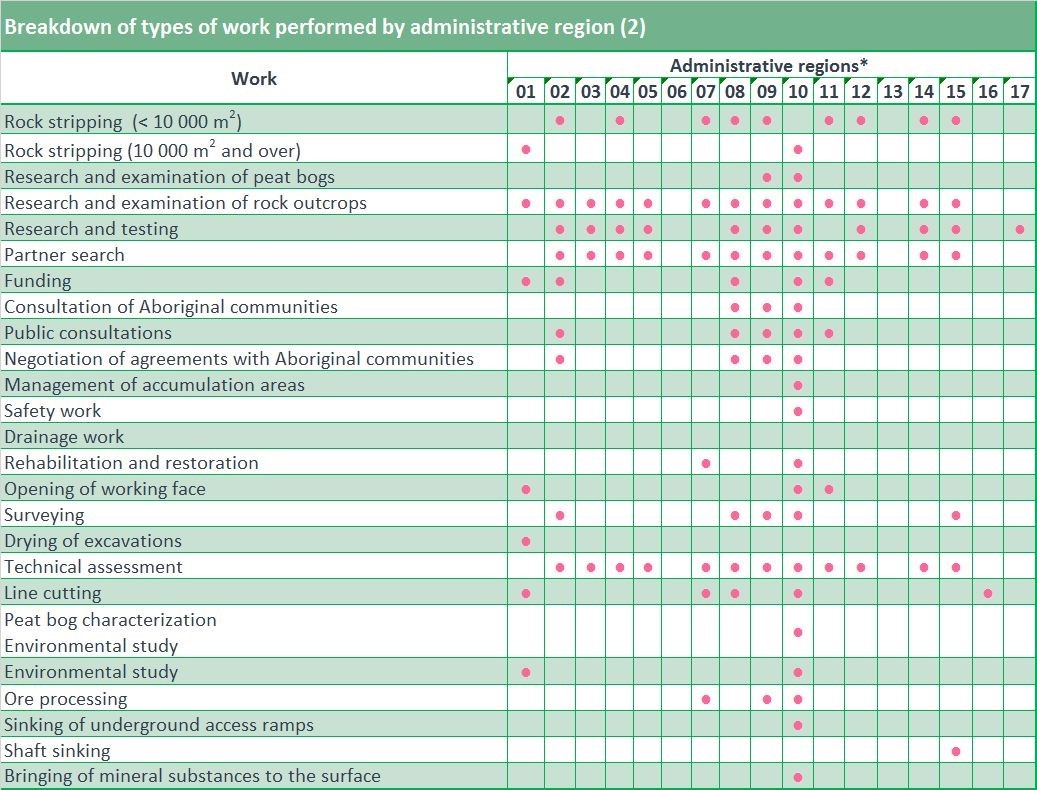

Distribution of Types of Work Done on Claims by Administrative Region

* Administrative regions : Bas‑Saint-Laurent (01), Saguenay–Lac-Saint-Jean (02), Capitale-Nationale (03), Mauricie (04), Estrie (05), Montréal (06), Outaouais (07), Abitibi-Témiscamingue (08), Côte-Nord (09), Nord-du-Québec (10), Gaspésie–Îles-de-la-Madeleine (11), Chaudière-Appalaches (12), Laval (13), Lanaudière (14), Laurentides (15), Montérégie (16) and Centre-du-Québec (17).

Chapter 2 – SOCIAL ACCEPTABILITY

Over the years, public land and resource use has become much more diverse. The number of rights and special status designations has also increased, and discussions are often needed to reconcile land use and natural resource development.

The communities are increasingly concerned about the potential repercussions of land, energy and mineral resource development projects on their activities and quality of life. They now wish to be involved as early as possible in the project development process. As a result, a ministerial workshop on social acceptability was launched on November 18, 2014. Five guidelines and associated actions were published on January 24, 2017. The actions were designed to ensure that the factors relating to social acceptability are taken into consideration:

- by offering better support for promoters and local actors;

- by making land planning and land use harmonization mechanisms more transparent;

- by promoting the sharing of benefits from energy and mine development projects with local communities.

In adopting its social acceptability guidelines, the MERN confirmed its commitment to a more responsible form of mine development, in line with the amendments made to the Mining Act and the Regulation respecting mineral substances other than petroleum, natural gas and brine in 2013. The MERN also reviewed its practices and methods, among other things to improve the availability of support for promoters and local actors.

On December 14, 2016, the Gouvernement du Québec adopted its land use planning guidelines for mining activity (GLPG-Mines). The purpose of this was to ensure that mining could coexist harmoniously with other land uses in the RCMs:

- by establishing mining-incompatible territories;

- by regulating the introduction of sensitive uses near mining sites;

- by temporarily suspending staking rights and map designations in proposed mining-incompatible territories during final delimitation of these areas in the RCMs’ land use and development plans.

ACHIEVEMENTS

As of December 31, 2018, the MERN had issued 14 opinions concerning the delimitation of mining-incompatible territories. In two cases, the RCMs concerned (Coaticook and Laval) obtained favourable opinions allowing them to implement their mining-incompatible territories. Two other RCMs elected to request provisional opinions until the regulations concerning their mining-incompatible territories were adopted by the MERN. In addition, the MERN instituted temporary suspensions at the request of 24 RCMS wishing to designate specific areas as mining-incompatible territories.

CURRENT WORK

The MERN is currently preparing a good practice guide to assist promoters and local actors with the creation and operation of their monitoring committees. The document, entitled Best Practices Guide for Monitoring Committees and Legal Obligations of Mining and Petroleum Project Promoters, will be published in 2019.

As of December 31, 2018, the MERN was engaged in compliance analyses for mining-incompatible territory proposals filed by two RCMs. Given the new and complex nature of the GLPG-Mines, the MERN took particular care to provide the RCMs with clear explanations of any changes to be made to their proposals in order to bring them into line with the Government’s guidelines.

