Chapter 1 – ECONOMY and MINING TITLES

Economy

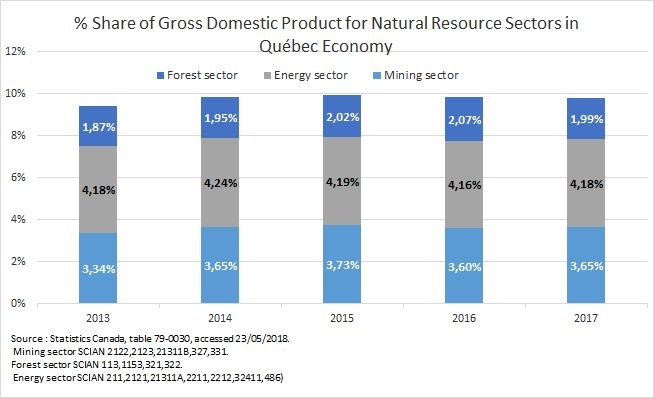

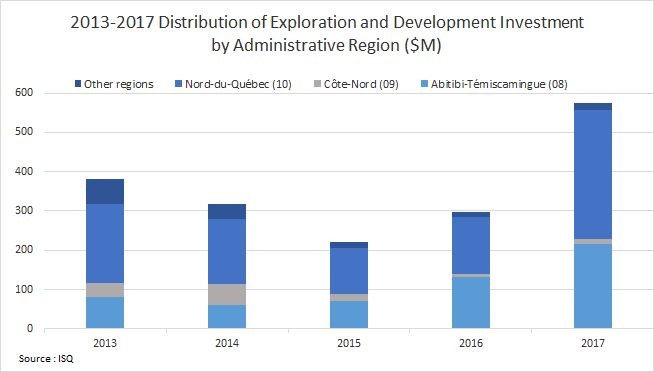

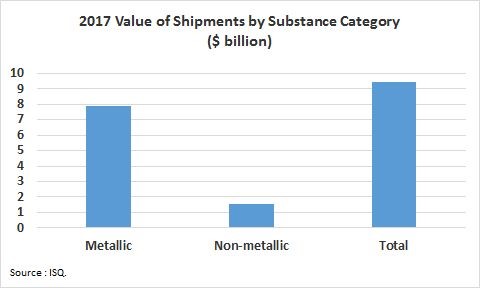

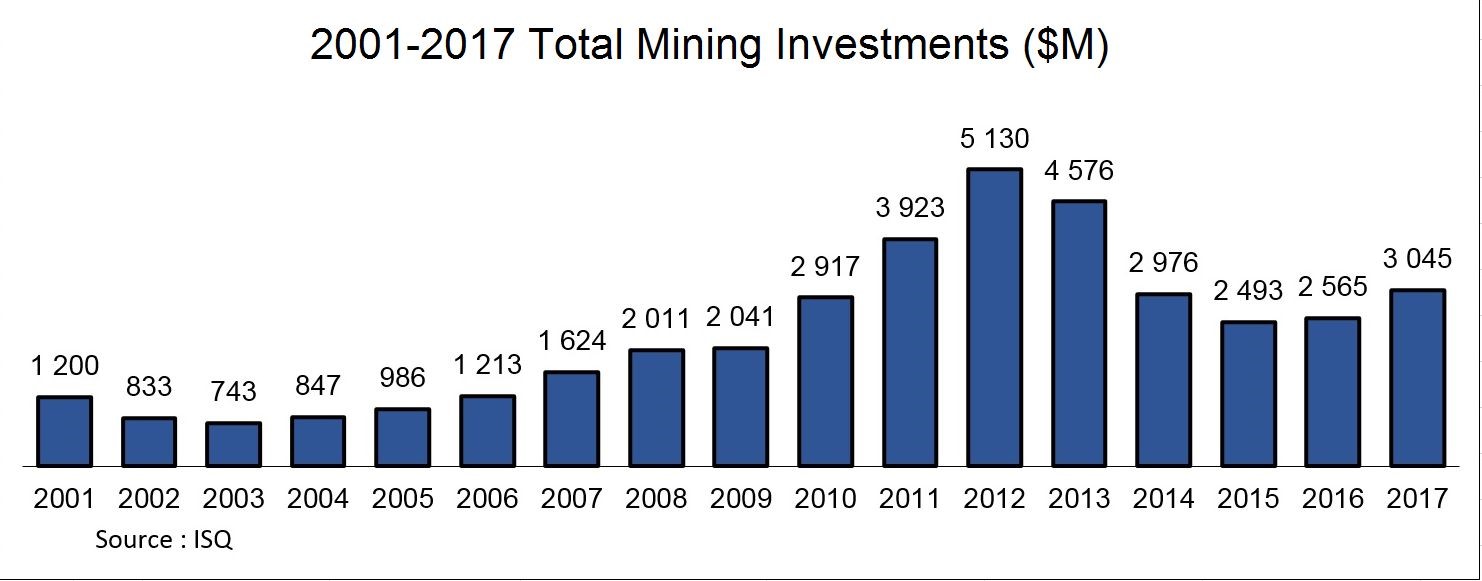

In recent years, the markets for mineral substances have evolved in a more difficult market. However, 2017 was largely a year of growth; prices for most substances have increased steadily or remained stable. This more favourable economic situation has resulted in increased investment in exploration, development and the value of deliveries. These positive results were apparent in the mining sector’s share of GDP in Québec’s economy. This reflects the positive results of 2017.

Employment

Value of Shipments

Mining Investments

Mining Titles

Number and Area of Exploration Mineral and Mining Titles in Québec

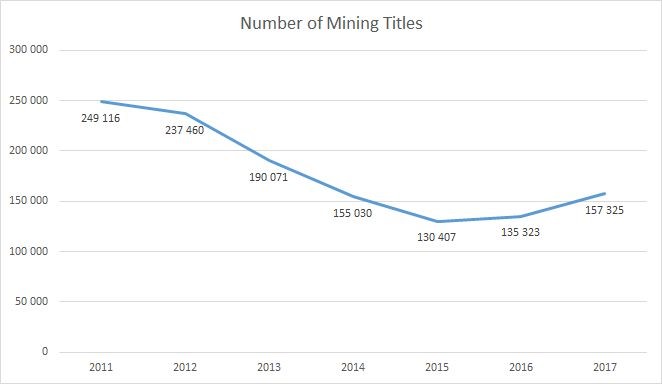

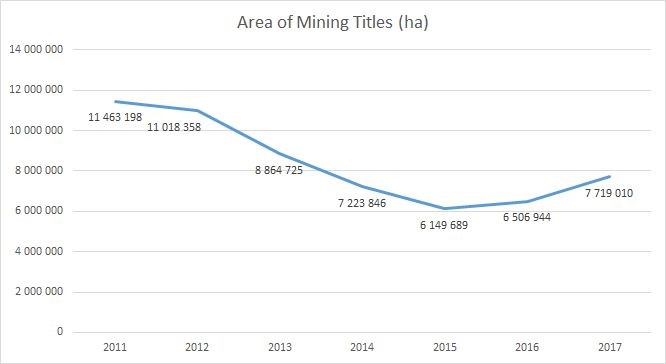

During the 2011-2015 period, the number of mining titles declined significantly. In 2011, Québec had 249 116 mining titles, for a total area of 11 463 198 ha. In 2015, there were 130 407 mining titles in Québec, for a total area of 6 149 689 ha. This represents a 52.3% decrease in the number of mining titles and a 53.6% decrease in the total area compared to 2011.

Over the past two years, the number of mining titles has regained some of the lost ground. As of December 31, 2017, the number of mining titles in Québec was 157 325, for a total area of 7 719 010 ha. This represents an increase of 20.6% in the number of mining titles and 25.5% in the total area compared to 2015.

Distribution of Exploration Mineral Titles in Québec by Administrative Region

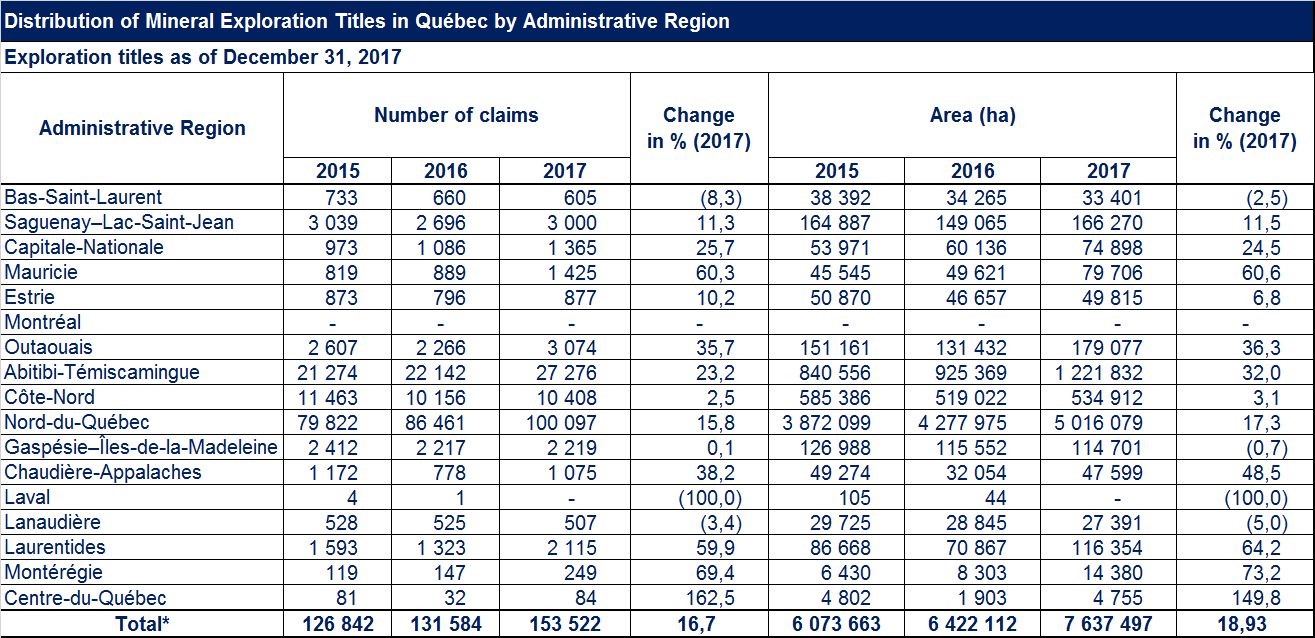

There has been an increase in the number of exploration titles compared to 2016 in certain administrative regions of Québec, particularly in the Centre-du-Québec (162.5%), Montérégie (69.4%), Mauricie (60.3%), Laurentides (59.9%) and Chaudière-Appalaches (38.2%) regions. In contrast, the number of exploration titles decreased in the Laval (100%), Bas-Saint-Laurent (8.3%) and Lanaudière (3.4%) administrative regions.