Chapter 3 – GEOSCIENTIFIC WORK

In 2018, the MERN carried out 17 geoscientific knowledge acquisition projects :seven geological surveys, two geophysical surveys, five Quarternary surveys, 1 inventory survey and two modelling projects. All the fieldwork had been completed by the end of the year. A summary of the projects can be found in the document entitled Résumé des conférences et photoprésentations, Québec Mines+Énergie 2018 (DV 2018-03 – available in French only).

The 67 documents published in 2018 in the QERPUB collection by the Direction générale de Géologie Québec (DGGQ) include:

- 9 documents in the GéologiQUE Newsletter (BG) series;

- 2 geoscientific compilation maps (CG);

- 8 documents in the Public Documents series (DP);

- 3 documents in the Miscellaneous series (DV);

- 1 document in the Studies series (ET);

- 1 document in the Geology for All series (GT);

- 31 documents in the Unpublished Manuscripts series (MB);

- 4 documents in the Geological Reports series (RG);

- 8 documents in the Preliminary Reports series (RP).

The Web format geological newsletters (BG series) are designed to speed up publication and simplify presentation of the geological information gathered by DGGQ geologists. The GéologiQUE is an innovative Web newsletter containing concise information highlighting the mineral potential of the region under study. It is easy to read and is linked to Québec’s geomining information system (SIGÉOM) and stratigraphic lexicon. It replaces the geological reports traditionally produced by the MERN.

Chapter 4 – MINING SECTOR HIGHLIGHTS

Saguenay–Lac-Saint-Jean (02)

In August 2018, Arianne Phosphate Inc. entered into a partnership with the New Brunswick government for its Lac-à-Paul project, with the aim of carrying out additional studies on the possible construction of a phosphoric acid plant in Belledune, in New Brunswick. As part of the agreement, the government, via Opportunities New Brunswick (ONB), will cover part of the cost of a pre-feasibility study which, for Arianne Phosphate Inc., is the next step in its assessment of a remanufacturing facility. In October 2018, the Saguenay Port Administration received a favourable decision regarding construction of a maritime terminal on the north short of Rivière Saguenay. The decision will allow Arianne Phosphate Inc. to ship its phosphate concentrate worldwide.

Mauricie (04)

Gespeg Copper received a certificate of authorization from the MERN for a resource evaluation and calculation at the mine tailings sites associated with the former Montauban-les-Mines mine. Three sites were evaluated: Anacon Lead 2, Tétrault 1 and Tétrault 2. A resource calculation is expected.

Estrie (05)

In October 2018, Fancamp Exploration Ltd. began to dig channels on its Baie-Verte property. Select sampling revealed levels of 13.7 g/t Au.

Outaouais (07)

First Energy Metals Ltd. carried out prospecting, mapping and sampling work at its Russel property. Select sampling revealed 29.90% Cg, 18.88% Cg, 10.60% Cg and 9.97% Cg.

In April 2018, Gratomic Inc. (formerly CKR Carbon Corp.) in a field data collection project at its Buckingham property, obtained 6.88% Cg over 62 m, 5.86% Cg over 17 m and 4.494% Cg over 66 m.

In February 2018, Sphinx Resources and SOQUEM completed a drilling and channel program in the Sonny and Sonny West areas of their Calumet-Sud property. Drilling produced 3.1% Zn over 6.4 m, 2.99% Zn over 6.8 m and 3.81% Zn over 5.0 m. The channel samples produced 8.14% Zn over 1.5 m, 6.61% Zn over 5.0 m and 6.72% Zn over 1.0 m.

In November 2018, Saint Jean Carbon Inc. published drilling report 43-101, along with a resource calculation showing 1.95 MT at 5.1% Cgp with a cutoff grade of 3.5% Cgp.

Abitibi-Témiscamingue (08)

Renforth Resources Inc. completed drilling programs at its Parbec property in the West Camp East, Deeper Intercept, No. 2 Zone Exploration and SW Corner zones, and also completed NW Partridge discovery. PAR-18-86 was used to cut a quartz vein with visible gold. Prospecting, mapping, sampling and geophysical work was also carried out and a resource calculation was completed: 368,105 t at 3.47 g/t Au for 37,224 ounces and presumed resources of 9,659,636 t at 2.33 g/t Au for 656,875 ounces of gold with a cutoff grade of 0.50 g/t Au. The company also acquired 58 new claims at its New Alger property. Work on the Discovery vein system, which is 230 m long and between 1 and 5 m thick, revealed an average content of 0.76 g/t Au in both veins, with visible gold. Geophysical surveys were also carried out. The company has applied for licences to carry out bulk sampling of the Discovery veins for metallurgical testing purposes.

In August 2018, Probe Metals Inc. began an 85,000 m drilling program at its Val-d’Or East property. Drilling produced two new discoveries. Technical report 43-101, containing scientific and technical data along with a resource calculation, was filed in SEDAR in March 2018. Indicated resources were 7,710,300 t at 2.16 g/t Au and inferred resources were 5,259,500 t at 1.46 g/t Au. Underground, indicated resources were 1,325,900 t at 3.44 g/t Au and inferred resources were 4,044,400 t at 3.65 g/t Au.

In addition to its drilling program in the Vintage zones, Radisson Mining Resources filed a technical resource calculation report in May 2018 for its O’Brien project. Indicated resources were 1,125,447 t at 6.45g/t Au and inferred resources were 1,157,021 t at 5.22 g/t Au, with a cutoff grade of 3.5 g/t Au.

Falco Resources continued its drilling program at its Horne 5 site. It began to acquire land and buildings, and obtained surface rights near the site. It also began work to build hoist and winch systems. Equipment for the processing plant has been ordered.