Distribution of Exploration Mineral Titles Granted in Québec by Administrative Region

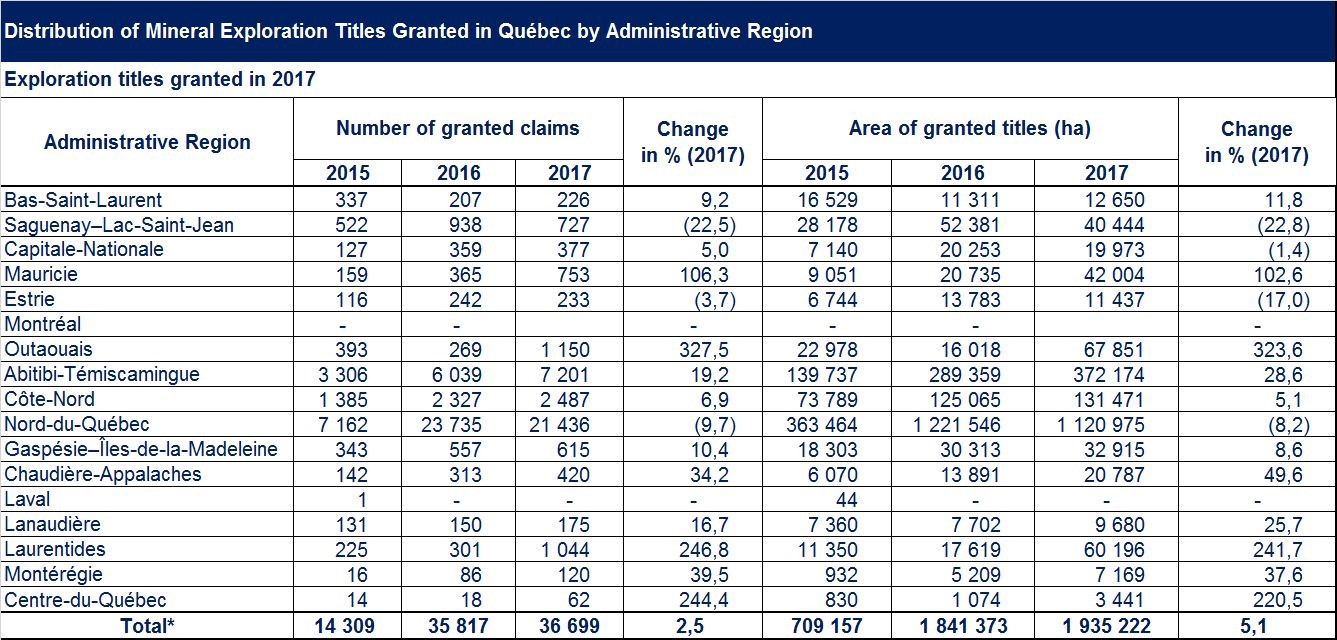

In 2017, 36 699 exploration titles were granted and registered on the Québec Public Register of Real and Real Property Rights (Register), covering 1 935 222 ha. This represents an increase of 2.5% over the number of exploration titles granted in 2016, as well as a 5.1% increase in the total area covered by the register.

This increase applies to most administrative regions in Québec, including the Outaouais (327.5%), Laurentides (246.8%), Centre-du-Québec (244.4%) and Mauricie (106.3%) regions.

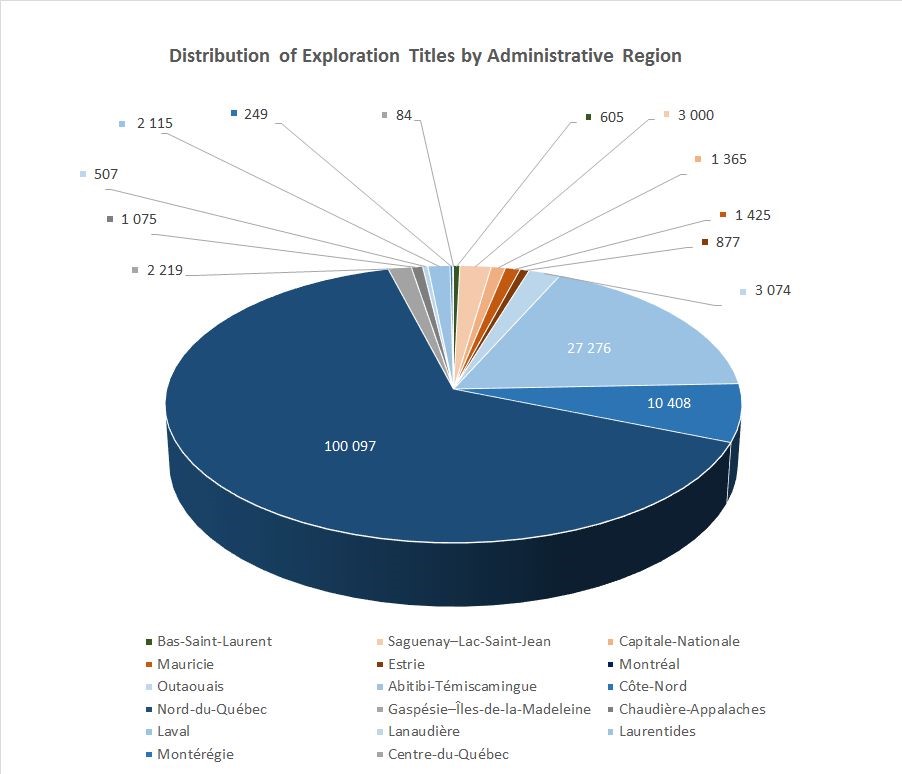

Distribution of Exploration Titles by Administrative Region

Data from the Register, as of December 31, 2017, show that 89.7% of exploration titles are located in the Nord-du-Québec (65.2%), Abitibi-Témiscamingue (17.8%) and Côte-Nord (6.8%) administrative regions.

At the same time, the Montréal and Laval administrative regions have no exploration titles and the following regions have less than 1%: Mauricie (0.9%), Capitale-Nationale (0.9%), Chaudière-Appalaches (0.70%), Estrie (0.57%), Bas-Saint-Laurent (0.4%), Lanaudière (0.3%), Montérégie (0.2%) and Centre-du-Québec (0.05%).

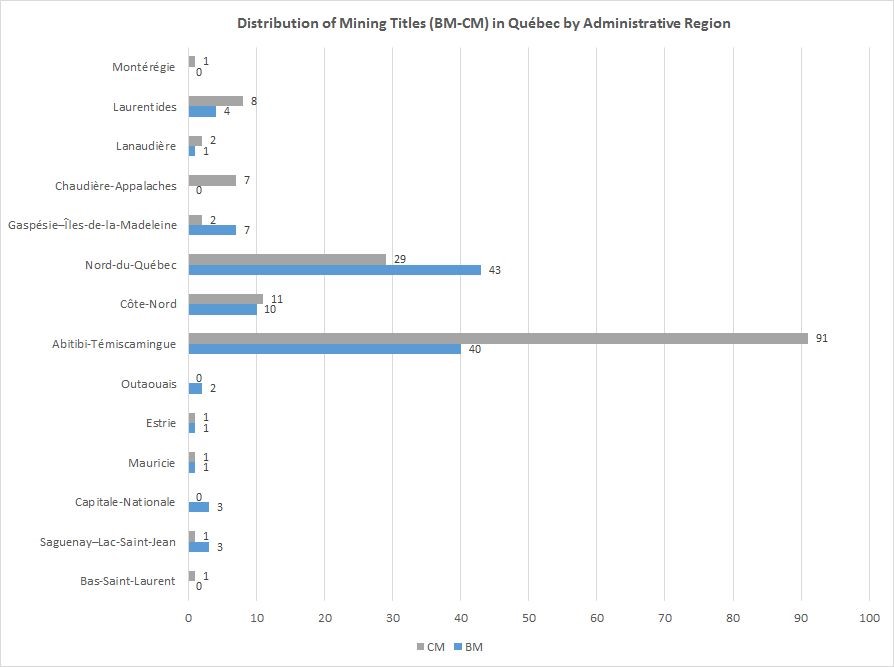

Distribution of Mining Titles (Mining Lease [BM] and Mineral Concession [CM]) by Administrative Region

Note: Titles overlapping several administrative regions are compiled in each region.

As of December 31, 2017, there are 114 mining leases and 155 mining concessions in Québec, for a total of 269 titles. In total, 83.2% of mining titles, either mining lease or mining concession, are located in the Abitibi‑Témiscamingue (48.7%), Nord‑du‑Québec (26.7%) and Côte‑Nord (7.8%) administrative regions.

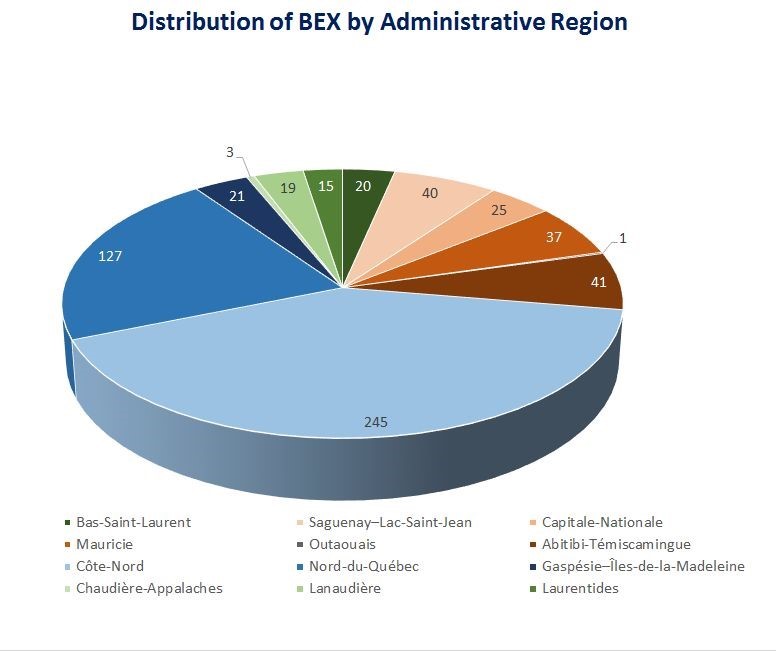

Distribution of Exclusive Mining Leases (BEX) by Administrative Region

As of December 31, 2017, the total number of exclusive mining leases (BEX) for surface mineral substances is 594. This number includes the various substances exploited under a BEX: dimensional stone, crushed stone, peat, silica ore, and sand and gravel.

Almost 76.3% of these BEX are located in the Côte-Nord (41.2%), Nord-du-Québec (21.4%), Abitibi-Témiscamingue (6.9%) and Saguenay–Lac-Saint-Jean (6.7%) administrative regions.

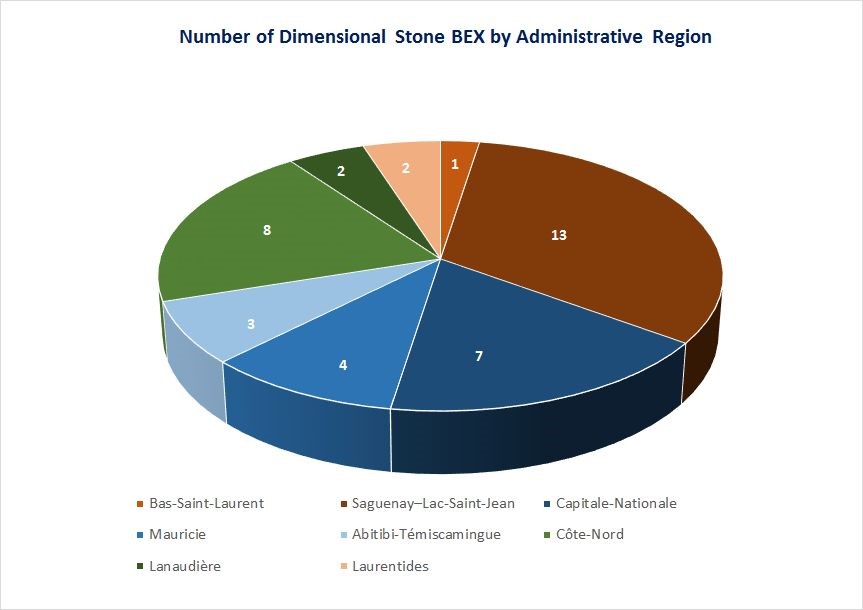

Distribution of Dimensional Stone Exclusive Mining Leases (BEX) by Administrative Region

As of December 31, 2017, the total number of dimensional stone BEX is 40 for all administrative regions in Québec. The majority of these BEX (70.0%) are located in the Saguenay–Lac-Saint-Jean (32.5%), Côte-Nord (20.0%) and Capitale-Nationale (17.5%) administrative regions.