Wesdome Gold Mines continued and completed the development of the exploration ramp towards the Deep and VC zones of the Kiena mine. Drilling continued and the Prospect vein was uncovered. In May 2018, the company published a technical resource calculation report. Measured and indicated resources were 3,120,200 t at 5.81 g/t Au for a total of 582,600 ounces and inferred resources were 4,138,500 t at 7.57g/t Au for a total of 1,007,200 ounces.

Cartier Resources Inc. continued its 20,000 m and 33,000 m drilling programs, targeting lateral and depth extensions to the 23 known zones. In July and August, the company undertook two additional 32,000 m and 45,000 m drilling stages for zones 5 and 6N1 and peripheral areas.

Monarques Gold launched a 30,000 m drilling program at its Beaufor mine, composed of 14,000 m of fill-in drilling and 16,000 m of exploration drilling, targeting depth extensions of the Q, 1700 and 173 zones, the western shear and the Beaufor fault. Another 20,000 m drilling program was completed in September for the Croinor Gold project. A prefeasibility study for the same project showed production ranging from 446 t/d to 583 t/d, at an average content of 6.66 g/t Au, to produce 31,472 ounces per year with a yield of 97.5 for processing at the Beacon plant with a life cycle of four years (12 months pre-production, two years and six months of production). After obtaining the McKenzie Break and Swanson projects, technical resource calculation reports were filed in SEDAR in July and August.

Regarding the company’s Wasamac project, a feasibility study revealed a total grinding capacity of 21.5 Mt with an average content of 2.56 g/t Au and a yield of 88,2%; annual production of 142,000 ounces with a life cycle of 11 years is anticipated; measured and indicated resources of 29.86 Mt at 2.70 g/t Au are expected. Proven reserves of 1,028,000 t at 2.66 g/t Au along with probable reserves of 20,427,000 t at 2.56 g/t Au with a cutoff grade of 1.0 g/t Au are anticipated.

RNC Minerals undertook metallurgical testing to produce nickel sulphate and cobalt. The company began the process of updating the feasibility study, which will include the results of the recently completed market value survey, updated macroeconomic assumptions and several other improvements and updates such as an updated mine plan and optimization of tailings.

Chalice Gold Mines completed an 87,300 m drilling program for its East Cadillac project and reported on the extension of the Nordeau West deposit, identifying three new zones: Simon West, North Contact and Lac Rapides. Cartographic, geological, geophysical and geochemical work was carried out.

In February, IAMGOLD Corporation produced a new resource calculation, with proven reserves of 998,000 t at 7.9 g/t Au and probable reserves of 3,770,000 t with a cutoff grade of 7.6 g/t Au; measured resources were 788,000 t at 13.2 g/t Au, indicated resources were 2,808,000 t at 11.9 g/t Au and inferred resources were 5,189,000 t at 11.0g/t Au with a cutoff grade of 6 g/t Au.

Eldorado Gold announced the results of its 47,750 t ore extraction test at 8.6 g/t Au for its Lamaque. In all, 9,000 m of drilling led to the delimitation of the Triangle zone, and the C zones and other targets were delimited from 44,000 m of drilling. A prefeasibility study published in March reported a grinding capacity of 800,000 tpa with an average content of 7.30 g/t Au and a yield of 94.5% to produce 135,000 ounces. A resource calculation published in November showed proven reserves of 215,000 t at 7.12 g/t Au for 49,000 ounces and probable reserves of 3,872,000 t at 7.26 g/t Au for 904,000 ounces. The company obtained pre-commercial production of roughly 13,430 ounces of gold.

Metanor Resources completed a 32,271 m drilling program on the structure under the pit at its Barry project. High-content subvertical shears were identified over a distance of 1,500 m and at a depth of 440 m. A ramp is currently under construction to obtain a 10,000 t bulk sample that will be processed at the Bachelor plant. The company was purchased by BonTerra Resources in the fall of 2018.

In June 2018, Canada Strategic Metals and Matamec Explorations officially combined their two organizations to form Québec Precious Metals Corporation.

Sayona Québec published the results of its feasibility study for its Authier Lithium project, which anticipated annual processing of 675 000 tpa and annual production of 87,400 t of 6% Li2O concentrate, with a life cycle of 18 years. Proven reserves were 6.10 Mt at 0.99% Li2O and probable reserves were 6.00 Mt at 1.02% Li2O, with a cutoff grade of 0.55% Li2O.

In April, QMX Gold Corporation completed a 23,400 m drilling program for its Val d’Or East projects. Based on the positive results, a new drilling program was launched in the fall, and a resource calculation for the Bonnefond South zone will follow.

Agnico-Eagle Mines Ltd. began sinking a development and exploration ramp at its Goldex mine to reach the Deep 2 and South zones. Drilling continued. With regard to the Odyssey project (50% AEM), 86,051 m of drilling was completed and a resource calculation was published, showing presumed resources of 11.2 Mt at 2,32 g/t Au for 838,000 ounces. A new 140,000 m drilling program was announced for the Odyssey, East Malartic, Sladen and Sheehan projects. The Akasaba West project was approved by Environment and Climate Change Canada, which concluded that the project was not likely to generate major environmental impacts and could therefore proceed. The decision came with a number of conditions. It was followed by approval of the order-in-council by Québec’s Council of Ministers. The company must now apply for a certificate of authorization and a mining lease. The mine’s life cycle is five years, and production is expected to be 115,000 ounces of gold and 21,000 tons of copper. A study was carried out in Zone 3 of the La Ronde mine, and phased development began between levels 311 and 350. A study of the development of Zone 11-3 under Bousquet 2 continued, with resources estimated at 82,480 t at 4.76 g/t Au for 126,000 ounces. With regard to La Ronde Zone 5, development of the first five galleries was completed and commercial production began on June 1. Production is estimated to be roughly 350,000 ounces and should continue until 2026.