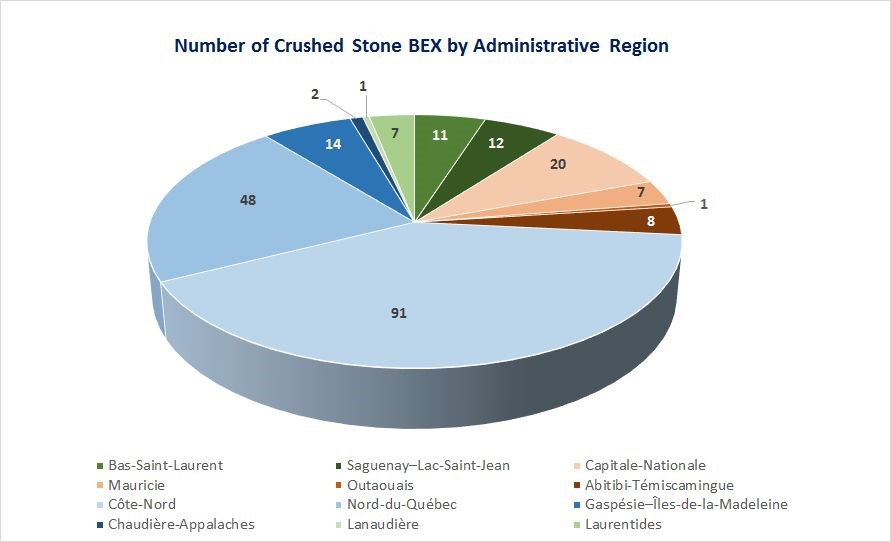

Distribution of Crushed Stone Exclusive Mining Leases (BEX) by Administrative Region

As of December 31, 2017, 222 crushed stone BEX were located in 11 administrative regions of Québec. Of these, 91 BEX were located in the Côte-Nord administrative region (40.9%), 48 BEX in Nord-du-Québec (21.6%) and 20 BEX in Capitale-Nationale (9.0%).

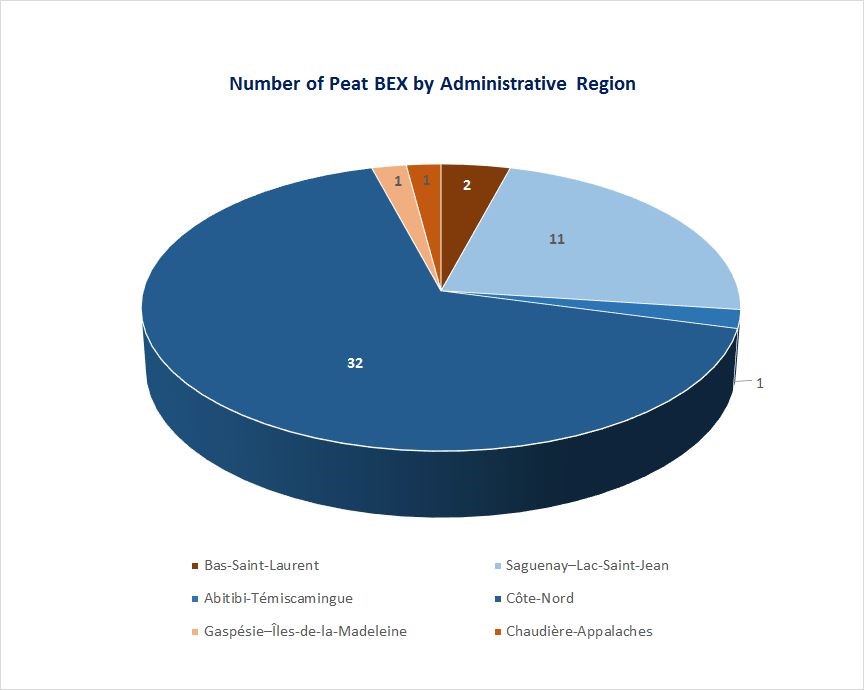

Distribution of Peat Exclusive Mining Leases (BEX) by Administrative Region

As of December 31, 2017, Québec had 48 peat BEX. They were mainly located in two administrative regions, 32 for the Côte-Nord region (66.7%) and 11 for the Saguenay–Lac-Saint-Jean region (22.9%).

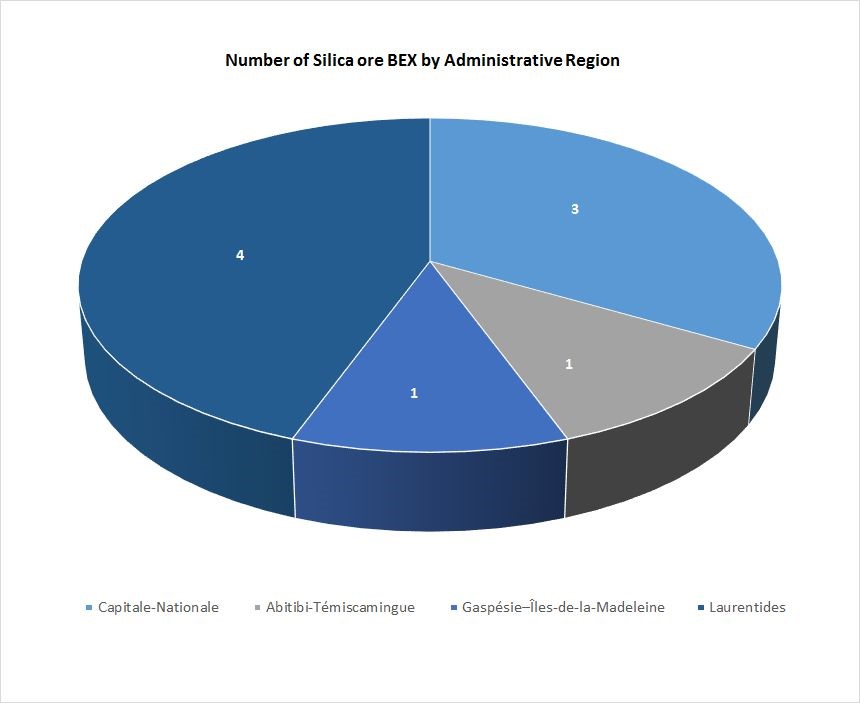

Distribution of Silica ore Exclusive Mining Leases (BEX) by Administrative Region

As of December 31, 2017, the total number of silica ore BEX is 9. They are located in four administrative regions, mainly the Laurentides (44.4%) and Capitale-Nationale (33.3%).

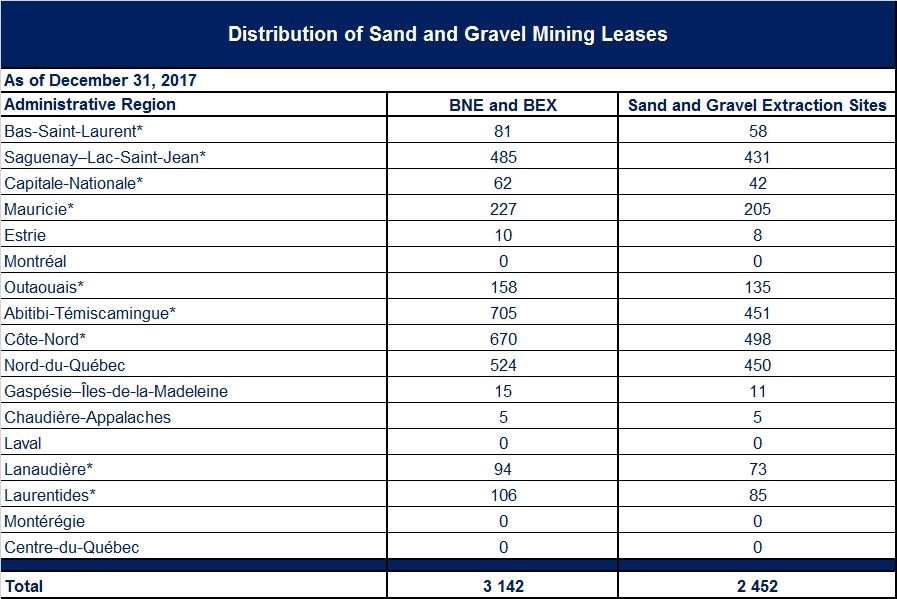

Distribution of Sand and Gravel Mining Leases by Administrative Region

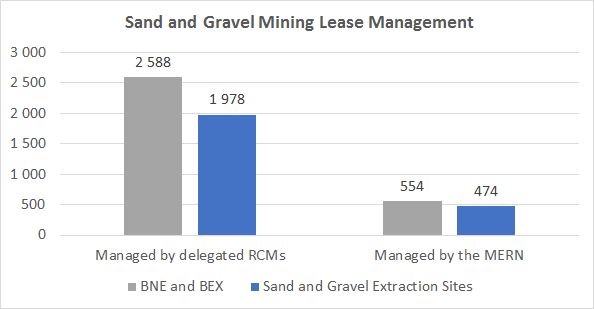

Acronyms

BEX: Exclusive mining lease for surface mineral substances

NBE: Non-exclusive mining lease for surface mineral substances

* Delegated administrative regions

As of December 31, 2017, the number of sand and gravel mining leases, throughout Québec, was 3142 for 2452 surface mineral extraction sites. Of these, 2588 titles were managed by the Regional County Municipalities (RCMs), which represents 82.3% of the total. The remaining 554 titles were managed by the ministère de l’Énergie et des Ressources naturelles (MERN).

The Laval, Montréal, Montérégie and Centre-du-Québec administrative regions do not have any sand and gravel extraction sites in the domain of the State. Existing pits in these areas are on land that was granted or alienated by the State for non-mining purposes prior to January 1, 1966. Some substances, such as sand and gravel, have been abandoned to the land owner and are therefore not part of the domain of the State.

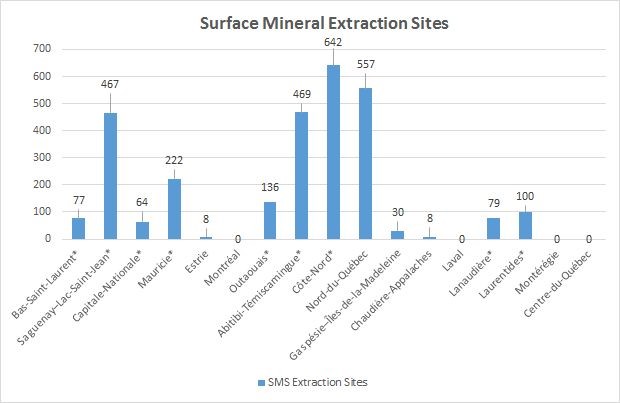

Distribution of Surface Mineral Extraction Sites by Administrative Region

*Delegated administrative regions

Administrative regions with the most surface mineral extraction sites (SMS) are Côte-Nord (22.5%), Nord-du-Québec (19.5%), Abitibi-Témiscamingue (16.4%) and Saguenay–Lac-Saint-Jean (16.3%).