Abcourt Mines produced new resource calculations for its Elder mine, following a drilling program. Measured resources were 56,131 t at 5.52 g/t Au, indicated resources were 409,695 t at 6.57 g/t Au and inferred resources were 380,251 t at 6.12 g/t Au. The calculation revealed a cutoff grade of 3.45 g/t Au. For the Tagami project, located close by to the north of the mine, the calculation showed indicated resources of 174,258 t at 6.22 g/t Au and inferred resources of 167,495 t at 5.48 g/t Au, calculated with a cutoff grade of 3.45 g/t Au.

With respect to its Orenada property, Alexandria Minerals Corporation published a resource calculation in June, after its drilling program, for zones 2 and 4, for both the pit and the underground resource. Indicated resources were 3,754 Mt at 1.61 g/t Au for 194,522 ounces, inferred resources were 2,079 Mt at 1.89 g/t Au for 126,259 ounces and cutoff grades were 0.4 g/t Au for the pit and 2.0 g/t Au underground.

The Impact Assessment Agency of Canada asked North American Lithium for a public opinion on the possibility of environmental impacts from mine operations, even though the mine was already in operation. The Canadian Government subsequently announced that the mine did not generate any major negative environmental impacts due to the mitigation measures that had been applied.

A feasibility study and resource calculation for the pit at Granada Gold Mine Inc.’s Granada mine presented the following results: measured and indicated resources were 22,432 000 t at 1.13 g/t Au for 813,000 ounces and inferred resources were 6,930,000 t at 2.04 g/t Au for 455,000 ounces, with a cutoff grade of 0.4 g/t Au.

Canadian Malartic Partnership, Agnico-Eagle Mines Ltd. and Abitibi Royalties Inc. published a resource calculation. For the Barnat and Jeffrey zones, proven reserves were 378,449 t at 1.04 g/t Au and probable reserves were 4,054,393 t at 0.89 g/t Au. For the Odyssey, Barnat, Jeffrey and East Malartic zones, inferred resources were 32,779,651 t at 2.20 g/t Au. Sinking of a ramp to prepare a bulk sample began late in the year at Odyssey South and East Malartic.

Jourdan Resources extracted 50 t of spodumene-rich material at its Vallee Lithium project, and is awaiting processing to obtain concentrate.

Côte-Nord (09)

A considerable amount of work was done at Berkwood Resources Ltd.’s Lac Guéret project in 2018, including 3-D modelling, geophysical surveys, a drilling program and metallurgical testing. Drilling revealed 20.95% CG over 64.69 m, 17.34% CG over 74.59 m and 16.23% Cg over 56.58 m.

Mason Graphite began engineering work on a mine and mine tailings site at its Lac Guéret project. Plant engineering was half completed.

Argex Titanium Inc. published the results of drilling for its Lac Brûlé project. The best contents were 28.2 m at 35.8% TiO2 and 0.37% V2O5, and 20.7 m at 35.02% TiO2 and 0.37% V2O5. A resource calculation was underway.

Focus Graphite and SOQUEM published the results of a preliminary economic survey giving measured and indicated resources of 6.92 Mt at 2.72% OTRT and inferred resources of 1.33 Mt at 3.64% OTRT, for the Josette North-East zone only.

Nord-du-Québec (10)

Exploration work continued for gold in several sectors considered to be of interest, namely Urban-Barry to the east of Lebel-sur-Quévillon, along regional structures (Sunday Lake, Lower Detour and Casa Berardi) identified to the west of Matagami, the region of Lebel-sur-Quévillon−Desmaraisville, the Opinaca reservoir region, the deformation corridors to the south of Chapais, the green rock belts in Eeyou Itschee Baie-James including the Troilus sector resurgence, and the Labrador Trough.

In March 2018, Balmoral Resources Ltd. published an initial resource estimate for its Martinière surface mine project.

Wallbridge Mining Company Ltd. completed dewatering of the open pit and ramp at its Fenelon Mine, and began underground development with a view to obtaining a 35,000 metric ton bulk sample.

In October 2018, Mines Abcourt Inc. updated a resource calculation for its Géant Dormant gold mine.

Maple Gold Mines updated its mineral resource estimate for its Douay gold mine project.

Osisko Mines published a mineral resource estimate for the Windfall and Osborne-Bell deposits, along with the results of a preliminary economic survey presenting an assessment of a basic scenario involving the development of both deposits into underground mines accessible by ramp and providing for a centralized gold processing plant in Lebel-sur-Quévillon. The company also presented the results of a 5,000 metric ton bulk sample obtained from zone 27 following the development of the Windfall project ramp.

Partners Enforcer Gold Corporation and SOQUEM published an update to the assessed mineral resources on the Mop II copper-gold deposit, Roger project, in Chibougamau.

IAMGOLD Corporation, in partnership with TomaGold Corporation and Quinto Resources, presented an initial mineral resource estimate for the Monster Lake gold mine project.

Troilus Gold Corporation produced a new mineral resource estimate for its Troilus copper-gold project.

During the year, Osisko acquired Beaufield Resources Inc., and BonTerra Resources acquired Metanor Resources.

Several gold drill intersections were reported in various projects: Perron (Amex Exploration Inc.), Martinière and Detour East (Balmoral Resources Ltd.), Casault (SOQUEM and Midland Exploration joint venture), Beschefer and Fenelon Mine (Wallbridge Mining Company Ltd.), Douay (Maple Gold Mines), Moroy (Metanor Resources, now BonTerra Resources), Gladiator and Duke (BonTerra Resources), Windfall and Osborne-Bell (Osisko Mines), Fenton (SOQUEM and Cartier Resources Inc.), Montalembert (Enforcer Gold Corporation), Roger (Enforcer Gold Corporation et SOQUEM), Nelligan (IAMGOLD Corporation and Vanstar Mining Resources Inc.), Monster Lake (IAMGOLD Corporation, TomaGold Corporation and Quinto Resources), Fecteau (Opus One Resources), Guercheville (Tarku Resources and SOQUEM), Clearwater (Eastmain Resources Inc.), Cheechoo (Sirios Resources), Au33 (Dios Exploration), Troilus (Troilus Gold Corporation), Éléonore Sud JV (Partnership of Eastmain Resources Inc., Goldcorp, now Newmont Goldcorp and Azimut Exploration Inc.), Sakami (Precious Metals of Québec Corporation) and Qiqavik (Orford Mining Corporation).

Numerous companies actively searched for base metals, mainly in the Matagami and Chapais-Chibougamau regions. Galway Metals Inc. updated the mineral resources for the Estrades deposit (Cu-Zn-Au-Ag), and reported new Cu-Zn-Ag-Au intersections 8 km south-east of Estrades. Imperial Mining Group Ltd. and SOQUEM identified new Cu-Zn-Au-Ag intersections in their Carheil-Brouillan project. SOQUEM announced the results of an updated resource estimate for deposit B26 (Cu-Zn-Ag-Au), located 90 km west of Matagami. Balmoral Resources Ltd. continued to assess the Ni-Cu-Co-ÉGP potential for its Grasset project.

MPV Explorations Inc. used drilling to confirm historical yields (1969-1970) of Cu-Zn-Au-Ag for its UMEX project west of Chapais.

Azimut Exploration Inc. transected several separate levels of chromium while drilling for its Chromaska project, located roughly 50 km northeast of the Cree community of Nemaska.

In Eeyou Istchee Baie-James, development of lithium projects on a mainly north-south axis, including the Moblan (Guo Ao Lithium), Whabouchi (Nemaska Lithium), Rose (Critical Elements Corporation) and James Bay (Galaxy Lithium) projects, continued throughout the year. In addition, Vision Lithium, at its Surmac property located roughly 180 km northwest of Chibougamau, reported the results of lithium drilling in the Dyke No. 5 zone, and also published a new surface discovery known as the “East Zone”. Stria Lithium published the results of its first drilling program in 2017, at its Pontax project, located roughly 30 km south of the kilometre 381 roadside rest area on the James Bay Road. MetalsTech Ltd. discovered several lithium intersections when drilling at its Adina property located roughly 60 km south of the Mirage Outfitter.

In the Chibougamau region, Vanadium One Energy Corporation (now Vanadium One Iron Corp.) completed second stage drilling for its Mont du Sorcier project, where it is searching for iron, titanium and vanadium.

Commerce Resources Corp. Continued to work on the pre-feasibility study for its Eldor rare earths project.

Imperial Mining Group Ltd. published results for rare metals from its Crater Lake project, located roughly 150 km east of Schefferville.

Gaspésie–Îles-de-la-Madeleine (11)

Canadian Metals Inc. completed a resource calculation for its Langis property. Measured resources were 3.9 Mt at 99.01% SiO2 and indicated resources were 3.7 Mt at 98.92% SiO2 with a cutoff grade of 97% SiO2. Inferred resources were 14 Mt at 98.97% SiO2. The company began work on a prefeasibility study.

Gespeg Copper began updating the resource calculation for the Sullipek block of its Vortex project, with inferred resources of 2.24 Mt at 1.09% Cu.

Lanaudière (14)

Nouveau Monde Graphite carried out a new resource calculation for the Tony block of its Matawinie property. Indicated resources were 95.8 Mt at 4.28% Cg and inferred resources were 14.0 Mt at 4.19% Cg, with a cutoff grade of 1.78% Cg. A prefeasibility study was carried out, and showed a 25-year operational life cycle, a supply of 9,200 tons per day, annual production of 100,000 tons of graphite concentrate with an average content of 4.35% Cg, a yield rate of 94% and a finished product purity level in excess of 97%.

Laurentide (15)

Kintavar Exploration Inc. completed a 30,000 m drilling program at its Mitchi property, along three favourable corridors: Sherlock, Nasigon and Hispana. The results of the geophysical surveys on Nasigon showed a high correlation between induced polarization anomalies, mineralized outcrops and anomalies on the ground. New channels produced up to 9.21% Cu and 48.7 g/t Ag, 9.12% Cu and 100 g/t Ag. Drilling produced 0.63% Cu and 7.45 g/t Ag over 34.25 m, 0.56% Cu and 6.48 g/t Ag over 6.75 m and 0.62% Cu and 9.6 g/t Ag over 5.6 m.

Canada Carbon Inc. carried out a hydrological study for a proposed marble quarry with a view to obtaining a certificate of authorization from the Ministère de l’Environnement et de la Lutte contre les changements climatiques (MELCC). Testing of the waste rock, ore and tailings revealed no effluent contamination, no potential for acid drainage and no impacts on drinking water wells. An agreement was signed with Dunedin Energy Systems Ltd. to supply it with 200 tons of graphite per year for a six-year period with an option for 50 additional tons per year.

Chapter 5 – MINING ACTIVITY

Mines and Mining Projects

In 2018, Québec had 26 producing mines, two mining projects and 24 development projects. Information on these activities is available in the form of a downloadable PDF table.

Active Mines – For project locations, see Active Mines map.

The active mines included ten gold mines (of which one was a polymetal mine), five industrial mineral mines (diamonds, feldspar, graphite, mica and salt), four iron mines, two base metal mines, two nickel-copper-platinum group elements mine, one niobium mine, one lithium mine and one ilmenite mine.

Mining Projects – For project locations, see Mining Projects map.

Both mining projects in progress targeted lithium and gold mineralizations.

The 24 development projects targeted mineralizations of gold (11 including two polymetal projects), industrial minerals (seven targeting graphite, apatite or lithium), iron-titanium-vanadium (2), nickel-cobalt-platinum group elements (1), rare earths (2) and base metals (1).

Industrial Stones

Industrial stone extracted in Québec includes limestone, dolomite, marble, quartzite, clay and shale. Industrial stone quarries are listed in a PDF table and their locations are shown on this map.

Silica operations are not subject to the Mining Tax Act and are treated in the same way as industrial stone.

Limestone, dolomite and marble are used to produce quicklime, granulated products (amendments, mineral fillers, granulate) or cement.