Reported Exploration Activities

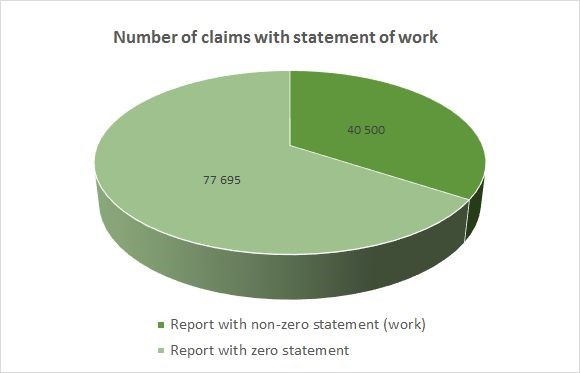

As of December 31, 2017, the total number of claims was 153 522. Of these claims, 118 195 (77.0%) were the subject of statements of work through a recorp of the work completed in 2017, provided to the Minister by the holders of these claims.

The report of 40 550 claims (34.3% of claims with statements of work) has non-zero statement. These are claims that have been the subject of exploration work, fundraising activities, partner search, or public or Aboriginal consultation.

77 695 claims (65.7% of claims with statements of work) reported no work. In fact, no exploration work has been done on the lands concerned by these claims.

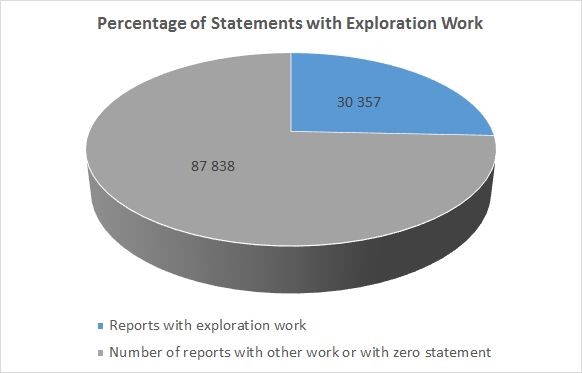

Statements with Exploration Work

In 2017, 30 357 claims were the subject of exploration work. This represents nearly 25.68% of the 118 195 claims for which an annual report was filed. This is reported work other than funding, seeking partners and public or Aboriginal consultations.

Exploration Activities on Claims

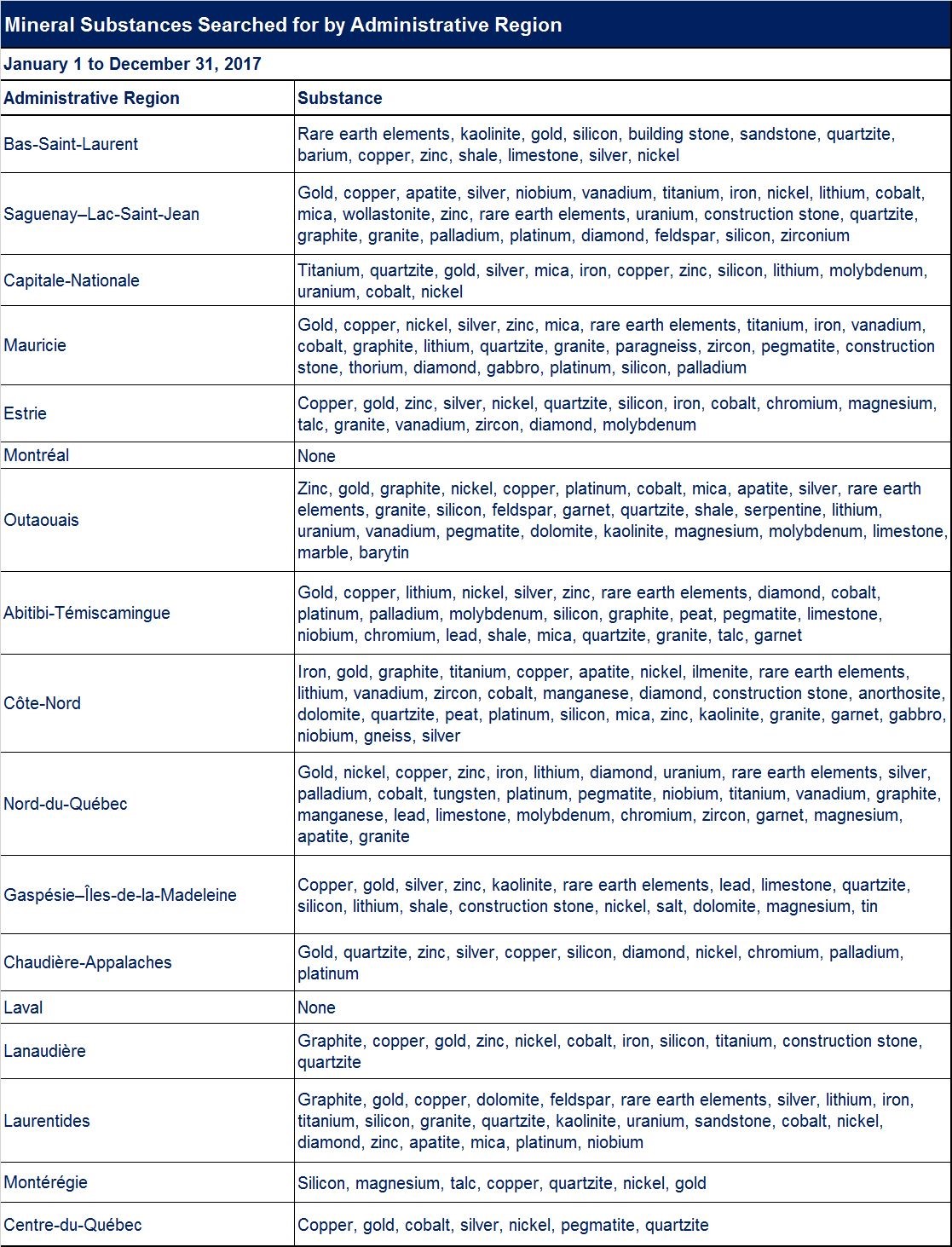

Distribution of Mineral Substances Searched by Administrative Region

Distribution of Primary Mineral Substances Searched in the Main Administrative Region

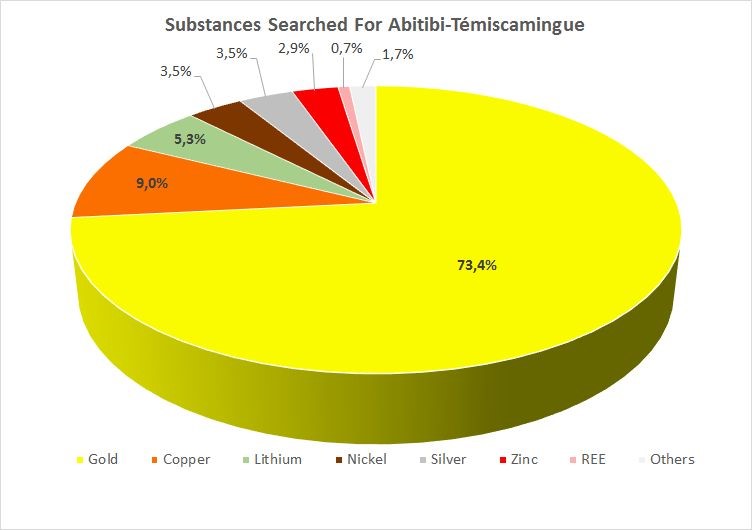

Abitibi-Témiscamingue

The primary mineral substances declared searched for on claims located in Abitibi-Témiscamingue are classified as gold for 73.4% of claims, copper for 9.0% of claims and lithium for 5.3% of claims.

Côte-Nord

The primary mineral substances declared searched for on claims located in the Côte-Nord region are classified as iron for 39.0% of claims, gold for 24.8% of claims, graphite for 14.1% of claims and titanium for 6.7% of claims.

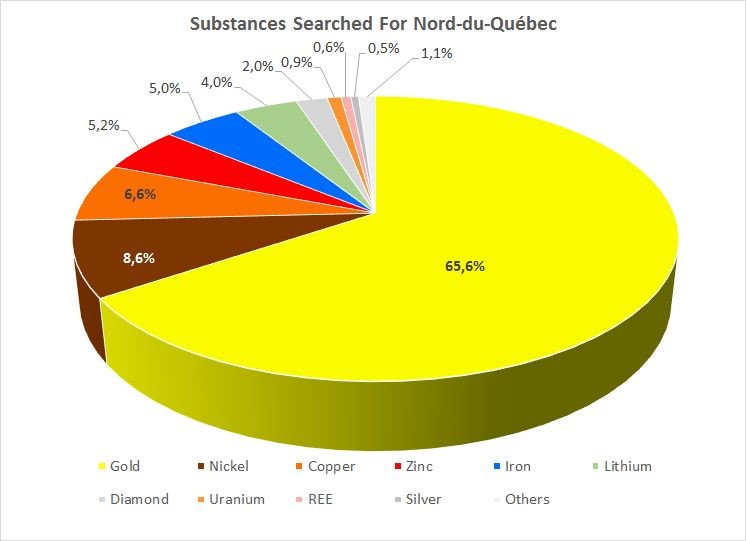

Nord-du-Québec

The primary mineral substances declared searched for on claims located in Nord-du-Québec are classified as gold for 65.6% of claims, nickel for 8.6% of claims and copper for 6.6% of claims.

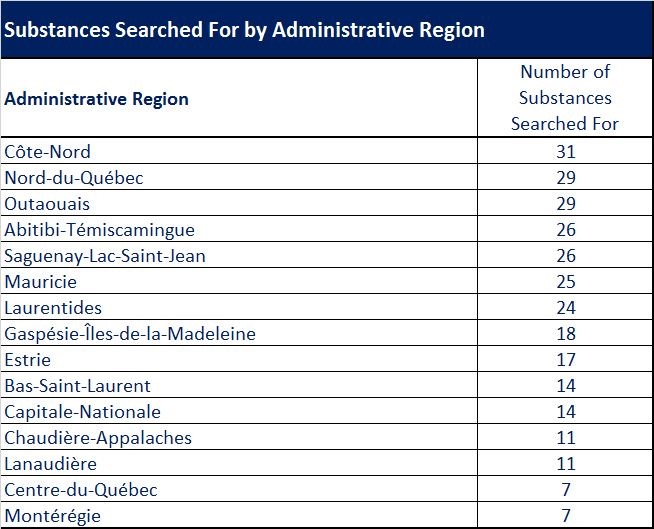

Number of Mineral Substances Searched by Administrative Region

The number of substances being searched is higher in the Côte-Nord (31 substances), Nord-du-Québec and Outaouais (29 substances), Abitibi-Témiscamingue and Saguenay–Lac-Saint-Jean (26 substances) regions.

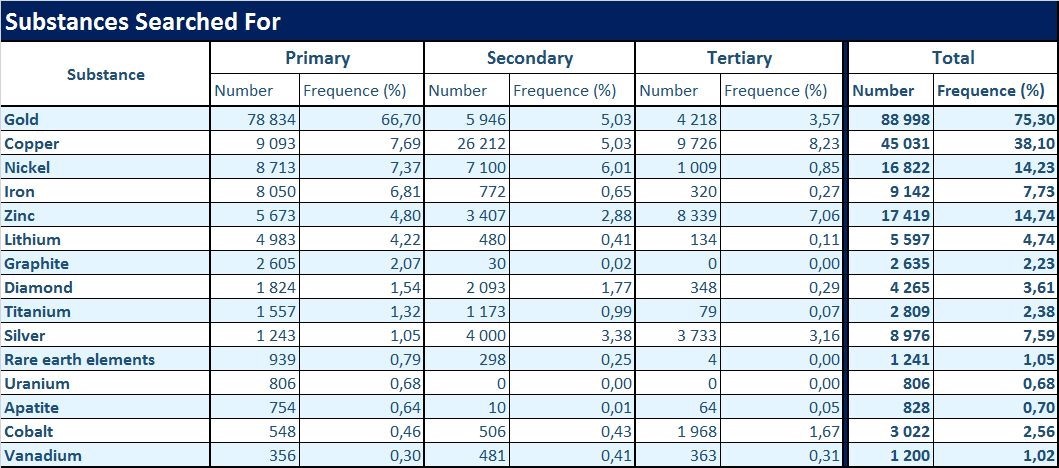

Distribution of Mineral Substances Searched For in Order of Importance

Note: In an annual report, the claim holder may report, in order of importance, three different substances searched for under their claim: a primary substance considered primarily wanted, a secondary and a tertiary.

Gold was declared searched for as a primary substance on 78 834 claims, representing 66.70% of claims with statement of work.

Copper was reported as a primary substance on 9093 claims, representing 7.69% of claims with statement of work.

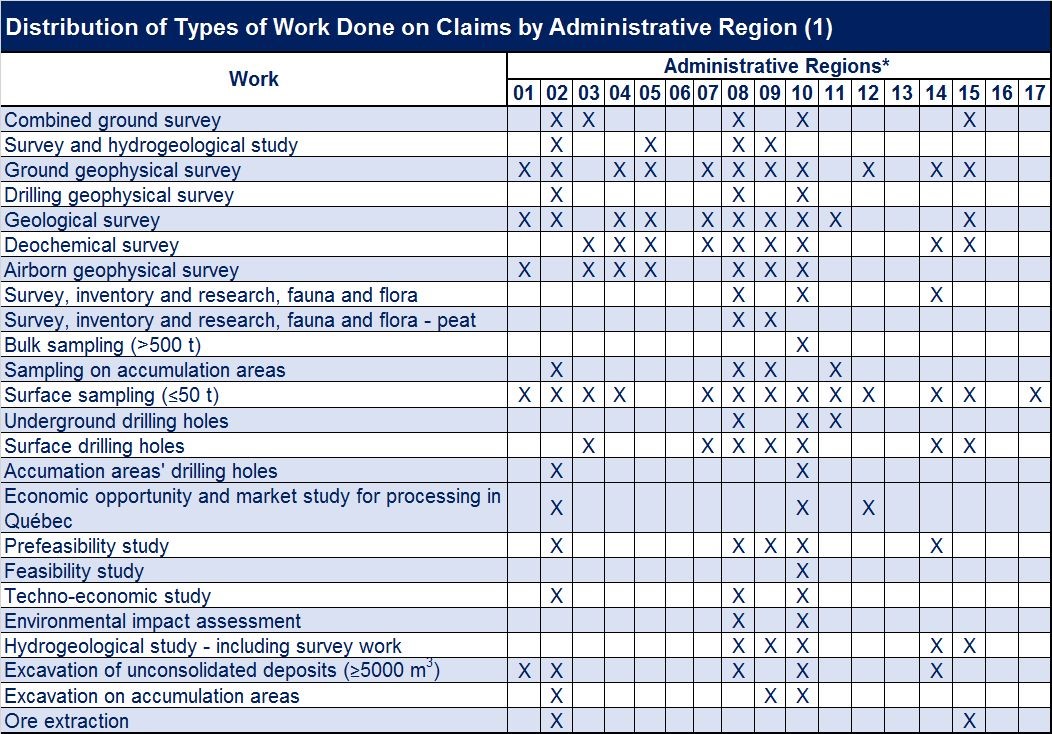

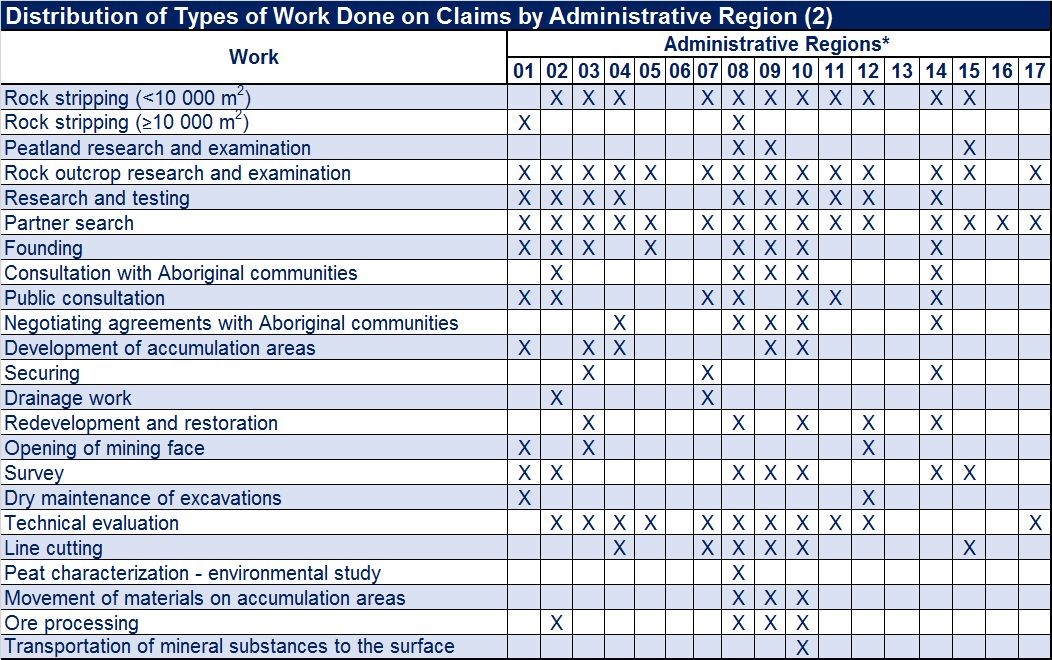

Distribution of Types of Work Done on Claims by Administrative Region

* Administrative regions : Bas‑Saint-Laurent (01), Saguenay–Lac-Saint-Jean (02), Capitale-Nationale (03), Mauricie (04), Estrie (05), Montréal (06), Outaouais (07), Abitibi-Témiscamingue (08), Côte-Nord (09), Nord-du-Québec (10), Gaspésie–Îles-de-la-Madeleine (11), Chaudière-Appalaches (12), Laval (13), Lanaudière (14), Laurentides (15), Montérégie (16) and Centre-du-Québec (17).

Chapter 2 – SOCIAL ACCEPTABILITY

Over the years, activities related to the use of lands and resources of the domain of the State have diversified. The number of rights and statutes granted has increased, which requires discussions to achieve a reconciliation between land use and natural resource development.

Communities are increasingly concerned about the impact that land and mineral development projects can have on their activities and quality of life, and want to get involved, as early as possible, in project development. It was in this context that on November 18, 2014, a departmental social license project was launched. On January 24, 2017, five guidelines were released, along with the 31 actions resulting from them. These actions promote better consideration of social acceptability factors by:

- ensuring better support for local developers and stakeholders;

- making usage planning and reconciliation mechanisms more transparent and participatory;

- promoting sharing of the benefits of energy and mining development projects with local communities.

The adoption of the social acceptability guidelines confirms MERN’s commitment to more responsible mining development, consistent with amendments to the Mining Act and the Mineral Substances Other than Oil, Natural Gas and Brine Regulations in 2013. The MENR has reviewed its practices and ways of doing things, in particular to improve the support offered to developers and local stakeholders.

ACCOMPLISHMENTS

On December 14, 2016, the Government of Québec adopted a land use planning guidance for mining activities to ensure harmonious cohabitation of mining with other land uses across the RCM:

- by delineating territories incompatible with mining activity;

- by overseeing the establishment of sensitive uses near mine sites;

- by temporary suspension of the right to stake and map claims on land projects incompatible with RCM mining activity during the final delimitation process of these territories in their planning and development schemes.

WORK IN PROGRESS

The MERN is developing a new best practice guide to support developers and local stakeholders in the establishment and operation of monitoring committees.

Chapter 3 – GEOSCIENTIFIC WORK

In 2017, the MERN completed 19 geoscience knowledge projects : nine geological surveys, three geophysical surveys, five Quaternary surveys and two mineral potential assessment studies. All field work was completed by the end of the year. An overview of these projects is available in the document Résumé des conférences et photoprésentations, Québec Mines 2017 (DV 2017-03).

Among the 61 documents published by the Direction générale de Géologie Québec (DGGQ) in 2017 (QERPUB collection), are:

- 1 document in the Bulletin géologiQUE series (BG);

- 8 documents in the Bulletin géologiQUE préliminaire series (CG);

- 24 geoscientific compilation maps (CG);

- 10 documents in the Public Document series (DP);

- 1 document in the Miscellaneous series (DV);

- 1 document in the Geology for All series (GT);

- 16 documents in the Manuscripts series (MB);

- 1 document in the Memoir series (MM);

- 6 documents in the Geological Report series (RG);

- 1 document in the Preliminary Report series (RP).

Of these, a first web-based geological bulletin (BG series) on the geology of Amisquioumisca Lake was published in September 2017 and eight preliminary web-based geological bulletins (CG series) were published in November 2017. This new dissemination tool aims to speed up publication and simplify presentation of geological information collected by DGGQ geologists. The Bulletin géologiQUE contains concise data highlighting the mineral potential of the study area. Very user-friendly and easy to navigate, this innovative web bulletin is linked to the Québec Geomining Information System (SIGÉOM) and the Stratigraphic Lexicon of Québec. Il se démarque par sa facilité d’utilisation et offre aux clients toutes les possibilités du SIGÉOM dans un contexte Web. The Bulletin géologiQUE replaces geological reports traditionally produced by the MERN.

Chapter 4 – MINING SECTOR HIGHLIGHTS

Bas-Saint-Laurent (01)

In September 2017, Canadian Metals announced the results of 16 drilling projects conducted under the Langis project. Drilling PL-17-17 intersected a 37 m interval at 98.47% SiO2. In December 2017, the company released a resource recalculation. Measured and reported resources are 7.6 Mt at 98.96% SiO2, while assumed resources are 14 Mt at 98.97% SiO2, calculated at a cut-off grade of 97% SiO2.

Saguenay–Lac-Saint-Jean (02)

During 2017, Arianne Phosphate entered into numerous agreements with various key suppliers for its Lac à Paul phosphate mine project. Among other things, agreements have been signed to provide project management expertise, production equipment for the future processing plant and for road transport of phosphate concentrate between the mine site and the marine terminal located on the north shore of the Saguenay River.

Outaouais (07)

In August 2017, Canada Carbon conducted a campaign of 31 drills (2358 m total) as part of the Miller Project.

In February 2017, Lomiko Metals and Canada Strategic Metals announced the results of drilling in the Refractory zone of the La Loutre property. Drilling LL-16-006 intersected 85 m at 7.67% Cg, including a 31.50 m zone at 13.09% Cg. NW-SE oriented mineralization was defined over an area of 200 m wide and 400 m long.

In May 2017, the Sphinx Resources cociety completed 10 drills (969 m total) targeting geophysical anomalies identified in 2016 on its Green Palladium property.

Abitibi-Témiscamingue (08)

In February 2017, Falco Resources reported that 2016 Horne 5 project drilling identified the H5-SW lens, located 200 m southwest of the Horne 5 deposit. A 10 000 m drilling campaign was planned during the year to target the westward extension of this lens between the Zone Ouest and H5 lens. On October 16, 2017, the company announced positive results of the feasibility study. If the project proceeds, the mine will have a lifespan of 15 years, with an average annual production of 219 000 ounces of gold from ore with an average grade of 1.44 g/t Au. The processing plant is scheduled for commissioning in the first half of 2021.

Monarch Gold Corporation released the latest results of the 2016 10 000 m drilling campaign for its Croinor project in February 2017. Drilling CR-16-515 intersected 2.1 m at 6.74 g/t Au and 2.8 m at 11.91 g/t Au, including 0.6 m at 46.6 g/t Au. In December 2017, the company announced that the 2017 drilling season had been completed. Drilling was conducted on the Croinor Gold zone and Gold Bug showing. Driling CR-17-574 intersected 4.0 m at 13.10 g/t Au, including 1.0 m at 33.70 g/t Au.