The main sources of silica are quartzites, clays and natural sand deposits. Very pure silica is extracted from the Saint-Canut deposits (Mirabel region) and the Petit lac Malbaie deposits (Charlevoix region). Silicium Québec extracts and processes its ore at Petit lac Malbaie. Some of its production is used to fuel its silicon metal plant in Bécancour. Shale is extracted from a single site in the Montreal region and is used to produce facing bricks.

Architectural Stone

There are many architectural stone quarries in Québec. They are listed in a PDF table and their locations can be found on this map.

The Rivière-à-Pierre sector (Portneuf) is the main source of cut stone in Québec. Other sites at which architectural stone is extracted include the Saint‑Alexis‑des‑Monts region in Lanaudière, and the Stanstead sector in Estrie.

Chapter 6 – RESTORATION OF MINING SITES

The Mining Act provides that a rehabilitation and restoration plan must be approved before a mining lease can be awarded to undertake mining operations. The plan sets out the restoration work to be done and the amount to be paid as a guarantee.

In addition to proposed mines and active mines, Québec also has a number of abandoned mines. The owners of these sites are either unknown or insolvent. The Ministère de l’Énergie et des Ressources naturelles (MERN) has elected to take action and restore these sites. It also monitors sites that were given back to it or for which a certificate of release from restoration obligations has been granted, as provided for in the Mining Act.

The Gouvernement du Québec considers the restoration of mining sites to be a priority. Its work plan for the restoration of abandoned mining sites has been published on its website since 2014.

ACTIVE MINING SITES

Every person who carries out mining activities must file a rehabilitation and restoration plan, along with a financial guarantee, before beginning work.

In 2018, mine operators had paid a total of $104.8 million in financial guarantees, bringing the total amount of guarantees held by the MERN to $1.08 billion.

GOVERNMENT MINING SITES (RETROCEDED, RELEASED OR ABANDONED)

Environmental Liabilities

In 2006, to reduce the scope of the environmental liability, the Government asked all departments and public agencies to prepare an inventory of contaminated abandoned sites.

The monies needed to restore abandoned mining sites are set against the amount of environmental liability from contaminated sites in the Government’s consolidated financial statements.

On March 31, 2018, the Minister of Finance entered an amount of $1.2 billion in the public accounts as environmental liabilities from mining activities, including $761.4 million for sites currently under the Government’s responsibility and $457.2 million for sites likely to become the Government’s responsibility due to the precarious financial status of the companies concerned. Since 2006, the MERN has invested a total of $158 million to restore, secure, maintain and monitor mining sites for which the Government is responsible.

As of March 31, 2018, 452 abandoned mining sites were listed as environmental liabilities. Of these sites:

- 223 were mine exploration sites requiring cleanup and located in Nunavik or in the Eeyou Istchee James Bay territory;

- 221 were active mining sites:

- 139 had been restored or secured and were being monitored and maintained;

- 6 sites were undergoing restoration;

- 18 sites had been characterized and had yet to be restored;

- 33 sites were awaiting characterization;

- 25 sites had yet to be secured;

- 8 sites were quarries and sand pits.

The MERN’s work plan for the restoration of abandoned mining sites, along with a list of sites entered as environmental liabilities and a map showing their locations, can be found on the MERN’s website at: https://mern.gouv.qc.ca/en/mines/mining-reclamation/list-of-abandoned-mining-sites/.

Characterization Work

To identify the environmental impacts of abandoned mining sites in more detail, the MERN has set up an environmental characterization program for sites awaiting restoration. Among other things, characterization is used to assess the real impacts of an abandoned site for the surrounding environment. It constitutes the first step in the process of preparing a restoration plan, and is needed to obtain an accurate estimate of restoration costs, which are entered as environmental liability, and also to establish the site’s restoration priority level.

In 2018, characterization work continued at the West Malartic and Normetmar mine sites, and was completed at St Lawrence Colombium and Joutel Copper.

Pre-characterization work was carried out at the former Vauze and Granada mining sites near Rouyn-Noranda. The environmental characterizations begun in December 2018 are expected to be completed in 2020.

Restoration Work

Outaouais (07)

Lac Renzy

The former Lac Renzy mine is located north of Maniwaki, in Outaouais. Nickel and copper were mined at the site from 1969 to 1972. Nearly 0.8 Mt of ore was extracted from an open pit and was processed on site. The pit itself has been flooded by Lac de Renzy. Mining operations generated a waste rock stack covering an area of 1.2 hectares and a mine tailings site covering roughly 6.7 hectares in the middle of Lac de Renzy, splitting it into two separate hydrological entities.

The tailings and waste rock may be acidic and leachable. In addition, soil, sediment and surface/underground water contamination levels were in excess of the thresholds set by the MELCC for certain metals.

Preparatory work was completed in the spring and fall of 2018, and consisted mainly in deforesting the target sectors, setting up the contractor’s work area and temporary storage area, building new access roads, collecting and disposing of waste and debris on the site, and excavating and stacking contaminated materials.

A second call for bids will be prepared in 2019 for the restoration of accumulation areas by submerging the tailings and waste rock.

Abitibi-Témiscamingue (08)

Manitou

The Manitou site is located south-east of Val‑d’Or. Zinc, copper and lead were mined at the site between 1942 and 1979, producing nearly 11 Mt of acid tailings. The tailings were deposited at two inadequately confined sites and have spread alongside the storage area and along the Manitou stream over a distance of 6.5 km, up to Rivière Bourlamaque. In all, roughly 200 hectares have been damaged by the tailings.

The MERN became responsible for the Manitou site when the most recent holder of mining rights went bankrupt in 2002. At the end of 2008, the MERN signed an agreement with Agnico Eagle Mines Ltd. that allowed it to use alkaline tailings from the Goldex mine to restore the Manitou tailings site. Since September 2008, tailings from Goldex have been sent to Manitou via a 23 km pipeline. New mineralized areas have since been brought into production at Goldex, and as a result the MERN estimates that the Manitou site will be completely restored by 2025.