In February 2017, Integra Gold Corporation (Integra) released the 2016 drilling results ont the Triangle zone of its Lamaque project, located just east of Val-d’Or. Drilling TM-16-225 intersected a 2.80 m interval at 40.43 g/t Au. A few days later, the company released the results of the project’s preliminary economic assessment update. It reported daily production of 1675 t ore at 6.96 g/t Au, a recovery of 93.6%, an average production of 123 000 ounces/year and an estimated lifespan of 10.3 years. In March 2017, Integra released a resource update for the Triangle deposit. Reported resources are estimated at 6262 Mt at 7.32 g/t Au and assumed resources are 5441 Mt at 5.67 g/t Au, calculated at a cut-off grade of 3 g/t Au. On May 15, 2017, the company announced the signing of the final agreement for the Eldorado Gold Corporation (Eldorado) society to acquire all of Integra’s shares. In November 2017, Eldorado published an update on activities since the project was acquired. It said, among other things, that more than 31 000 m of drilling had been done in the Triangle zone and that a 20 992 t bulk sample from zone C2 had been machined at the Camflo plant. The sample contained 7.10 g/t Au and the recovery was 95.52%.

With respect to its Chimo property, located east of Val-d’Or, Ressources Cartier continued drilling that targeted extensions of known mineralization in depth and laterally, as well as extensions of the main zone in depth. This zone was the source of most of the ore mined in the past. Drilling CH17-12 intersected a 2.4 m interval at 5.8 g/t Au, including 0.5 m at 21.0 g/t Au.

In March 2017, Probe Metals announced results of the last nine holes conducted during the 2016 11 500 m drilling campaign under the Val-d’Or Est project. The company also published results of drilling conducted on its property during the year. Drilling PC-17-182 intersected a 100.5 m interval at 1.1 g/t Au, including 3.8 m at 18.1 g/t Au.

Alexandria Mineral Corporation has drilled extensively on zone 4 of its Orenada property, located a few kilometres east of Val-d’Or. Drilling OAX-17-090 intersected a 17.10 m interval at 8.40 g/t Au, including 4.00 m at 24.15 g/t Au.

In early May 2017, Wesdome Gold Mines announced its decision to launch an exploration ramp at the Kiena Mine Complex to reach the Kiena Deep and Upper quartz vein zones. Exploration drilling continued throughout 2017. Drilling 6179 intersected 14.3 m at 5.19 g/t Au, including a 5.2 m interval at 11.38 g/t Au.

Radisson Mining Ressources has conducted a lot of drilling for the O’Brien project in the Cadillac area. Drilling OB-17-23 intersected two intervals, 3.0 m at 11.9 g/t Au and 10.9 m at 2.5 g/t Au, including 1.4 m at 13.9 g/t Au. In October 2017, the company announced the results for the Vintage zone, located 85 m north of the Cadillac Tectonic Zone, within Cadillac Group rocks. Drilling OB-17-45 intersected 1.5 m at 8.6 g/t Au and 0.5 m at 8.2 g/t Au.

In May 2017, Granada Gold Mine (formerly Gold Bullion Development Corp) released a resource recalculation for its Granada project, located south of Rouyn-Noranda. Mineral resources that could be mined by an open pit were determined to be 17 068 500 t at an average content of 1.14 g/t Au (measured resources) and 4 507 000 t at 1.26 g/t Au (indicated resources), calculated at a cut-off grade of 0.39 g/t Au. Assumed resources, defined for potential underground mining, are 10 386 500 t at 4.56 g/t Au, calculated at a cut-off grade of 1.5 g/t Au.

In February 2017, Sayona Québec announced positive results of its pre-feasibility study for the Authier Lithium project, located near the municipality of La Motte. The open pit mine would have an annual production of 99 000 t at 5.75% Li2O, an initial investment of $66 million, and a 13-year lifespan. In June 2017, the company published a resource estimate, based on the Australian JORC standard. Measured resources are 5.62 Mt at 1.01% Li2O, reported resources are 9.57 Mt at 1.03% Li2O and assumed resources are 2.21 Mt at 0.99% Li2O, calculated at a cut-off grade of 0.45% Li2O. Metallurgical tests were also performed on the ore.

Métanor Resources has drilled on its Barry project, located approximately 100 km south of the Lac Bachelor Mine. Drilling MB-17-41 intersected 114.6 m at 1.6 g/t Au, including 16.2 m at 4.9 g/t Au. In June 2017, the company indicated that it had identified a new structure, zone Sud, located 75 m south of the pit and measuring 300 m laterally and 250 m deep. Other drilling results were announced throughout the year.

Canadian Malartic Partnership partners (Agnico Eagle Mines and Yamana Gold) drilled the Odyssey Project, located 3 km east of the Canadian Malartic Mine. In October 2017, they announced drilling of 106 holes (69 139 m total) in the first nine months of 2017.

QMX Gold Corporation has conducted several drills on the Camp Val d’Or project lands east of the municipality of the same name. Drilling 17319-17-005 intersected a 5.4 m interval at 6.1 g/t Au, including 1 m at 32.6 g/t Au.

Côte-Nord (09)

For the Knife Lake project, Focus Graphite announced a resource adjustment in 2017. A recalculation shows that measured and reported resources total 13.56 Mt at 14.95% Cg while assumed resources are 840 000 t at 13.90% Cg, calculated at a cut-off grade of 3.0% Cg.

In November 2017, Berkwood Resources announced results of 13 drills conducted on zone 1 of the Lac Guéret Sud Property. Drilling BK1-01-17 intersected 38.29 m at 14.68% Cg.

In June 2017, the Ministère du Développement durable et de l’Environnement et de la Lutte contre les changements climatiques (MDDELCC) confirmed the admissibility of the environmental impact assessment conducted by Mason Graphite for its Lac Guéret project. The company indicated that the matter is proceeding towards public hearings on the environment (BAPE).

In October 2017, Focus Graphite and SOQUEM announced the award of a contract for the preliminary economic assessment of the Kwyjibo rare earth earth project.

Nord-du-Québec (10)

Exploration for gold continued in several areas of interest, including the Urban-Barry Belt east of Lebel-sur-Quévillon, along regional structures (Sunday Lake, Lower Detour and Casa Berardi) west of Matagami, the Lebel-sur-Quévillon–Desmaraisville area, the Opinaca Reservoir area, deformation corridors south of Chapais, Eeyou Istchee James Bay territory greenstone belts, the Ashuanipi area and the Labrador Trough.

Wallbridge Mining Company has received approval for the Fenelon gold project ramp dewatering.

Aurvista Gold Mines (now Maple Gold Mines) has updated the mineral resource estimate for the Douay gold project.

For the Osisko Mining Lac Windfall project, definition drilling programs (24 rigs) continued across all gold zones within three large WSW-ENE oriented mineralized corridors. In addition to filing its notice of project, the company proceeded with dewatering and boring of the main project ramp.

For the Clearwater property, Eastmain Resources has released a new estimate of the Eau Claire deposit gold resources that will allow for a preliminary economic assessment of the project in 2018.

Several auriferous drilling intersections have been reported on projects including Balmoral Resources’ Martinière, Casault of SOQUEM and Exploration Midland, Wallbridge Mining Company’s Fenelon Mine, Aurvista Gold Mines’ Douay, Métanor Resources’ Moroy, BonTerra Resources’ Gladiator, Beaufield Resources’ Urban, Cartier Resources’ Wilson, Vior Mineral Exploration Corporation’s Mosseau, Fenton of SOQUEM and Cartier Resources, Enforcer Gold Corporation’s Montalembert, Northern Superior Resources’ Lac Surprise and Croteau Est, Genesis Metals’ Chevrier, Nelligan of IAMGOLD Corporation and Vanstar Mining Resources, Monster Lake of IAMGOLD Corporation and TomaGold Corporation, Eastmain Resources’ Eastmain Mine and Clearwater, Sirios Resources’ Cheechoo, Dios Exploration’s Au33W‑Heberto, Éléonore Sud JV of Eastmain Resources, Goldcorp ans Azimut Exploration, Sakami of Matamec Explorations and Canada Strategic Metals, Orford Mining Corporation’s Qiqavik, Kan-Fosse of Osisko Mining and Barrick Gold Corporation, and Midland Exploration’s Willbob.

For the search for base metals, several companies have announced drilling results, including Galway Metals’ Estrades project (Cu-Zn-Au-Ag), SOQUEM’s B26 project (Cu-Zn-Au-Ag), Caribou (Cu-Zn-A-Ag) and Scott (Cu-Zn-Au-Ag, preliminary economic assessment) projects of Yorbeau Resources, Berrigan (Zn-Au-Ag-Pb) and Bateman (Cu-Au-Ag) projects of Chibougamau Independent Mines, Tomagold Corporation’s Obalski project (Cu-Au-Ag), X-Terra Resources’ Ducran project (Cu-Ni-Co-Ag) and Northern Shield Resources’ Huckleberry project (Cu -Ni-PGE).

In Eeyou Istchee James Bay, lithium research and development in the NW-SE corridor that hosts Moblan (SOQUEM), Whabouchi (Nemaska Lithium), Rose (Critical Elements Corporation) and Cyr-Lithium (Galaxy Lithium) deposits continued throughout 2017. Nemaska Lithium published drilling results in the Doris zone and results of the first spodumene concentrate (6.65% LiO2) produced at the modular plant on the Whabouchi Mine site. Critical Elements Corporation filed its environmental and social Impact assessment and published results of the feasibility study for its Rose project (lithium-tantale). Galaxy Lithium has published a resource estimate for its James Bay project.

In the Chibougamau area, Vanadium One Energy Corporation conducted a drilling program on its Mont du Sorcier project (iron, titanium and vanadium).

Commerce Resources Corp continued to develop the pre-feasibility study for its Eldor project (rare earths).

Gaspésie–Îles-de-la-Madeleine (11)

In early February 2017, Gespeg Copper submitted a resource estimate for its Sullipek project, located 40 km west of Murdochville. Assumed resources are 2.24 Mt at an average content of 1.09% Cu, calculated at a cut-off grade of 0.4% Cu.

Lanaudière (14)

The Nouveau Monde Graphite company published a new resource estimate for the West zone of the Tony block of the Matawinie project in March 2017. Reported resources are 32.9 Mt at 4.50% Cg and assumed resources are 0.2 Mt at 4.84% Cg, calculated at a cut-off grade of 2.28% Cg. In October 2017, the company announced positive results of the Tony block West zone prefeasibility study. According to this study, the mine would have an average annual production of 52 000 t of graphite concentrate at a 4.39% Cg content and >94% recovery rate. The mine would have a 27 years lifespan and the finished product would have >97% Cg purity.

The Sphinx Resources and SOQUEM partners conducted exploration and diamond drilling on the Sonny and Sonny Ouest zones of the Calumet Sud property. A campaign of 11 drills targeting coincident geophysical and geochemical anomalies began in March 2017. In November 2017, companies announced results of channel samples. A content of 2.37% Zn over 20.3 m was obtained from the Sonny zone (sample #17-04) while a content of 1.77% Zn over 4.4 m was obtained from the Sonny Ouest zone (sample #17-02).

Chapter 5 – MINING ACTIVITY

Mines and Mining Projects

In 2017, Québec had 25 active mines, 3 mining projects under development and 23 development projects. Data for these different activities are presented in a downloadable PDF table.

Active Mines – For project locations, see Active Mines map.