Work has been ongoing at the Manitou site since 2016 to test the behaviour of two different multi-layer coverings with a view to choosing the best scenario for covering the top part of the tailings site.

Preissac Molybdénite

This is a former molybdenum and bismuth mine located near the municipality of Preissac. The mine was active from 1962 to 1971, and roughly 2.2 Mt of ore were extracted and processed on site. These activities generated a waste rock stack covering approximately two hectares, plus two unconfined mine tailings sites covering approximately 2 hectares (site A) and 22 hectares (site B). Site B, located on lots 11 and 12 of Rang IV of the Township of Pressiac, was restored in 1992.

In 1971, tar containing copper chloride was burned clandestinely at the site and along the shores of Lac Fontbonne. The burn waste was placed on the waste rock stack when the mining facilities were subsequently decommissioned. Environmental characterization work has confirmed the presence of contamination by chlorine-containing dioxins and furans (D and F) in the waste rock, fill materials, surface soils and underground water. The Public Health department of the Abitibi-Témiscamingue Health and Social Services Agency has also recommended that the general public in the area should avoid the site and should not consume food commodities harvested in the sector. The Public Health Department’s recommandations were updated in 2018, based on data collected in 2017.

In addition to contamination by dioxins and furans (D and F), some waste rock was contaminated by petroleum hydrocarbons and the site’s waste rock is also considered to be acid-producing. As for the site’s mine tailings, they are leachable and subject to water erosion, which affects the quality of the surface water downstream from the site. Site restoration solutions, including rehabilitation of the land contaminated by dioxins and furans, are currently being identified.

Nord-du-Québec (10)

Principale Mine

The site includes a former mine with two main shafts (Main and Merrill) located on Merrill Island, near Chibougamau. The copper and gold deposit was mined intermittently from 1953 to 1980, and the ore was processed on site, at the plant. When the mine closed, the plant remained active until 2005, processing ore from other mines in the vicinity. These activities generated three mine tailings site and one polishing basin, as well as numerous abandoned structures. At 300 hectares, the Principale Mine is the largest abandoned mining site in Québec.

A number of studies, including an environmental characterization and geotechnical and hydrogeological reviews, have been carried out since 2010 to gather information and identify the problems. In 2015, the MERN hired a firm to carry out these studies, perform engineering work including prefeasibility and feasibility studies, produce plans and specifications and oversee restoration work at the Principale Mine site.

A major geotechnical characterization program was carried out in 2016, and the results were analyzed in 2017 to decide which openings needed to be secured, and the methods required. Work in the problem areas was completed in the fall of 2018.

At the same time, following studies of the site’s hydrogeological conditions and water balance and a characterization of the tailings, a restoration method was chosen for the two acid-generating tailings sites. In the case of the third site, there is no acid drainage from its tailings, and vegetation will be planted to limit any spread. Detailed engineering for all three sites is currently being prepared.

Nunavik Mineral Exploration Sites

An inventory carried out in 2001 identified 275 abandoned mine exploration sites in Nunavik, including 18 sites classified as major.

The Gouvernement du Québec, the Kativik Regional Government, the Makivik Corporation and the Restor-Action Nunavik Fund (a group of mining companies) signed a partnership agreement in 2007 to clean up the 18 major sites.

Since the agreement was signed, cleanup operations have taken place at 76 mine exploration sites in Nunavik considered to be of major or intermediate importance. This number includes 11 newly identified sites at which work has taken place recently.

In August 2018, the parties agreed to prolong the agreement for a further three years, from March 31, 2019 to March 31, 2022, in order to clean certain sites classified as being of lesser importance.

Abandoned mine exploration sites in the Eeyou Istchee James Bay Territory

The Gouvernement du Québec signed an agreement on August 9, 2018, with the Cree Nation Government (CNG), the Eeyou Istchee James Bay Regional Government (EIJBRG) and the Restor-Action Fund to cover cleanup of abandoned mine exploration sites in the Eeyou Istchee James Bay territory. The purpose of the agreement is to ensure that the abandoned mine exploration sites identified by the CNG are cleaned up by October 31, 2029. The CNG and EIJBRG are responsible for managing and carrying out cleanup work at the sites.

A detailed inventory of abandoned mine sites in the Eeyou Istchee James Bay territory is currently being prepared following site visits by the CNG in the summer of 2018. Further site visits will take place in the summer of 2019. When the agreement was signed, the MERN had identified 213 sites requiring cleanup in the area.

INSPECTION AND SECURITY

Every year, the MERN carries out an extensive inspection program at mining sites on its environmental liability list, to identify potential risks to the environment or to human safety, and to plan maintenance and securement work. The main purpose of this is to secure former mine openings by filling them or installing fences or concrete slabs.

In 2016, 209 abandoned mining sites were visited by MERN inspectors, among other things to ensure that they were safe.

ENVIRONMENTAL MONITORING OF ABANDONED MINE SITES RESTORED BY THE GOVERNMENT

The MERN carries out annual monitoring of surface water and groundwater quality at mining sites restored under State responsibility.

Monitoring is required to comply with the conditions contained in the certificates of authorization issued by the MELCC for the restoration work. More specifically, it is used to ensure that the effluent from the sites satisfies the requirements of Directive 019 on the mining industry, published by the MELCC, and to assess the performance of restoration measures applied to the sites.

In 2018, monitoring took place at 19 sites that had been or were being restored. They were located in the following regions: Abitibi-Témiscamingue (11), Estrie (2), Gaspésie (2), Nord-du-Québec (2), Outaouais (1) and Mauricie (1).

Chapter 7 – RESEARCH AND DEVELOPMENT

Research Funding

Below are some of the research programs underway in 2018.

- Mining Research and Innovation Support Program (Programme d’appui à la recherche et à l’innovation du domaine minier; PARIDM)

As of December 31, 2018, the MERN had received six applications for financial assistance. The program ended on that date, and the MERN has taken steps to renew it.

- Partnership Research Program for Sustainable Development of the Mining Sector

As of March 31, 2018, the MERN had received 35 of the 63 final reports due under the program. The 28 other will be filed by January 2021. The MERN has also taken steps with the Fonds de recherche du Québec – Nature et technologies (FRQNT) to renew the program subsidy.

- Clean Growth Program

Canada’s Clean Growth Program has a total budget of $155 million and has received more than 750 applications. Ten of these proposals are in connection with Québec’s mining sector.

- Hydrometallurgy Research Support Program

The Gouvernement du Québec granted allocations of $1 million in 2016-2017 and $2 million per year for 2017-2018 and 2018-2019 to support hydrometallurgy research. Six projects received funding as a result of the first call for projects in November 2016, and a further eight as a result of the second in 2017. The third and last call for projects was launched in October 2018, and four proposals were accepted.

- Other initiatives

- The Australian Academy of Science launched a detailed ten-year plan (2018-2027) to develop the geosciences in Australia. One of the plan’s elements is to implement an “inverting telescope” able to capture high-resolution geophysical, geochemical and remote sensing data. The program, designed to observe the Earth and scan to a depth of up to 300 km below the Earth’s surface, will be used among other things to detect the minerals required for new technologies.

- Natural Resources Canada has launched its “Crush It!” Challenge (with a budget of $10 million), encouraging Canada’s innovators to design new clean technology solutions that will transform how energy is used to crush and grind rock in the mining sector.

R&D FUNDING

- The Gouvernement du Québec has allocated nearly $31 million to Alliance Magnesium for a commercial demonstrator plant. The federal government will also be granting a $12 million subsidy from its Sustainable Development Technology Canada (SDTC) fund.

- ArcelorMittal will invest $360,000 in McGill University to fund research projects and design programs for the Mining and Materials Engineering Department.

- Nouveau Monde Graphite (NMG) has begun a feasibility study with the aim of presenting a proposal for a fully electric open-cast graphite mine.

- The Gouvernement du Québec has awarded $15 million in financial assistance to CO2 Solutions to support its Valorisation Carbone Québec project.

- Nemaska Lithium has launched a test bench to use waste from its lithium hydroxide production process as an additive in high performance cement or concrete.

- The INNOV-R greenhouse gas reduction program was introduced by seven sector-based industrial research groups. The program is intended for all Québec’s economic sectors, including the mining sector. Projects must be submitted by enterprises that are based in Québec and have internal production or R&D activities, and must involve at least one university, college technology transfer centre or public research centre. An initial call for proposals was issued on June 22, 2018, and another will be issued in 2019. Details can be found at [http://innov-r.org/].

- The next step, after self-driving trucks and automated transportation systems, may be minerless mines. Rio Tinto unveiled plans for a $2.2 billion “intelligent mine” that will use robotics and self-driving trains and trucks.

INNOVATIONS

- Rio Tinto announced that its AutoHaul autonomous train project in Western Australia is now fully operational.

- lAMGOLD Corporation developed several innovations to restore the former Doyon mine (multi-layer covering, desulfurization of tailings, development of lime mud).

- Falco Resources used artificial intelligence to identify new, high-potential mineral targets in relatively unexplored sectors of the Rouyn-Noranda mining camp, with almost no new fieldwork.

- Arianne Phosphate announced the beginning of research and development to incorporate aluminium into its trailer designs.

TRENDS

- Digital transformation: A report produced by Québec’s Institut national des mines (INMQ) provides potential digital transformation solutions for mine owners. They include:

- innovating in different ways and in different sectors of the organization;

- establishing a clear digital transformation vision for the organization;

- exploring new types of partnerships.

- Vertical integration: Apple was in direct talks with a mining company to secure its long-term cobalt supplies, so that it will be able to meet growing needs for the metal, used to manufacture many of Apple’s energy-intensive devices.

| Jean-Yves Labbé, directeur p.i., Direction générale de Géologie Québec |

| Andrea Amortegui, directrice p.i., Bureau de la connaissance géologique du Québec |

| Mona Baker, géo., directrice p.i., Direction de l’information géologique |

| Hélène Giroux, directrice, Direction des affaires minières et de la coordination |

| Robert Thériault, géo., directeur p.i., Direction de la promotion et du soutien aux opérations |

| Katrie Bergeron, ing., Direction générale du développement de l’industrie minière |

| Louis Bienvenu, ing., Direction générale du développement de l’industrie minière |

| Nathalie Bouchard, tech., Direction de la promotion et du soutien aux opérations |

| Steve Boulet, bur. coord. des projets majeurs et d’analyse des impacts économiques |

| Suzanne Côté, tech., Direction régionale Abitibi-Témiscamingue |

| Claude Dion, ing., Direction de la promotion et du soutien aux opérations |

| Dorra Djemal, Direction du développement et du contrôle de l’activité minière |

| Mehdi A. Guemache, géo., Direction de la promotion et du soutien aux opérations |

| Patrick Houle, géo., Direction régionale Nord-du-Québec |

| Vicki Laflamme, adjointe exécutive, Direction générale de Géologie Québec |

| Philippe-André Lafrance, ing., Direction de la restauration des sites miniers |

| Josée Morency, adjointe exécutive, Direction de la restauration des sites miniers |

| Sophie Proulx, ing., Direction de la restauration des sites miniers |

| Henrik Rasmussen, ing., Direction de la restauration des sites miniers |

| Caroline Thorn, Analyste, Direction générale de Géologie Québec |

| N’Golo Togola, géo, Direction de la promotion et du soutien aux opérations |

| Sophie Turcotte, géo., Direction de la restauration des sites miniers |

| Malek Zetchi, chimiste, Direction de la restauration des sites miniers |

9 mars 2020