Active mines include 11 of gold (including one polymetallic), five of industrial minerals (diamond, feldspar, graphite and mica), three of iron, two of base metals, two of Ni-Cu-PGE, one of niobium and one of ilmenite.

Mining Projects – For project locations, see Mining Projects map.

The three mining projects under development include lithium (2) and iron (1) mineralization.

The 23 development projects relate to gold mineralization (10, including three polymetallic), industrial minerals (8, targeting graphite, apatite or lithium), Fe-Ti-V mineralization (2), Ni-Co-PGE mineralization (1), rare earth mineralization (1), and base metals (1).

Industrial Stones

Industrial stones mined in Québec are limestone, dolomite, marble, quartzite, sandstone and shale. Industrial stone quarries are listed in a PDF table and located on this map. Silica mines are not subject to the Mining Tax Act and are treated with industrial stones.

Limestone, dolomite and marble are used for industrial purposes for the production of quicklime, granular products (amendments, mineral loads, pellets) or cement.

The main sources of silica are quartzites, sandstones and natural sand deposits. High-purity silica comes from Saint-Canut (Mirabel area) and Petit lac Malbaie (Charlevoix area) deposits. Silicium Québec mines and processes its ore at Petit lac Malbaie. Part of the production is used to feed its Bécancour silicon metal plant. Shales are extracted from a single site in the Montréal area and are intended for the production of siding bricks.

Architectural Stone

Many architectural stone quarries are exploited in Québec. These quarries are listed in a PDF table and located on this map. The Rivière-à-Pierre area (Portneuf) is the main dimensional stone mining area in Québec. Other architectural stone mining sites include the Saint-Nazaire area (Lac-Saint-Jean), the Saint-Alexis-des-Monts area (Lanaudière) and the Stanstead area (Estrie).

Chapter 6 – RESTORATION OF MINING SITES

The Mining Act requires that a redevelopment and restoration plan be approved prior to the granting of the mining lease required to undertake a mining operation. This plan sets out the restoration work to be done and the amount to be paid as collateral.

In addition to mining projects and active mines, Québec also has abandoned mine sites. These sites have no known or solvent ownership. The MERN intervenes and restores these sites. It also tracks sites that have been retroceded in the past or that have been issued with a certificate of release from restoration obligations under the Mining Act.

In November 2017, an updated work plan for the restoration of abandoned mine sites was completed. This work plan reflects the commitment of the Government of Québec. Since October 2014, the MERN has made it public on its website.

ACTIVE MINING SITES

Any person engaged in mining activities must file a redevelopment and restoration plan with a financial guarantee before the work begins.

In 2017, $197 million in financial security was provided by operators, bringing the total amount of collateral held by the MERN to $1.04 billion.

GOVERNMENT MINING SITES (RETROCEDED, RELEASED OR ABANDONED)

Environmental Liabilities

In 2006, to assess the magnitude of environmental liabilities, the government asked all government departments and agencies to prepare an inventory of abandoned contaminated sites.

Money required for restoration of abandoned mining sites is deducted from environmental liabilities of contaminated sites listed in the government’s consolidated financial statements.

As of March 31, 2017, 459 mining sites were listed in the Government of Québec’s environmental liability inventory, for a total amount of $744.9 million. Of these:

- 223 are mineral exploration sites:

- 10 exploration sites in Nunavik;

- 213 exploration sites in Eeyou Istchee James Bay.

- 225 are mining sites:

- 139 sites are restored or secured. The MERN carries out monitoring and maintenance;

- 20 sites are being restored;

- 35 sites are to be restored;

- 31 sites are to be secured.

- 11 are quarries or pits.

As of March 31, 2017, the MERN has invested close to $153 million in this area since 2007.

The complete list of environmental liability sites and a location map are available on the MERN website at https://mern.gouv.qc.ca/en/mines/mining-reclamation/list-of-abandoned-mining-sites/.

Characterization Work

The MERN is interested in better defining environmental impacts of abandoned mining sites. To this end, the MERN has established an environmental characterization program for sites where restoration work is still to be undertaken. Characterization allows, among other things, to assess the actual impacts of each abandoned mine site on the environment. As a first step towards the design of the restoration plan, it is necessary to refine the assessment of restoration costs recorded in the mine environmental liabilities and to establish the level of priority assigned to each site to be restored.

In 2017, characterization work described below was conducted at the Normetmar, St-Lawrence Columbium, Joutel-Copper and West Malartic sites.

Normetmar

The former Normetmar Mine is located in the municipality of Normétal in Abitibi-Témiscamingue. The copper-zinc deposit, discovered in 1927-28, operated from 1965 to 1967 from a Normétal Mine gallery, and from 1989 to 1990 from a ramp on the Normetmar site. Mining resulted in an oxidized mine tailing accumulation area.

Environmental characterization of the site for restoration took place from July to October 2017. The work involves design, planning and completion of a study that addresses, among other things, the impacts of lands disturbed by mine tailings or any other source of contamination.

In the summer of 2017, the MERN completed 29 exploration trenches, 8 groundwater observation wells and 14 manual test drills on the site.

This work led to the following observations:

- Mine tailings are potentially acidogenic and leachable;

- The presence of tailings had an effect on both ground and surface water at the site. These waters are acidic and have metal contents that exceed the applicable criteria.

St-Lawrence Colombium

The St. Lawrence Columbium mining site is located in the municipality of Oka, 32 km west of Montréal.

This former niobium mine, operating from 1961 to 1976, allowed for open-pit and underground mining and on-site processing of nearly 6.2 million tonnes of pyrochlore ore. These activities resulted in a tailings management facility of approximately 20 hectares, four waste rock piles with a total area of nearly 22 hectares and two contiguous trenches covering approximately 4 hectares.

The site also includes an industrial area where some of the foundations and structures of the former mining facilities are still present.

The environmental characterization study of the site undertaken in April 2017 is expected to be completed in March 2018. To date, 136 manual test drills, 39 exploration trenches, and 19 drills, including 18 drills converted into observation wells, have been completed.

Joutel-Copper

The Joutel-Copper mining site is located 3.5 km west of a place called Joutel in Eeyou Istchee James Bay.

This former base metal mine (silver, copper and zinc) was in operation from 1967 to 1975. Ore was processed at the Poirier Mine site; no tailings accumulation areas (mill discharges) are present at the site. Tailings generated were stored on site or used to construct access roads. Buildings have been demolished and mining openings secured.

Environmental characterization of the mining site began in March 2017 and is expected to be completed in 2018.

To date, 42 exploration trenches, 21 drills, including 19 observation well drills, and 63 manual test drills have been conducted as part of this study. Samples of taillings, waste, soil, groundwater, surface water and sediment were also collected.

West-Malartic

The former West-Malartic Mine is located 8 km northwest of the city of Malartic. The gold deposit was mined from 1942 to 1946. The ore was processed on site by cyanidation. Mining activities generated two tailings management facilities, respectively 1 hectare and 15 hectares in size, and a waste rock pile with an approximate area of 0.5 hectares.

Environmental characterization of the site for restoration was conducted in the fall of 2017 to assess the impacts of lands disturbed by the presence of tailings, waste rocks or other sources of contamination associated with past mining activities.

During the characterization work, 29 exploration trenches, 17 drills, including 13 drills converted into groundwater observation wells, and 85 manual test drills were conducted to sample tailings and waste rocks, soils, groundwater, surface water and sediments. The study will be completed in 2018.

Restoration Work

Outaouais (07)

Lac Renzy

The former Lac Renzy Mine is located approximately 40 km west of Road 117, at Kilometre 294, on the Poirier Outfitter’s territory.

This nickel and copper mine operated from 1969 to 1972. Approximately 0.8 Mt of ore was mined from an open pit. The ore was processed on site. The pit created by mining is now submerged by Renzy Lake. Mining generated a 1.2 hectare waste rock pile and an approximately 6.7 hectare tailings accumulation area in the middle of Renzy Lake, dividing the lake into two separate hydrological entities.

Site characterization studies have shown that tailings and waste rocks are potentially acidic and leachable. In addition, soil, sediment, surface water and groundwater contamination exceeds the MDDELCC criteria for some metals.

The plans and specifications, and preliminary engineering of the concepts selected for the restoration plan were completed in 2016, in conjunction with environmental authorization applications. A tailings and waste rock drowning concept in the downstream portion of Renzy Lake, which was used as a polishing pond during operation, was retained. For remediation of contaminated soils at former mining facilities, a biopile treatment was selected. Detailed engineering and restoration work began in the last quarter of 2017, following receipt of federal and provincial environmental approvals.

Abitibi-Témiscamingue (08)

Manitou

The Manitou site is located approximately 10 km southeast of Val-d’Or. Mining of zinc, copper and lead deposits from 1942 to 1979 produced approximately 11 Mt of acidogenic tailingss. These tailings distributed in two tailings management facilities without adequate containment dispersed around the deposit zone and along Manitou Creek for a distance of 6.5 km to the Bourlamaque River. The total area disturbed by tailings is approximately 200 hectares.

Following bankruptcy of the last holder of mining rights in 2002, the MERN took over the Manitou site. In late 2006, an agreement was reached between the MERN and Agnico Eagle Mines to use Goldex mine alkali tailings to restore the Manitou tailings management facility. Goldex Mine tailings have been transported through a 23 km pipeline to the Manitou site since September 2008.

Tailings deposit, originally scheduled for eight years, was halted as a result of temporary suspension of Goldex Mine operations in October 2011. Nearly 8 Mt of Goldex Mine tailings were deposited at the Manitou site. During the shutdown period, a new restoration scenario was developed to optimize the original design. The volume required for recovery has been reduced due to new operating practices at Goldex Mine and the need to backfill sites in the future. Eventual mining of the Akasaba West project developed by Agnico Eagle Mines, coupled with mining of new mineralized zones at Goldex Mine, enables the MERN to fully restore the Manitou site in 2025.

Since operations resumed in 2013, a total of 3100 Mt of tailings have been sent to the Manitou site, namely 1.01 Mt in 2015, 632 644 tonnes in 2016 and 548 000 tonnes in 2017. Note that the small tonnage deposited at Manitou in 2016 and 2017 is due to maintenance or replacement work on the tailings pipe.

Two test cells were also installed on the tailings management facility in 2015. The two 100 m2 parcels test the behaviour of two different multilayer covers to determine the best scenario for covering the sommital portion of the tailings management facility. These tests, which have been ongoing since 2016, are still ongoing.

Preissac Molybdénite

This is a former molybdenum-bismuth mine located near the municipality of Preissac. This mine operated between 1962 and 1971 and approximately 2.2 Mt of ore was mined and processed on site. Activities resulted in a waste rock pile of approximately 2 hectares and two unconfined tailings parks of approximately 12 hectares (Park A) and 22 hectares (Park B). Park A, located at the site, would contain approximately 1.2 Mt of tailings. Park B, located on Lots 11 and 12 of Range IV of the Township of Preissac, was restored in 1992. In 1971, underground flaring of tar containing copper chloride occurred at the site and along Fontbonne Lake. Burning residues were incorporated into the waste rock pile during decommissioning of mining facilities that subsequently occurred. Environmental characterization studies, conducted since 2011, have confirmed the presence of dioxin and chlorinated furan (D and F) contamination in taillings, backfill, surface soils and groundwater collected at the site and along Fontbonne Lake. Contamination has also been confirmed in foodstuffs (fish, hare, groose, moose and berries) collected in the area. As a result, the Public Health Direction (PHD) of the Abitibi-Témiscamingue Health and Social Services Agency issued recommandations to the population of the area aimed at restricting use of the site and consumption of certain foodstuffs from the area.

Data acquisition work carried out in 2017, including food sampling in the exposure area (on and near the site) as well as in the control area (non-contaminated area), led to updating of the PHD recommendations.

In addition to D and F contamination, more than 2000 m3 of taillings are contaminated with petroleum hydrocarbons. Site taillings are also considered to be acidogenic, as very acidic pH was obtained in groundwater at the taillings management facility site. Tailings from the site are leachable and subject to water erosion, which impacts the quality of the surface water downstream of the site. Development of site restoration solutions, including remediation of lands affected by D and F contamination, is underway.

Nord-du-Québec (10)

Principale Mine

The site includes an old mine with two main wells (Principale and Merrill) located on Merrill Island, near the town of Chibougamau. From 1953 to 1980, the copper-gold deposit was mined intermittently and the ore was processed on site at the mill. Subsequently, until 2005, only the mill remained in operation and processed ore from nearby mines. These activities generated three tailings management facilities (A, B and C) and a polishing pond, not to mention several abandoned structures on the site. With a total area of over 300 hectares, the Principale Mine is the largest abandoned mining site in Québec.

Since 2010, the site has undergone a number of studies to increase knowledge and identify issues. These include environmental characterization of the operations and tailings management facilities sector, geotechnical and hydrogeological studies, etc. In 2015, the MERN commissioned a firm to carry out studies and engineering work such as prefeasibility, feasibility, plans and specifications, and monitoring work for the restoration of the Principale Mine site. The mandate also included specific studies such as hydrogeological modelling and geotechnical characterization for backfilling underground openings and site securement.

In 2016, a major geotechnical characterization campaign of mouths was conducted to validate the stability of surface piers and pit. In 2017, results of this campaign helped determine which mouths to secure and which methods to use. Essentially, the work involves blasting, backfilling, and shelling of problem areas. The MERN is working with the contracted firm to develop plans and specifications for securing the ten targeted mouths.

At the same time, hydrogeological studies, water balance and characterization of tailings management facilities confirmed the restoration method for both Park A and Park B with acidogenic tailings. The restoration method is based on the principle of raised water table, which will limit oxygen supply to tailings. For Park C, tailings do not generate acid mine drainage. This park will be vegetated to limit spreading of residues. Detailed engineering of these parks is still in the development stage.

Nunavik Mineral Exploration Sites

The 2001 inventory identified 275 abandoned mining exploration sites in Nunavik, of which 18 were classified as major.

In 2007, the Government of Québec, the Kativik Regional Government, Makivik Corporation and the Fonds Restor-Action Nunavik (a group of mining companies) signed a partnership agreement to clean up the 18 major sites.

In 2012, with work on major sites at a lower cost than expected, clean-up of the 27 intermediate sites was added to the mandate. The agreement was extended to 2017.

Since the signing of this agreement, 65 mining exploration sites in Nunavik have been cleaned up.

In 2016, the parties agreed to extend the agreement for another two years, until 2019.

INSPECTION AND SECURITY

The MERN conducts an annual inspection program of environmental liability mine sites to identify potential risks to the environment and the safety of persons and to plan maintenance and security work. The main purpose is to secure old mining mouths by backfilling, fencing or concrete slabs.

In 2017, 200 abandoned mine sites were visited by MERN inspectors to ensure, among other things, that they are safe.

ENVIRONMENTAL MONITORING OF ABANDONED MINE SITES RESTORED BY THE GOVERNMENT

The MERN conducts annual monitoring of surface and ground water quality at restored mine sites under the responsibility of the Government.

This follow-up is required to meet the conditions set out in the certificates of authorization issued by the MDDELCC for restoration work. More specifically, it verifies whether effluents from these mine sites meet the requirements of the MDDELCC Directive 019 on the Mining Industry and assess the performance of restoration measures put in place at these sites.

To date, 19 mining sites that have been restored or are in the process of restoration have undergone annual environmental monitoring. They are located in Abitibi-Témiscamingue (11), Estrie (2), Gaspésie (2), Nord-du-Québec (2), Outaouais (1) and Mauricie (1).

The Government of Québec has made restoration of abandoned mining sites one of its priorities. The MERN therefore intends to meet the commitment announced in the 2016-17 Budget Speech to reduce mining environmental liabilities by 80% by 2022. The MERN’s work plan for restoration of abandoned mining sites is available at https://mern.gouv.qc.ca/en/mines/mining-reclamation/.

Chapter 7 – RESEARCH AND DEVELOPMENT

Research Funding

A few research funding programs were launched in 2017:

- Mining Research and Innovation Support Program (Programme d’appui à la recherche et à l’innovation du domaine minier; PARIDM)

Launched by the MERN on May 31, 2017, this program is aimed directly at mining companies by paying them up to 40% of eligible expenses related to research and technological innovation contracts awarded to research organizations in Québec. https://mern.gouv.qc.ca/mines/programmes/programme-dappui-a-recherche-a-linnovation-domaine-minier/

- Green Growth Program

The federal government launched this $155 million program to support research and development and demonstration of projects in the natural resource sectors (energy, mining and forestry). The call for proposals launched in November 2017 attracted 750 applications. Projects will be selected in 2018.

- #DisruptMining Contest

Goldcorp Mining is sponsoring this contest, which was launched at the Prospecters and Developers Association of Canada’s (PDAC) annual event in March 2017, to showcase technological advancements that have the potential to revolutionize the future of mining from discovery to production, whether for automation, financing, marketing or corporate social responsibility. The issue is a $1million investment from Goldcorp. In 2017, Cementation Canada and Kore Geosystems were declared co-winners. Cementation Canada wants to use sludge pumping techniques to bring the ore to the surface instead of using trucking or winching. Kore Geosystems plans to install instruments on a drilling rig that would provide real-time data to facilitate decision making.

- Hydrometallurgy Research Support Program

To support hydrometallurgy research, the Government of Québec provided $1 million in 2016-17 and $2 million per year for 2017-18 and 2018-19. The first call for projects launched in November 2016 funded six projects, while the second call in 2017 funded eight projects.

- Quebec Research and Innovation Strategy (SQRI) 2017-2022

In May 2017, the Government of Québec launched this strategy, which will invest $585 million over the next five years. Among the measures proposed, SQRI wants to support the entire innovation chain, from research to commercialization, and support research and innovation in SMEs. In the mining sector, SQRI recognizes the importance of supporting COREM in this period of significant downturn in the mining industry.

GREEN MINES – CLEAN TECHNOLOGY

- Goldcorp’s Éléonore Mine chose to dehumidify its tailings before transporting them to a tailings management facility.

- The viridis Terra Innovations company is working with LAB chrysotile for revegetation of taillings management facilities with fertilizing waste material. More than 25 hectares of management facilities have been revegetated to date.

- Dundee Sustainable Technologies presented its tailings vitrification method that would be the best of 40 solutions considered to stabilize arsenic dust at Giant Mine in Yellowknife.

- Alliance Magnesium applied for a Canadian patent for its hydrometallurgical process for the production of metallic magnesium from serpentine.

- Asbestos Corporation has signed an agreement with KSM to promote asbestos mine tailings. Some metals would be extracted and then used to produce high value-added fertilizers using a new technology acquired from Dundee Sustainable Technologies.

NEW PRODUCTS AND PROCESSES

New products or processes that made the headlines in 2017 are most often focused on new technologies, reducing environmental footprint and safety at mines. For example:

- Agnico Eagle Mines is evaluating the feasibility of installing a remote tracking system for each worker using chips that would be installed in the miners’ helmet, as the Éléonore Mine already does.

- The Université du Québec en Abitibi-Témiscamingue is interested in superplastifiers to increase the proportion of tailings returned underground and thereby reduce the costs associated with backfilling operations with cemented paste fill.

- A mining equipment manufacturer in Rouyn-Noranda, Équipements KN, manufactures mufflers for mining ventilation with hemp.

- Dundee Sustainable Technologies successfully completed a pilot plant-scale metallurgical testing program using its arsennopyrite treatment process on a five-tonne sample from the O’Brien gold project.

- GeoMegA Resources announced that its Innord subsidiary has successfully processed an industrial residue and produced a high-purity rare earth concentrate.

- In preparation for the development of the Horne 5 project, Falco Resources has signed an agreement worth approximately $60 million with Sandvik Mining and Rock Technology of Val d’Or for the supply of mining equipment, the majority of which will be automated.

- Researchers at Laurentian University in Sudbury have identified more effective microbes for recovering metals trapped in tailings, such as nickel and copper.

- The National Research Council of Canada funded the development of an anchor bolt support system technology to improve field monitoring systems.

- A Caterpillar electric-driven shuttle loader will be used in 2018 at a Canadian mine site.

- The Casa Berardi Mine, from Hecla Québec, is testing a remotely operated autonomous transport truck underground in a dedicated gallery. Results are very conclusive and better than expected. A second truck is expected to be added in 2018.

- Rio Tinto has announced the commissioning of its first fully autonomous train in Western Australia.

- Arianne Phosphate has reached an agreement with Groupe Alfred Boivin to create a trailer designed entirely of aluminum to increase the transport capacity of trucks transporting apatite concentrate extracted from the Lac à Paul Mine.

TRENDS

The Industrial Revolution 4.0, which covers mobile devices, geolocation, smart sensors, 3D printing, algorithm analysis and the Internet of things, continues to make news. By identifying areas for improvement and areas that have performed well in the past, Ernst & Young concludes that mining operators can digitize, increase productivity and reduce costs. “At the end of the day, mining needs to take advantage of the digital opportunity or risk falling behind in productivity” says Ernst & Young.

A panel discussion on the urgency of innovation in the mining industry and the importance of getting it right on corporate social responsibility kicked off the Northern Miner Mining Forum, held on October 23, 2017 in Toronto. The panel heard from mining companies:

- The next wave of innovation will aim to make life better for the communities around mine operators.

- Businesses need to learn to listen to the community and spend quality time with community representatives to understand their real needs.

- The industry has to stand up and share its successes. The mining sector has made great strides in technology, but it has not communicated them well to society as a whole.

- While the industry talks a lot about doing things differently, it has one of the worst reports of women in leadership.

- What role will recycling play in the future of the mining sector if a company like Apple says: “We want 100% of our products recycled?”.

| Robert Thériault, Geo, interim director, Direction de la promotion et du soutien aux opérations |

| Katrie Bergeron, Eng., Direction générale du développement de l’industrie minière |

| Louis Bienvenu, Eng., Direction générale du développement de l’industrie minière |

| Henrik Rasmussen, Eng., Direction de la restauration des sites miniers |

| Olivia Dawson, Eng., Direction de la restauration des sites miniers |

| Claude Dion, Eng., Direction de la promotion et du soutien aux opérations |

| Dorra Djemal, Direction du développement et du contrôle de l’activité minière |

| Hélène Giroux, director, Direction des affaires minières et de la coordination |

| Caroline Thorn, analyst, Direction générale de Géologie Québec |

| Julie Lévesque, executive assistant, Direction générale de Géologie Québec |

| Robert Lacroix, Eng., Direction de la restauration des sites miniers |

| Philippe-André Lafrance, Eng., Direction de la restauration des sites miniers |

| Josée Morency, executive assistant, Direction de la restauration des sites miniers |

| Nathalie Bouchard, Tech., Direction de la promotion et du soutien aux opérations |

| Sophie Proulx, Eng., Direction de la restauration des sites miniers |

| Jean-Yves Labbé, director, Direction générale de Géologie Québec |

| N’Golo Togola, Geo., Direction de la promotion et du soutien aux opérations |

| Mehdi A. Guemache, Geo., Direction de la promotion et du soutien aux opérations |

| Sophie Turcotte, Geo., Direction de la restauration des sites miniers |

| Malek Zetchi, chimist, Direction de la restauration des sites miniers |

| Céline Dupuis, Geo., Direction de la promotion et du soutien aux opérations |